The European Union says it is one of the darkest hours for Europe since World War Two, with reports of Russia mounting a full-scale invasion of Ukraine on Thursday 24th February 2022. At the time of writing, many commodity prices are rallying on the news. Oil, natural gas, wheat, corn, palladium, aluminium and nickel are all trading higher on Thursday 24th February 2022 as we indicated they would in What’s Hot: Do commodities offer an avenue to hedge against Russia-NATO tensions? The tragic event is even moving gold, a metal that has been sitting in the shadows, while other commodities have been rallying in the past year. Gold is often thought of as a geopolitical hedge instrument.

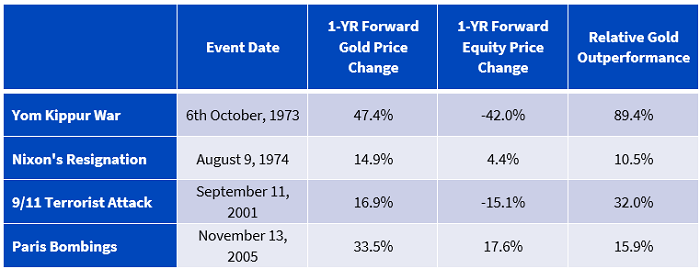

Geopolitical risk is inherently a difficult thing to quantify. Quantifying the relationship between an asset price and geopolitical risks is even more difficult. Looking back periods in which there has been a perception of elevated geopolitical events, it has been hard to say that asset prices have behaved in a consistent manner and any positive or negative price movement needs to be viewed in the context of broader economic activity at the time. Nevertheless, we can point to some geopolitical case studies where we have seen a very strong positive reaction from gold. The table below gives four examples where gold has significantly outperformed equities in the aftermath of a geopolitical shock.

Figure 1: Gold performance in the aftermath of geopolitical shocks

Source: WisdomTree, Bloomberg.

Gold is based on Bloomberg spot prices and Equities are based on the S&P 500 Index.

Historical performance is not an indication of future performance and any investments may go down in value

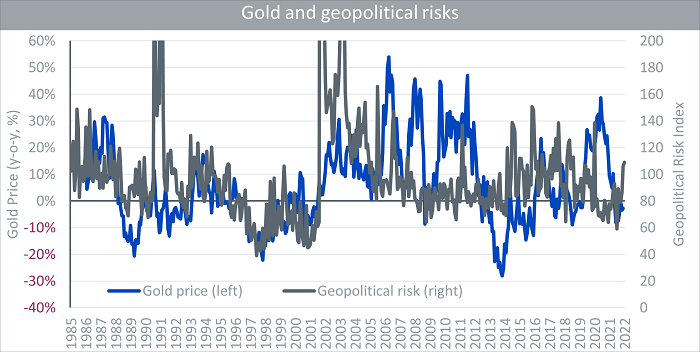

Notwithstanding the difficulty in quantifying geopolitical risk, we use a Geopolitical Risk Index developed by Dario Caldara and Matteo Iacoviello at the Federal Reserve Board based on automated text-search results of the electronic archives of 10 newspapers. Plotting their series against gold yields some interesting results.

- Immediately before the build-up to the Gulf War (1990), gold prices were quite depressed. The build-up to the war seemed to have ignited gold prices.

- Immediately before the 9/11 Terrorist attacks in the US (2001) gold was depressed. The attacks seemed to have ignited gold prices. The Iraqi war soon after (2002) kept gold well supported.

Figure 2: Gold and geopolitical risks

Source: WisdomTree, Bloomberg, Economic Policy Uncertainty (Geopolitical Risk Index by Dario Caldara and Matteo Iacoviello), January 1985 to January 2022.

Scale on right axis capped at 200 to allow for better visualisation of the gold trend.

Historical performance is not an indication of future performance and any investments may go down in value

We believe most people would agree that gold’s price behaviour in 2021 was disappointing, with the backdrop of an elevated level of inflation. Our internal forecast models indicate that gold should have been trading close to $2500/oz in January 2022 when inflation in the US was running at 7.5%1.

Could the beginning of a war in Ukraine on Thursday 24 February2 act as a catalyst for gold in a similar way to the noted events in 1990 and 2001? At the time of writing (11.00 am on Thursday 24 February), gold has risen 3.3% and reached an intraday high of US$1973/oz, the highest since August 2020.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance

Sources

1 Other relevant inputs to our model for this January gold price calculation include: Dollar basket (DXY) at 96.5, US 10-year Treasury yields at 1.78%, net speculative positioning on gold futures contracts at 245,782 (source: Bloomberg, 31/01/2022)

2 Source, FT: “Russia begins full-scale invasion of Ukraine” 9.30am on Thursday 24 February