Boston – Concerns over inflation and central bank responses have driven market volatility to very high levels around the globe. But while this is a fairly recent phenomenon in the G10 space, it has been playing out in Latin America over the last 18 months. The enormous volatility in local markets is now opening opportunities for investors who have been increasingly asking when and where they should buy duration.

How Latin America took the lead

Inflation spiked early in LatAm due to a variety of factors, including ultra-easy monetary policy during the pandemic, continued stimulus packages during multiple COVID waves, strict lockdowns impacting local supply and pension withdrawals in some countries.

Perhaps surprisingly, central banks didn’t wait to respond. The “transitory” debate, while present, never gained much momentum, and central bankers began tightening monetary policy almost at the first signs of real inflationary pressures:

- Brazil hiked in March 2021, but signaled the move months earlier

- Chile, Peru and Mexico hiked last summer

These were swift and significant hikes, not token signals, reflecting a determination by the central banks to protect the credibility they had built up over the past two decades as serious inflation fighters. In many LatAm countries, the central bank is viewed as the most credible governmental institution. As a result, even in challenging domestic environments politicians have maintained an arms’ length distance that has allowed the bankers to do their jobs.

Where we stand now

While markets tried to price the end of the hiking cycles a few months ago, inflation continued to surprise on the upside and central banks continued to react. Rates now do appear close to terminal, albeit very high.

- Brazil is above 13%

- Chile, Colombia and Mexico are close to 10%

With the exception of Chile, most banks are priced to remain at these high levels for the next couple of years. The market is signalling an expectation that central bankers will maintain this restrictive policy as long as needed to tame inflation.

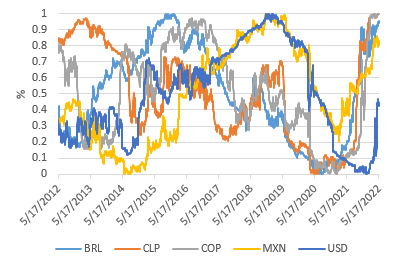

Real 1 Year Interest Rates, Percentile Since May 2012*

* Real 1-year rates are 1-year swaps less 12 months ahead inflation expectations BRL represents the Brazilian Real, the currency of Brazil; CPL represents the Chilean Peso; COP represents the Colombian Peso; MXN represents the Mexican Peso; and USD represents the U.S. dollar. Generally, higher interest rates increase the value of a country’s currency.

Real rates and currencies

Real rates have also gone up significantly, with countries like Mexico offering 5-year real rates above 4%. That’s equivalent to the pre-pandemic level and 450 bps higher than the U.S. Notably, rate volatility has come down despite the pickup in developed-rate volatility.

Moreover, currencies in Latin America have been generally well behaved compared to other emerging markets and even compared to the G10. There is no talk about further hikes needed to stem any FX issues, something that is very different from past emerging market risk-off periods.

A window for duration

Given the high levels of yield around the world, investors have been asking when and where they should buy duration. In the face of continued inflationary pressures coupled with hawkish central banks, for the last few months the answer has been to wait. But we think the window to start taking advantage of market pricing has now opened in Latin America.

For investors who prefer to remain cautious on duration, stepping into the real rates curve may offer a very compelling risk-reward, with less beta (a measure of a stock’s volatility in relation to the overall market) and greater inflation protection.

Investing entails risks and there can be no assurance that any strategy will achieve profits or avoid incurring losses. It is not possible to directly invest in an index. Past performance does not predict future results.

The value of investments may increase or decrease in response to economic and financial events (whether real, expected or perceived) in the U.S. and global markets. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, currency exchange rates or other conditions. Investments in debt instruments may be affected by changes in the creditworthiness of the issuer and are subject to the risk of nonpayment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. As interest rates rise, the value of certain income investments is likely to decline.