Sharply rising energy prices are pressuring politicians to react. Last week the European Commission called for an overhaul of the electricity market following price increases in excess of 20% in a single day in France. The European Commission is talking tough but is offering very little in terms of detail on its proposals1.

Poland is looking for a suspension of ETS...

Poland’s Prime Minister called for a suspension of the EU’s Emission Trading System (ETS)2 to deal with the stress of rising prices. Poland’s state-owned electricity company has launched an advertising campaign blaming the ETS for the country’s high energy prices. With EUA prices reaching a new all-time high of EUR98.42/MT CO2e last week, it’s easy to see how their rhetoric could gain momentum.

…which appears unlikely to happen

However, there appears to be no legal basis for a suspension of the ETS. A suspension would need to be decided through a joint decision by EU member states and lawmakers as an amendment to the ETS Directive. The process will need to involve the European Commission, European Parliament and Council. Changes would first need to be decided at an EU level and then implemented by each member state. Even if the political will was strong across-the-board that would take over a year to pass and thus do very little to lessen the immediate stress on households.

The political will is lacking to suspend ETS. REpowerEU – the policy proposal to wean off Russian energy dependency – also focuses on speeding up the energy transition away from hydrocarbons in general. In short, the energy shock is unlikely to derail EU ETS from being the cornerstone of EU’s climate policy.

Article 29a reform, however, could gain some momentum

However, there has been much talk about reforming Article 29a of the Directive – the mechanism designed to reduce instability caused by price spikes. Despite the high price volatility of EUAs and the sharp price increases in the past two years, the clauses under Article 29a have never been invoked. Under Article 29, if for more than six consecutive months, the allowance price is more than three times the average price of allowances during the two preceding years, the Commission shall convene a meeting of the Climate Change Committee. As a second condition, the EC Climate Change Committee has to determine that the excessive price fluctuations do not correspond to market fundamentals, while the legislator does not define market fundamentals. Only if both conditions are met, Article 29a is triggered.

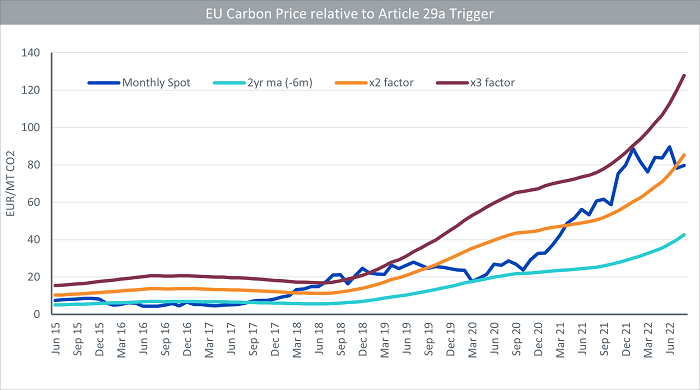

The Directive is ambiguous and makes calculating the thresholds difficult. For example, it is unclear if the past years include the 6-month look-back window. Whether it’s based on monthly or daily prices. Our calculations show that the trigger would not have been met on this “3 times” threshold (spot prices have been below the ‘x3 factor’ line in the chart below). But reform to a “2 times” threshold would have triggered the first stage (spot prices have been above the ‘x2 factor’ line for a period greater than six months). Several Members of the European Parliament (“MEPs”) have been pushing for this lower threshold, including Peter Liese, environment and climate policy spokesman for the EPP Group and rapporteur on emissions trading for the European Parliament3.

Source: WisdomTree, Bloomberg. Data from March 2013 to August 2022. Monthly data. Spot price is proxied by next-day-delivery EUA futures price. 2 yr ma (-6) is the trailing two-year moving average lagged six months. x2 factor is what many MEPs are pushing for. X3 factor is our interpretation of current Article 29a rules.

Historical performance is not an indication of future performance, and any investments may go down in value.

Summer recess is over; Fit for 55 legislative progress to resume

With summer recess in the European Parliament over, Trialogue discussions on the Fit for 55 package the Commission, Parliament and Council agreed on separately in June4 will now commence. As we have argued before, the package is highly supportive for the EUA market. At the same time, with other discussions around the energy crisis brewing, there is a risk some aspects of the ETS get watered-down while other aspects are strengthened.