With growth companies riding high for much of the last decade, there has been plenty of speculation about when, if ever, markets would see a sustained value rotation.

Vaccine breakthroughs late last year sparked just such a resurgence in traditional value sectors and our Liontrust Multi-Asset portfolios have benefited, increasing our cyclical bent via managers looking to take advantage of these out-of-favour areas.

Putting aside concerns that the rotation may already be petering out, what this rally has reinforced is that these style terms are broad labels and there is far more nuance in markets than a simple growth/value divide. The idea of playing one style over another has to be filtered through regional and sector lenses to tease out opportunities and relying on historical trends can often send investors down the wrong path.

Coming into 2021, as the rotation took off in earnest, being underweight the US and overweight Europe, Japan and the UK (as the premier growth and three value markets) superficially seemed the best way to access the rally – but this has only proved partially true.

Looking at US equities, for the latter half of the 20th century and the first part of the 21st, performance was roughly on a par with the rest of the world, albeit with large swings in either direction. This changed significantly in the wake of the Global Financial Crisis, with the US’ dominance in technology – and the emergence of the FAANG (Facebook, Amazon, Apple, Netflix and Google) giants – dovetailing with the overall growth trend in markets. As a result, growth dominated overall ‘equity’ returns for the bulk of the last decade.

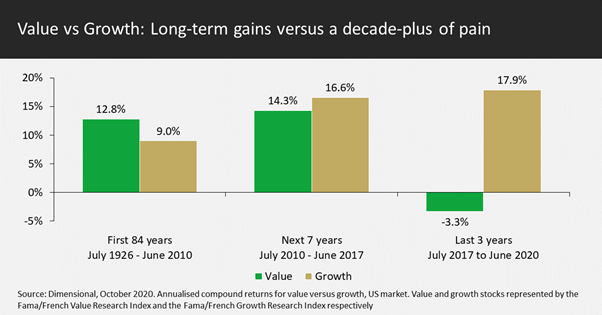

As would be expected, this led to a protracted period in the doldrums for ‘value’. It has always been accepted investment wisdom that value outperforms growth over the long term: over the near 100 years from 1926 to the end of 2020, the respective figures were 1,344,600% versus 626,600% according to Bank of America data. But as the years passed and the disparity in favour of growth got ever larger, with tech dominance continuing to grow, investors began to question the attractiveness of value as an investment style.

Please remember that past performance is not a guide to future performance and the value of an investment and any income generated from them can fall as well as rise and is not guaranteed, therefore you may not get back the amount originally invested and potentially risk total loss of capital.

This content should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, faxed, reproduced, divulged or distributed, in whole or in part, without the express written consent of Liontrust.