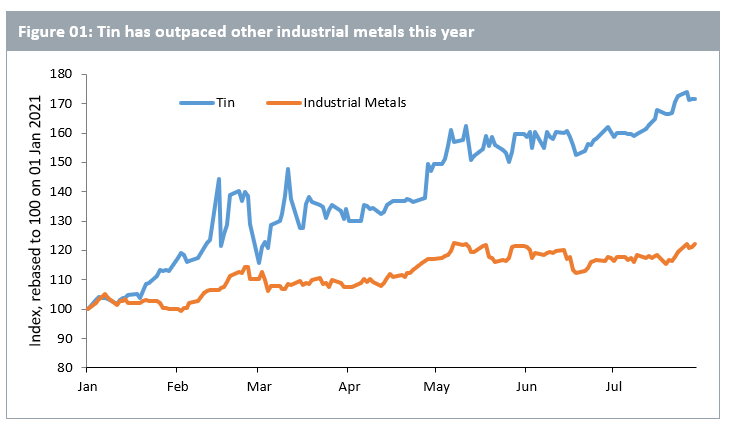

Earlier this year in February, we saw early signs of a budding rally in tin backed by fundamentals. What has transpired since then is nothing short of an exemplary run for the metal taking it to new record highs, surpassing its previous peak in 2011. Not only that, but tin’s surge this year also makes the strong run in other industrial metals appear lacklustre in comparison (see figure 01 below). But has tin run its course or is the metal poised to rise much further still?

Source: WisdomTree, Bloomberg. Data from 01 Jan 2021 to 29 Jul 2021. Tin prices are based on the generic 1st tin futures contract while industrial metals refer to the Bloomberg Industrial Metals Subindex, which is composed of copper, nickel, aluminium, and zinc.

Historical performance is not an indication of future performance, and any investments may go down in value.v

Fuelled by supply tightness

Chinese exports fell during June due to continued power outages in Yunnan, the country’s main tin producing region. Yunnan Tin, the world’s largest producer of the metal, also began maintenance during the month reducing the supply of refined tin. With China accounting for 31% of world’s tin mining supply1, these outages have been significant especially given surging coronavirus cases in other key producing countries including Indonesia, Myanmar, Malaysia, and Rwanda have already prompted lockdowns and travel restrictions creating supply bottlenecks. Indonesia and Myanmar collectively account for 35% of world’s tin mining supply2.

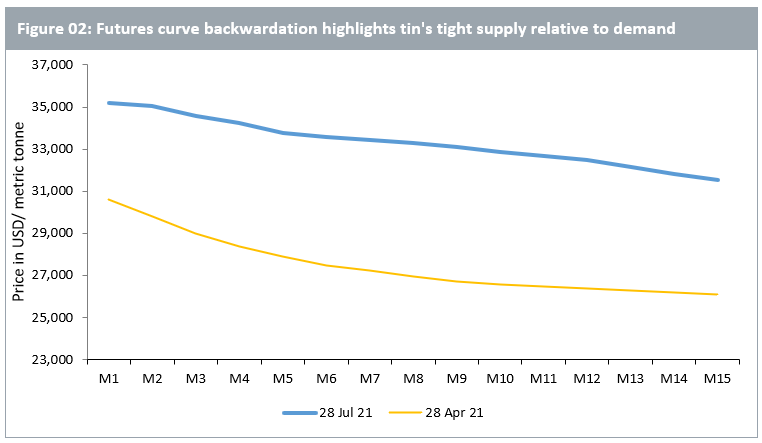

With markets expecting tin to remain undersupplied in the near term, tin’s futures curve continues to be in sharp backwardation, a relatively unusual state for an industrial metal (see figure 02 below). Investors who have held tin in recent months have, therefore, not only benefited from the price gains, but also bagged a positive roll yield (the return earned from maintaining a rolling futures exposure).

Source: WisdomTree, Bloomberg. Data as of 29 July 2021.

Demand outlook looks promising

Supply disruptions can produce sharp rallies in commodity prices, creating opportunities for tactical investors. But for investors looking at industrial metals through a longer-term thematic lens, and seeking to position themselves for a potential supercycle, demand dynamics are key.

Tin’s draws 49%3 of its demand from solders – metal alloys primarily used in electronics. The demand for consumer electronics has bounced back strongly this year adding impetus to tin’s rally. Other sources of tin’s industrial demand include chemicals (18% of total demand), tinplate (12% of total demand), and batteries (7% of total demand)4. Tin’s demand from fast-growing technologies including autonomous and electric vehicles, energy generation, energy storage, and energy infrastructure, helps tin join the ranks of copper, nickel, aluminium, silver, and others, as a thematic investment tied to the energy transition and green infrastructure megatrends. Demand may, therefore, continue to see persistent growth in the years to come helping maintain tin’s relevance.

Sources

1-4: International Tin Association