Key Takeaways

- The prospects for corn and wheat prices are improving following the favourable estimates in the May World Agricultural Supply and Demand Estimates (WASDE) report.

- USDA raised its estimate for global consumption by 2mn tons to a record 802.4mn as food, seed and industrial use are expected to continue growing.

- USDA lowered their estimates for the Argentine and Brazilian corn harvests as the countries have been battling disease, pests and weather problems in recent weeks that are likely to limit yields.

- Related ProductsWisdomTree Corn, WisdomTree Grains, WisdomTree WheatFind out more

After a relatively lacklustre performance over the past year, grains are showing a ray of light following the release of the May World Agricultural Supply and Demand Estimates (WASDE) report. The May WASDE report is one of the biggest reports the US Department of Agriculture (USDA) publishes in the year. It offers a first look at the new crop marketing year production, supplies and usage estimates, updated US winter wheat balance production estimates alongside modifications to South American crops currently being harvested.

In USDA’s first estimates for the 2024/25 marketing year, wheat and corn ending stocks for both US and the global balance came in below expectations fuelling a rally for wheat and corn prices. However, US and global soybean ending stocks surprised on the upside sending soybean prices lower.

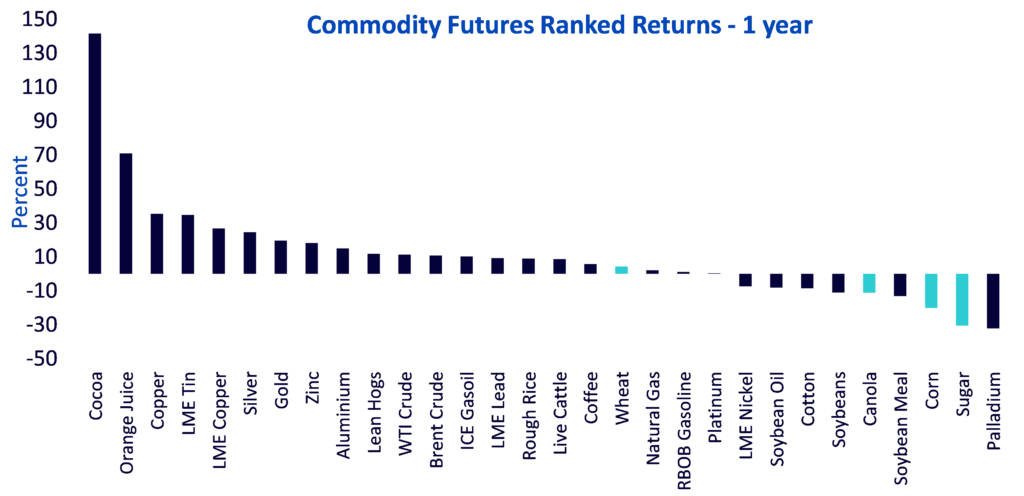

Figure 1: Grains performance lags other commodities

Source: Bloomberg, WisdomTree from 15 May 2023 to 15 May 2024. Historical performance is not an indication of future performance and any investments may go down in value.

May WASDE report constructive for wheat

Shrinking global wheat stocks over 2024/25 marketing year helped fuel rallies in the wheat market. USDA forecasts global ending stocks to fall from 257.8mn tons in 2023/24 to 253.6mn tons in 2024/25, marking the lowest level since 2015/16 season1. Contributing to the decline in global ending stocks was Russia, the world’s largest exporter of wheat. Russia is expected to face a 4% decline in Russian production owing to drought and recent frost damage1. While production cuts in Ukraine and the European Union are providing early indications of supply tightening in the global wheat market.

USDA expects US wheat ending stocks for 2024/25 to increase by 78mn bushels to 766mn bushels, marking its highest level in four years1. However, the estimates were still well below the 780mn the market was expecting. The increase in US wheat production is largely due to larger area and improved yields.

USDA raised its estimate for global consumption by 2mn tons to a record 802.4mn as food, seed and industrial use are expected to continue growing1. The initial projections from USDA show global wheat demand exceeding production by over 4mn tons.

Figure 2: wheat stocks-to-use ratio is expected to decline for the fifth year in a row

Source: USDA, WisdomTree as of 12 May 2024. Historical performance is not an indication of future performance and any investments may go down in value.

Corn stocks come in lower than expected

In the case of corn, USDA expects US corn production in 2024/25 to decline by over 3% annually from last year’s record crop as farmers switch to soybeans1. Despite weaker domestic production and expectations for stronger demand, US ending stocks are still forecast to increase from 2.02bn bushels in 2023/24 to 2.1bn bushels in 2024/25, marking the highest level since 2018/191. Yet the forecasts were well below market expectations of close to 2.3bn bushels.

For the global balance, world production is estimates to reach 1.2bn tonnes in 2024/25, down 0.7% over the prior year. USDA lowered their estimates for the Argentine and Brazilian corn harvests as the countries have been battling disease, pests and weather problems in recent weeks that are likely to limit yields. As a result, global ending corn stocks are projected at 312.3mn tons, down 0.8mn tons versus the prior year and well below the 319mn tons the market was anticipating1. Higher stocks in the US were mostly offset by declines in Brazil and Ukraine.

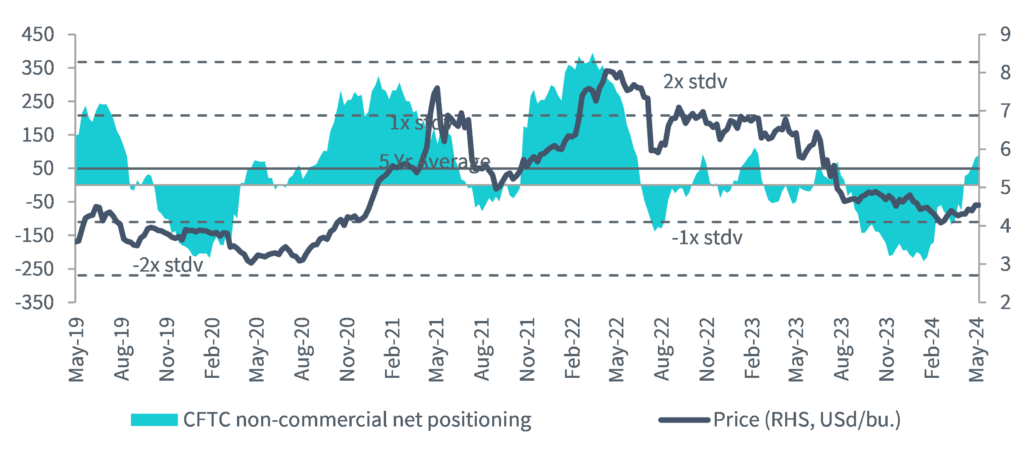

In the wake of the May WASDE report, net speculative positioning in corn swung from net short to net long underscoring the improvement in sentiment towards corn2.

Figure 3: Net speculative positioning in corn rises following the release of the May WASDE report

Source: Commodity Futures Trading Commission (CFTC), WisdomTree as of 7 May. Historical performance is not an indication of future performance and any investments may go down in value.

Sources

1 May World Agriculture Supply and Demand Estimates WASDE

2 Commodity Futures Trading Commission (CFTC) as of 7 May 2024