Commodities had a party in 2021, but platinum and palladium never made it. But are the two poised to make a return in 2022? Is there light at the end of the tunnel?

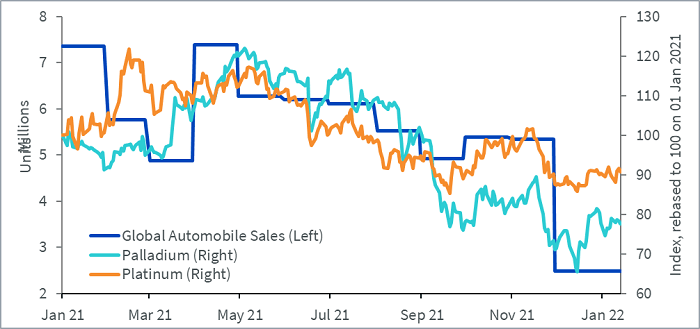

When we last wrote about them in July 2021, we explored whether the two metals could defy near term headwinds. Alas, they didn’t. At the time, hopes of such defiance rested on mining disruption in South Africa and rising inflation levels across major economies. Ultimately, demand destruction from weak automobile sales worldwide outweighed any potential tailwind (see figure below). And then came the Omicron variant in November, which didn’t help.

Figure 1: Automobile Sales have been hit by supply chain difficulties

Source: WisdomTree, Bloomberg. Data from 01 Jan 2021 to 13 January 2022. Spot prices of platinum and palladium used and rebased on 01 January 2021. Automobile sales represented by Global Total Vehicle Sales Index.

Historical performance is not an indication of future performance, and any investments may go down in value.

Are things about to change? Investors may want to consider the following.

An improving vehicle sales outlook?

The largest source of demand for platinum and palladium is autocatalysts for internal combustion engine (ICE) vehicles. With new car sales down due to semiconductor chip shortages facing the automobile industry, demand for both metals fell last year. According to Gartner1, however, the global chip industry committed to spending $146bn 2021, up around one third from 2020. Although only one-sixth of this will go towards legacy chips, such as those used in cars, the additional investment will still help ease the supply situation this year.

Tighter emission standards can also result in higher loadings of the two metals in autocatalysts. Europe is expected to approve the Euro VII emissions standards in the first half of this year. While the effect on actual physical demand may only increase in the coming years, markets are likely to react favourably to the approval announcement.

According to Metals Focus, the production of light-duty diesel cars will grow by 11% year-on-year in 2022, causing platinum demand to rise by 20%. And although the metal is expected to remain oversupplied in 2022, the oversupply will likely reduce relative to last year. Similarly, gasoline vehicles production is expected to grow by 10% year on year, causing palladium demand to increase by 8% this year. As a result, palladium markets will become more balanced in 2022 after being oversupplied in 20212.

Additional tailwind from the dollar?

Dollar’s strength throughout the pandemic hasn’t helped precious metals. The dollar was facing headwinds from the widening US twin deficit3 before the pandemic created haven demand for the currency. If dollar depreciation at the start of January is a symptom of pre-pandemic headwinds returning, this may provide just the right dose of additional impetus precious metals need.

Will the fates of the two remain intertwined forever?

Perhaps not. While both metals stand to benefit from the recovery in the automobile industry in the near term (which may continue into 2023), their paths may diverge in the medium term – say over the next 5-7 years. This may be due to a combination of two things. First, the development of technologies like BASF’s Tri-Metal Catalyst4 allows greater use of platinum in gasoline engines substituting some of the palladium demand in smaller vehicles. Second, suppose fuel cell vehicles become a viable alternative to battery electric vehicles. In that case, more platinum will be in demand as fuel cell vehicles run on electricity generated by burning hydrogen over a platinum catalyst.

With both platinum and palladium prices yet to recover after being hit hard in the last six months, it seems the upside potential is yet to be priced in. Investors may see this as an attractive entry point, especially with light at the end of the tunnel.

Sources

1 https://www.motortrend.com/news/automotive-car-industry-semiconductor-chip-shortage-reasons-solution

2 Based on Dec 2021 forecasts from Metals Focus.

3 A combination of current account and budget deficits

4 https://catalysts.basf.com/files/literature-library/BF-10654_US_TMC_Datasheet-08202020.pdf

Related blogs

+ What’s Hot: Are platinum and palladium gearing to defy short-term headwinds?

Related products