Markets have had a torrid year; equity and bonds have both struggled as we have been in a stagflationary environment (high inflation with weaker growth).

This environment is bad for bonds as interest rates have been rising globally given high inflation – globally; war in Ukraine added energy price inflation to already elevated inflation post the 2021 ‘supply chain’ inflation generated in opening up the global economy.

Rising interest rates are an unwelcome additional pressure on consumers already struggling with higher living costs and now being shocked at mortgage rates moving to more normal levels from the artificially low levels of the ‘Quantitative Easing’ era. Central banks are no longer printing money to buy government bonds; they are increasing interest rates to fight inflation.

We have delivered resilience this year through the deliberately significant diversification in our strategic asset allocations (SAA) and our active tactical asset allocation (TAA) improving risk and return.

When we design our SAAs, we aim to be the tortoise and not the hare; we create SAAs with the aim of generating consistent medium- to long-term risk-adjusted returns. This year is a year where it has been prudent to avoid having too much exposure to higher beta sectors and more expensive markets.

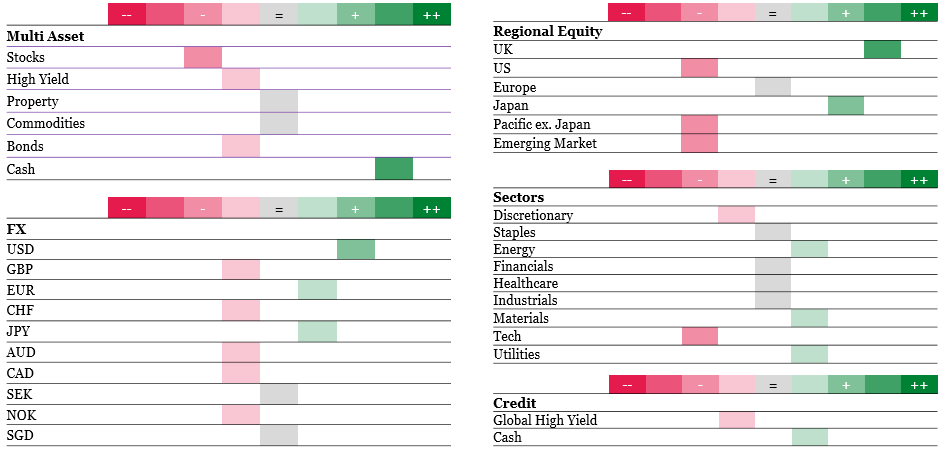

Our active TAA has been defensively positioned (see Fig 1 below). Currently, as global growth slows and rates are rising we retain that stance, but our daily analysis of markets and macro data is looking for evidence of the markets getting more positive. When evidence emerges, we will be changing the shape of the portfolio to benefit from stronger sentiment; but we are not there yet.

For now, through a challenging 2022, we have demonstrated resilience from our SAA diversification and active TAA process and remain defensive (overweight cash, staples, utilities while being underweight global equities and growth sectors, government bonds and high yield).

Where we stand

Figure 1: Overweight cash, UK and Japan stocks, underweight global and growth stocks, government bonds and high yield

Weightings may vary according to tactical asset allocation and the Fund may invest outside of indicated asset classes as the manager sees fit.

Source: RLAM. Tactical positions as of 21 September, 2022

This is a financial promotion and is not investment advice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.

Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice.