A slew of sharper than expected inflationary prints in 2022 across Developed Markets (DMs) has been a rude awakening for central banks. Last week’s US consumer price inflation surged to a fresh four decade high in January, fuelling pressure on the Federal Reserve (Fed) to be more aggressive in its rate-hike cycle. The subsequent hawkish pivot by DM central banks has ushered in a paradigm shift evident from rising bond yields, the decline in the total amount of negative yielding debt and the more persistent rise in commodity prices at the start of 2022. This paradigm shift has been reflected in global financial markets via a sharp rotation out of growth into value stocks. Sharp and sudden changes in interest rate expectations have historically been associated with having a large impact on the performance of value versus growth stocks in the US as has been the case in 2022.

Anchoring your equity portfolio duration with value

With expectations for rates to continue to rise, investors are scrambling for short duration assets. A crucial difference between value and growth stocks is duration. Growth stocks are a large beneficiary of falling bond yields unlike value stocks, since their cash flows extend much further into the future. Growth stocks tend to have a longer duration and therefore are more sensitive to changes in the discount rate used to price those cash flows, this is precisely why growth stocks have been at the epicentre of the sell-off in 2022. Across sectors we observed value-oriented sectors such as – banks, energy and basic resources with current cash flows and slower long-term growth tend to have amongst the lowest duration.

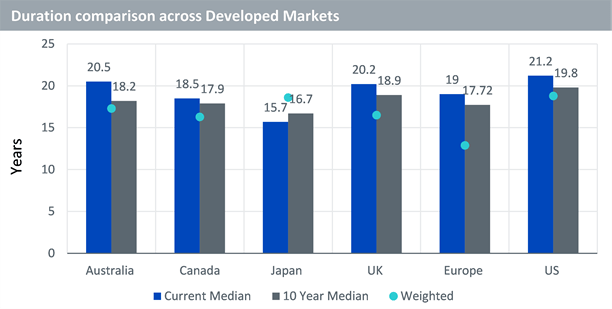

Whilst growth-oriented sectors such as – technology (including software, services and semiconductors), health care and industrials (capital goods and business services) which are characterised by high-growth and large cash flow further into the future, tend to have high durations. Geographically – Canada, the United Kingdom and Europe are all shorter duration on using median weightings for the respective underlying Index owing to their larger exposure to banks and commodities. In comparison to developed market peers, the US has the longest duration whilst Japan’s duration is exceptionally low at about 16 years using median weightings. That being said, index weighting skews duration results in the opposite direction with Japan’s duration at 18.6 years almost comparable to the US. This is because the top five companies on Japan’s benchmark index – Fast Retail, Tokyo Electron, Softbank, Fanuc and KDDI have durations above 20 and account for 25% of the market.

Source: Bloomberg Intelligence, WisdomTree as of 11 February 2022. Please note: The Indices used for US – S&P 500 Index; Europe – Euro Stoxx 600 Index; UK – FTSE 100 Index ; Japan – Nikkei 225 Index ; Canada TSX Composite Index ; Australia – S&P/ASX 200 Index

Historical performance is not an indication of future performance, and any investments may go down in value.

The valuation argument

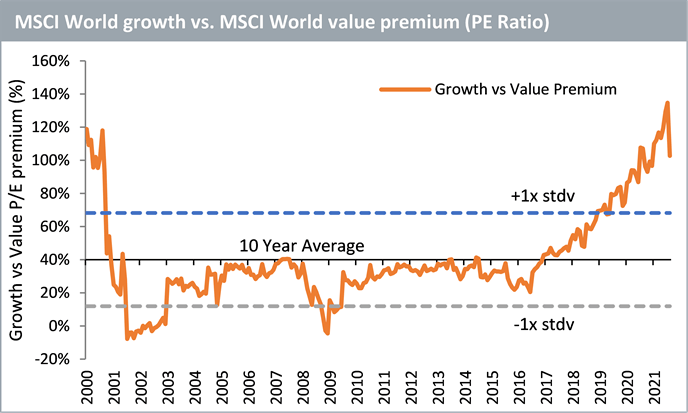

Over the past decade falling bond yields, low inflation and the scarcity of economic growth led to the wide valuation disparity between growth versus value stocks. The difference in valuation between value and growth stocks from a price to earnings perspective had never been so pronounced as seen back in December 2021, even during the internet bubble. We are still at the early stages of the unwind of this wide valuation gap between growth and value stocks which currently is more than 1 standard deviation above its 10-year average even after the sharp unwind at the start of this year.

Source: Bloomberg, WisdomTree as of 31 January 2022.

Historical performance is not an indication of future performance, and any investments may go down in value.

Navigating higher inflationary landscape with high dividend exposure and value factor

Amidst the rising rate environment and the rotation from growth into value stocks at its nascency, investors could seek opportunities in high dividend yielding value stocks in the US. Currently 56% of the companies on the S&P500 Index have a dividend yield above the level of the US 10-year Treasury and high dividend strategies would notably all be above the 10-year US Treasury. In a time when profitability matters and unprofitable technology stocks are being squeezed by rising rates, high dividend stocks are performing like shorter-duration assets.

Conclusion

Value and growth investing tend to be cyclical in nature, closely tied to an investor’s changing risk appetite. Once inflation begins to shift higher, it may take several years before the general market comes to terms with the rising trend and so focusing on rebalancing into the value factor would be prudent for investors with a long-term horizon. While recognising that markets are generally efficient longer term, we expect this pricing anomaly to correct as the macro backdrop favours a greater allocation to value. Performance and valuation aside, the tenets of diversification remain intact.

Related Blogs

+ What’s Hot: Do commodities offer an avenue to hedge against Russia-NATO tensions?

+ What do rising bond yields mean for banks?

Related products

+ DHSG – WisdomTree US Equity Income UCITS ETF – GBP Hedged Acc