The US announced on Monday 15th May it will be refilling its strategic petroleum reserve (“SPR”) soon, with a test of 3 million barrels by August 2023, followed by purchases of 10 million barrels by the year end, even as the Department of Energy complete mandated sales of 26 million barrels. Markets however shrugged off the news and oil prices have slipped since the announcement. US debt ceiling woes, tightening monetary policy and decelerating economic conditions seem to be driving price behaviour primarily.

A number of oil and gag wells in Canada have been forced to shut as a result of wildfires. A total of 92 wildfires were burning in Alberta as of 18 May 2023. Meteorologists are expecting hotter and drier weather over the coming week prompting concerns of further spread of fires. Once again, markets have barely reacted to this news.

Markets appear to be forgetting that 45% of global oil supply comes from the Organization of the Petroleum Exporting Countries (OPEC) and its partner countries (together OPEC+). President Putin of Russia, OPEC’s largest partner country, bluntly stated “All our actions, including those related to voluntary production cuts, are connected with the need to support a certain price environment on global markets in contact with our partners in OPEC+”. To the cartel, market balance is of secondary concern compared to price stability. That the us SPR refill announcement has done little to bolster prices, increases the risk that the OPEC+ group will make a further intervention when they meet at their June 4 ministerial meeting.

As we noted in What’s Hot: Oil too low for OPEC+’s comfort, futures market positioning in both Brent and WTI crude oil presents deep pessimism amongst futures investors. Little has improved in futures positioning since we wrote that at the beginning of the month (and Brent positioning has become more net short). However, when it comes to exchange-traded product (ETP) investors, we have seen considerably more interest in oil. This set of investors have historically been more contrarian than the broader market.

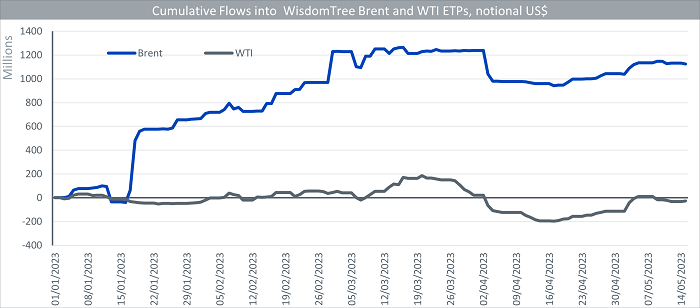

WisdomTree saw substantial gains flows into Brent products in January 2023 and strong momentum continued into the beginning of April 2023. That momentum cooled with some outflows at the beginning of April. However, by the middle of the month, inflows resumed. WTI flows, smaller in scale than Brent, peaked earlier in March. However, WTI flows have witnessed a similar scale increase as Brent since mid-April. It appears ETP investors are wearing their contrarian hat once again.

Source: WisdomTree. Notional flows into delta one, short and leveraged ETPs tracking Brent and WTI commodities. Notional flows are the sum of flows multiplied by the relevant leveraged factor.

Historical performance is not an indication of future performance and any investments may go down in value

Conclusions

While the broader market remains pessimistic on oil, contrarian ETP investors have been increasing allocations to oil. As otherwise bullish news fails to lift oil prices, the risk of another OPEC+ intervention has increased.