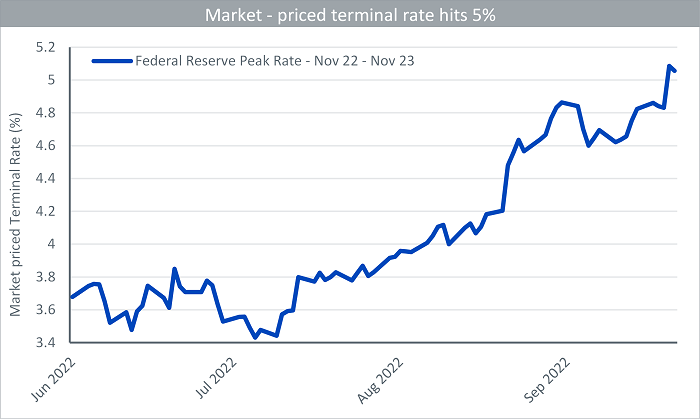

“Inflation is the parent of unemployment and the unseen robber of those who have saved.” – Margaret Thatcher1. I could not agree more with that statement, and this is precisely what equity markets are pricing. The stronger than expected inflation and employment report mean that the Federal Reserve (Fed) can remain squarely focussed on the labour market driven persistence in price inflation.

Source: Bloomberg, WisdomTree as of 13 October 2022 Historical performance is not an indication of future performance, and any investments may go down in value.

While the Fed is beginning to make progress in the process of rebalancing supply and demand in the labour market, it still has a long way to go. Majority of the decline in total labour demand has come from a 1.8mn decline in job openings and none of that decline in labour demand has come from a decline in employment. The Fed sees the current imbalances in the labour market as a major cause of high inflation. The data feeds into the Fed’s narrative unemployment will have to increase as inflation remains ingrained and the Fed continues to tighten policy aggressively.

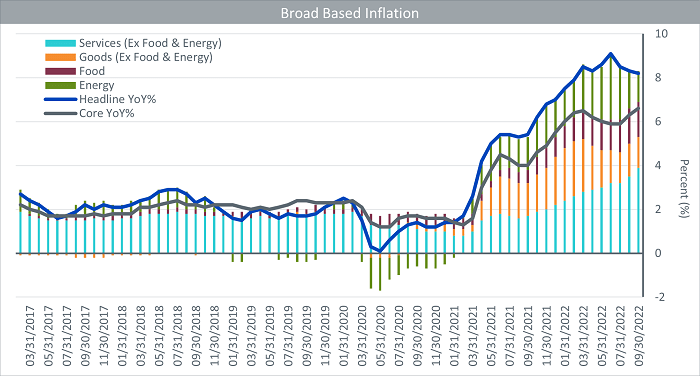

Surging Services outweigh cooling goods prices

This was evident in the September inflation report. The key upside surprise was in core inflation. Annual core Consumer Price Index (CPI) inflation surged to 6.6%, marking a 40 year high. The strength in the core CPI was driven by broad-based core services inflation (0.8% versus 0.6% in August). Both rental and Owners Equivalent Rent (OER) inflation rose from 0.7% to 0.8%. Transportation services (1.9%) and medical care services (1.0%) surprised on the upside. Worryingly, services price growth is around three times the monthly pace of price growth prior to the pandemic. The stickier high services inflation reflects strong labour market dynamics as services are labour intensive and housed domestically. However, we did see goods prices level out. The substantial decline in core goods inflation is in line with our view of goods price disinflation, as supply chain pressures ease in the US. Yet it’s hard to take comfort from the easing of goods inflation as we think concerns around services outweigh the encouraging news on goods.

Source: Bloomberg, WisdomTree as of 13 October 2022 Historical performance is not an indication of future performance, and any investments may go down in value.

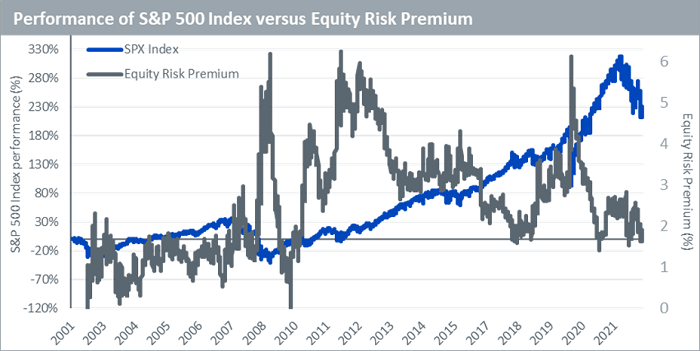

Equity risk premiums remain stubbornly low

A big part of the valuation problem is a rising risk-free rate (US 10-Year Treasury Yield). The sharp decline in US equity markets (-23%)2 year to date is a function of valuation derating. Equity risk premiums in the US fell sharply and we expect the path ahead to be lower for longer as bond yields continue to rise as the Fed goes from one policy extreme to another.

Source: Bloomberg, WisdomTree as of 13 October 2022. Please note: Equity Risk Premium is defined as the excess return earned by an investor when they invest in the stock market over a risk-free rate. Historical performance is not an indication of future performance, and any investments may go down in value.

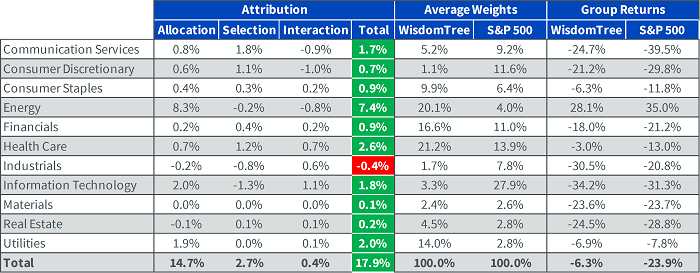

Finding value in high dividend stocks

Amidst this volatile market backdrop, tilting your equity portfolio towards low duration, high dividend and value stocks would be prudent. In a rate tightening environment, dividends provide investors an attractive cushion to shield their investments on the downside. Value stocks within the energy, healthcare and industrials sector are currently expected to be the top contributors to earnings growth in Q3 earnings season. Value stocks also have a better chance of defending and/or growing their operating margins compared to growth stocks which are more vulnerable to a rate rises at the long end. On comparing the WisdomTree US Equity Income UCITS Index to the S&P 500 Index, we find that the strategy outperformed the benchmark by 17.9%. Sector-wise, the allocation has been positive, contributing to the tracking difference by +14.7%. The overweight in Energy, healthcare and utilities benefitted performance by +7.4%, 2.6% and 2% respectively year to date.

Source: Bloomberg, WisdomTree as of 30 September 2022

Group return represents a return of a group rescaling the individual constituent weights within the Group to 100%. Return represents total return of a stock. If certain stocks were added to or deleted from the portfolio in a specified period, then their return is calculated only for the period they were part of the portfolio. Attribution is the contribution to excess returns.

You cannot invest directly in an index. Historical performance is not an indication of future performance, and any investments may go down in value.

Sources

1 Speech to Conservative Party Conference on 10 October 1980

2 As of 13 October 2022 – S&P 500 Index