Vietnam is increasingly becoming an attractive destination for investors encouraged by the country’s stable economic and political backdrop. On the domestic front, a young population and a better educated workforce with rising incomes is also driving the demand for investment products. This augurs well for the wealth management industry.

Vietnam’s economy remained resilient in 2020 despite COVID-19, expanding by 2.9%1, one of the highest growth rates in the world. This resilience stems from its growing middle-income class and a young population which kept the economy afloat via domestic spending, and in the absence of growth in other key sectors. The Vietnam government’s early and decisive responses to virus containment and well-targeted fiscal and monetary policies have also been crucial in seeing the economy through recurrent COVID-19 waves. To cope with the challenges brought about by the highly contagious Delta variant the government has switched the focus to patient treatment and large-scale vaccination and introduced other measures to help businesses maintain their production. The country is aiming to achieve herd immunity by April 2022 by prioritizing the biggest cities like Ho Chi Minh City and Hanoi. Despite the latest outbreak, Vietnam’s GDP is expected to expand by about 4.8% in 2021.2

Such moves by an active and flexible government have helped to reinforce investors’ belief in the post pandemic recovery and the long-term sustainable growth of the country; Vietnam is taking steady steps to become an emerging market. Against this stable economic and political backdrop, the country’s capital markets have grown tremendously in the last decade. Equity and bond markets now offer sustainable investment opportunities for investors.

A fast growing, resilient equity market

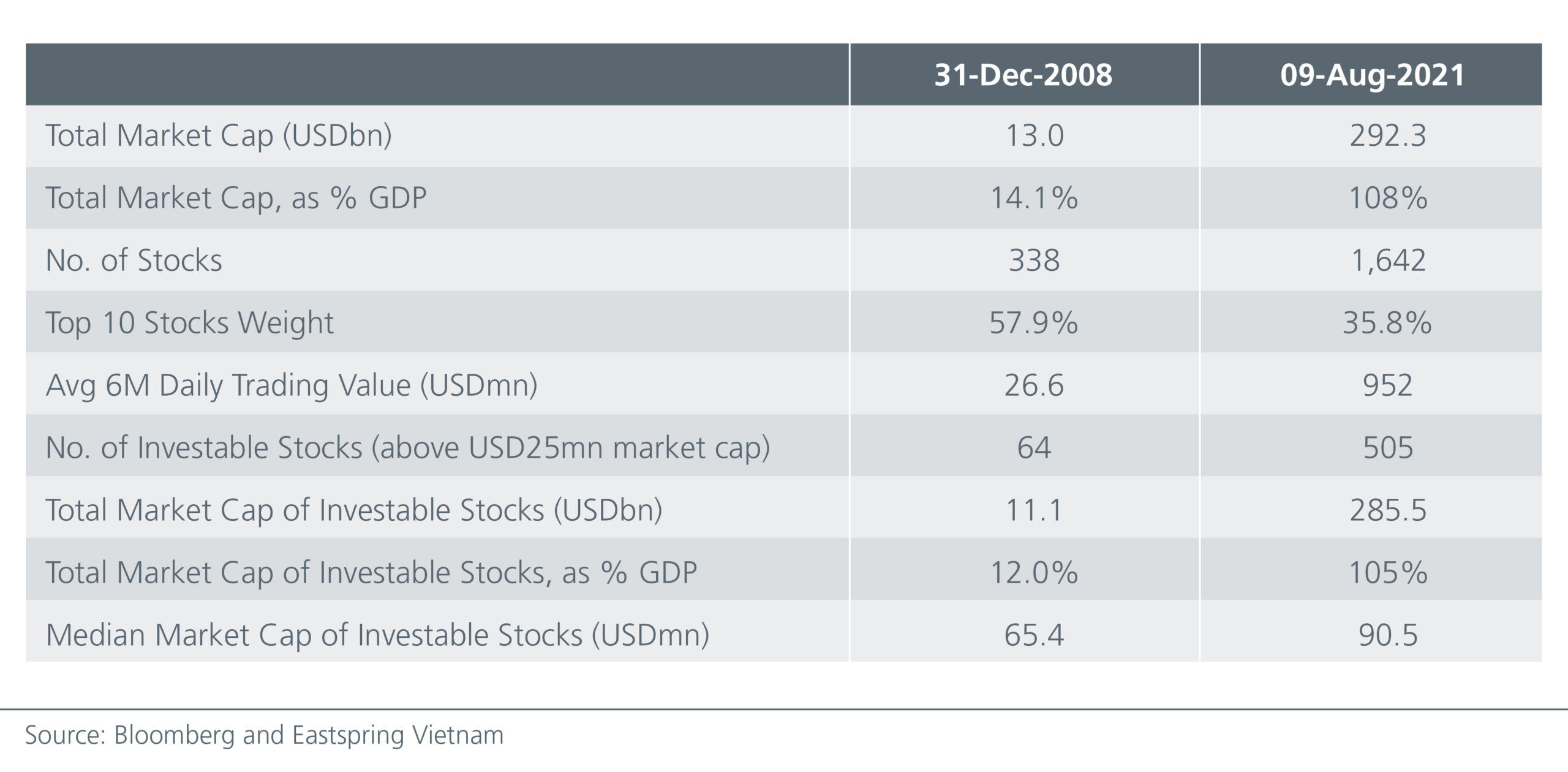

Vietnam’s equity market has been resilient during the COVID-19 pandemic and thus became one of the top performers in the first half of 2021. In fact, it has grown impressively post the US subprime crisis. See Fig 1. Market cap has expanded 22 times to USD292bn3, accounting for more than the country’s GDP. Annual return has averaged 15.5% over 12 years5 whilst the stock universe has seen a fivefold rise. More foreign investors have active and passive investment exposure, thanks to some relaxation in the foreign ownership limits. Market liquidity has also been healthy, driven mainly by retail investors. Newly opened local retail brokerage accounts hit new highs in 1H2021, reaching a penetration rate of 3.5% of the total population5.

Regulations have become more transparent and hence the market is better regulated. The New Securities Law which came into force on 1 January 2021 brings the legal framework in line with both the market practice and international standards. Among key highlights of the New Securities Law are stricter criteria for public companies and the introduction of new investment instruments, such as Depositary Receipt (DR), Non-Voting Depositary Receipt (NVDR), and Short Selling. Those are essential to increase the chances of Vietnam being reclassified as an emerging market in the coming years.

Fig 1: Breadth and depth of Vietnam’s equity market

Bond market has plenty of room to grow

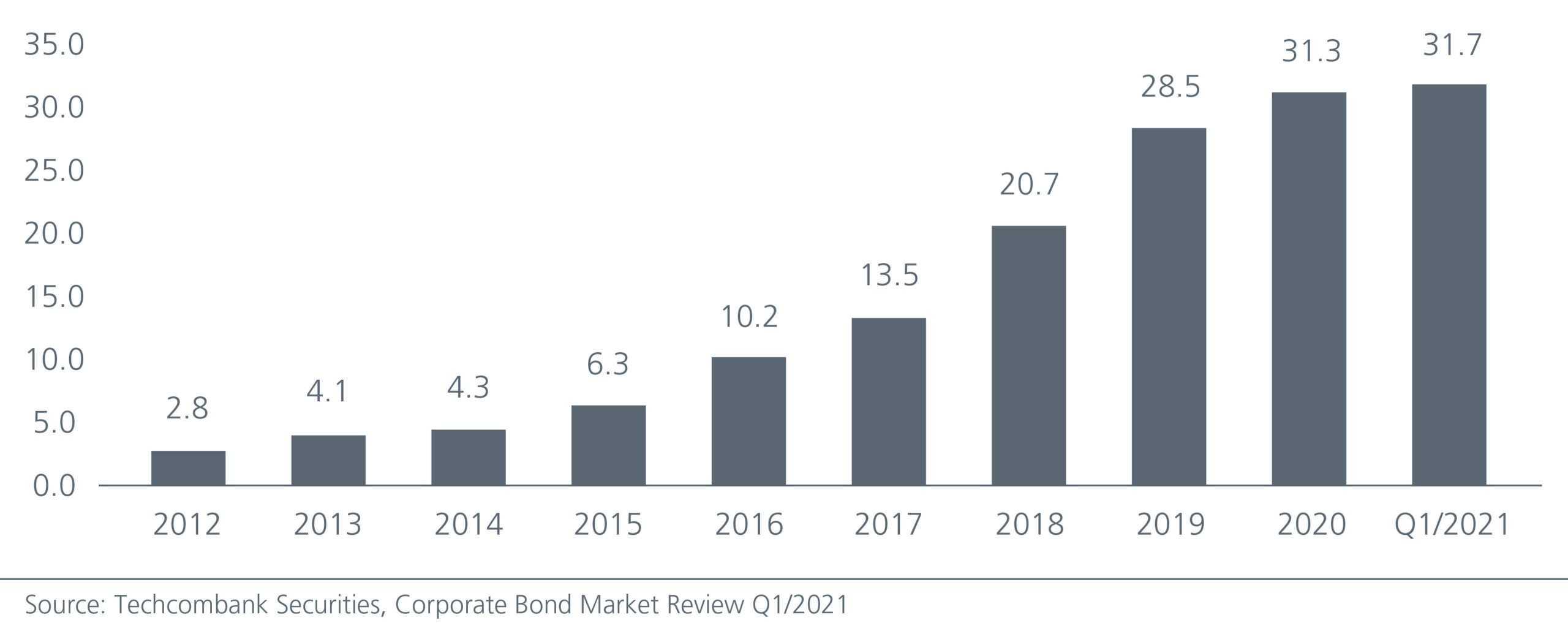

Government bonds dominate the USD90bn local currency bond market, accounting for ~65% share6. But in the last ten years, the corporate bond market has been expanding impressively at the CAGR of 27.4%7. See Fig 2. More high-quality issuers from several key sectors, dominated by real estate, banking and energy, are issuing bonds. Retail investors are also looking at the credit market as an alternative investment channel in view of the low rates offered by government bonds and bank deposits. In fact, the development of the mutual fund market in the last five years has provided the platform for retail investors to participate in the credit market.

The credit market has tripled its liquidity in the last five years with an average monthly trading value of USD110mn. Greater regulations to promote transparency and fairness in the market have slowed the growth recently. On the flipside, more regulations suggest greater comfort for an increasing number of educated investors. As such, the corporate bond market size which is currently only 11% of GDP has plenty of room to grow.

Fig 2: Growing corporate bond market (USD bn)

Basking in the demographic dividend

In the 10 years prior to the COVID-19 pandemic, Vietnam’s annual GDP growth averaged at 6.3%8, one of the fastest in Asia. This high growth has contributed to the fast-growing capital markets. Once an agricultural-based economy, growth is now led by industrial activity and services. This transformation has been aided by Vietnam’s attractive demographic dividend; 56% of its people are under 359 with a median age of 32.5 years, the highest among countries in the region with similar income levels. This has resulted in the country benefiting from a large labour workforce of 56.5 million, the second largest labour force in South East Asia, behind Indonesia.

Moreover, the rapidly growing middle-income class has fueled domestic consumption for services and higher value-added products. Currently the middle-income class earning above USD700 a month is estimated at one third of the population and is expected to double by 203010. The young middle class is also open and ready to embrace new trends such as digitalisation and are more aware of sustainability issues. Thus, they present a huge market for new investment opportunities in financial services, information technology, consumer goods and green products.

Investment-linked products to see higher demand

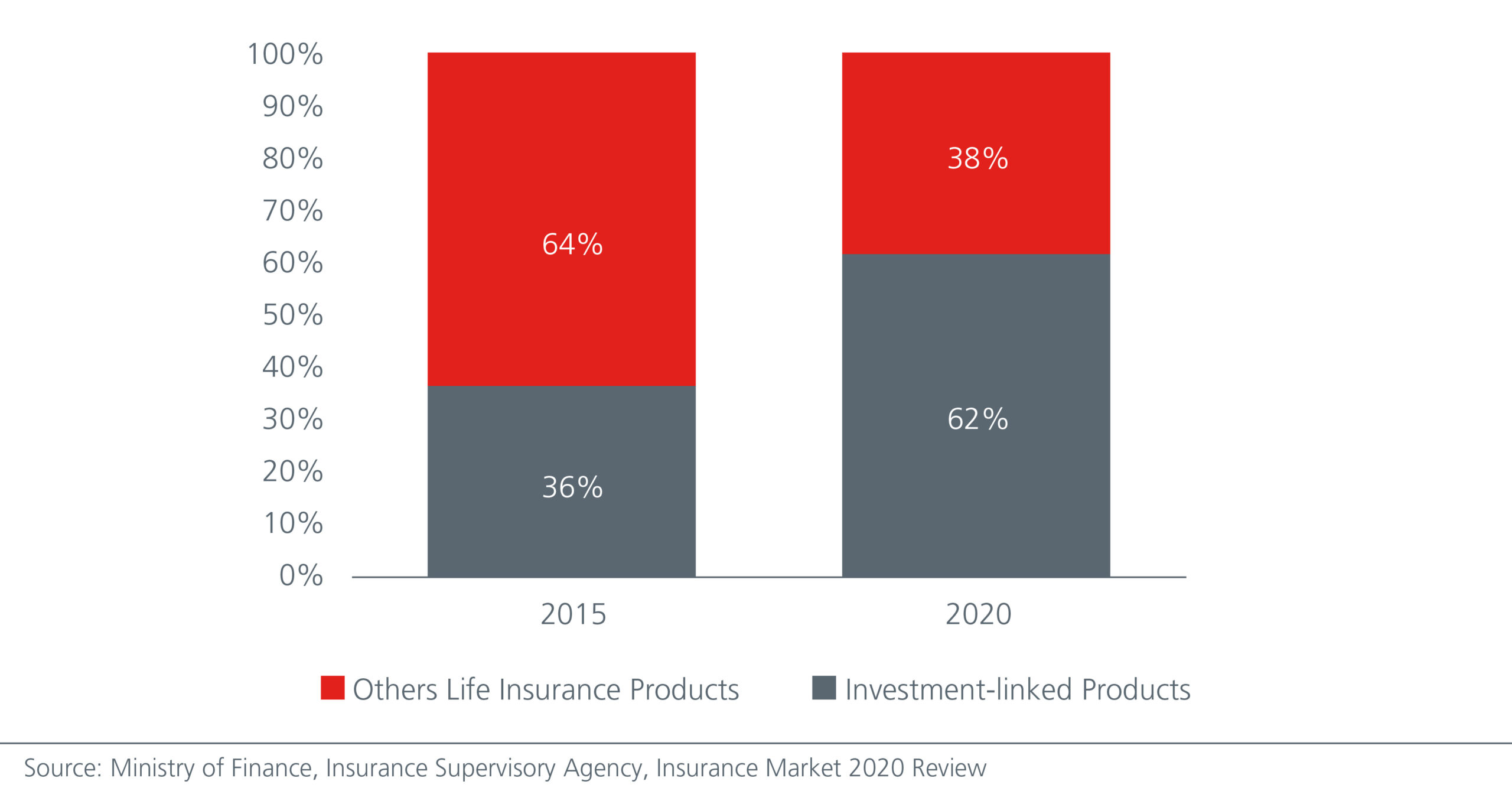

The above drivers, that is, a young population, a rising middle class, adoption of new trends and the development of financial markets have spurred the demand for investments and investment-linked insurance products; the latter recorded an annual growth rate of 42.9% in the last five years, higher than that of the total life insurance sector which is 28.3%11. As a result, universal and unit-linked products occupy the majority share of life insurance products. See Fig 3.

Equally Vietnam’s fund management industry has developed in tandem with the evolution of the country’s financial markets. Institutional investors, onshore and offshore, have almost tripled their assets under management from USD19.4bn in 201512 to USD52.5bn in 202013. Vietnam is considered as a proxy for emerging markets and that has been drawing in more foreign investors. Local retail investors are also more receptive to the idea of a professional fund manager as they see the benefits compared to self-investment. More investment products such as mutual open-ended funds, ETFs etc. have been embraced by local investors. All of this portends well for the industry going forward.

Fig 3 : Increasing market share of investment-linked products