More and more metal smelters are falling victim to the European energy crisis. Last week, Nyrstar, a large European zinc smelter, announced it would shutter production at its Dutch Budel facility from 1 September 2022 and Norsk Hydro, a significant aluminium producer in Norway, said it will close its Slovakian smelter around the same time.

Aluminium is one of the most energy intense metals to produce, leaving the metal very sensitive to soaring energy prices. Drought in parts of China is also reducing the availability of hydropower. Energy rationing in China resulting from this is likely to see a decline in aluminium production from the largest producing country.

In July, the European Union agreed that it would ration natural gas by 15% until spring 2023. That will mean the Union will have to depend on other forms of energy or cut back on economic production.

The production halts are likely to deepen recession risks in Europe. However, if demand for these metals does not fall as quickly as the supply is contracting, we may find base metals markets significantly tighten.

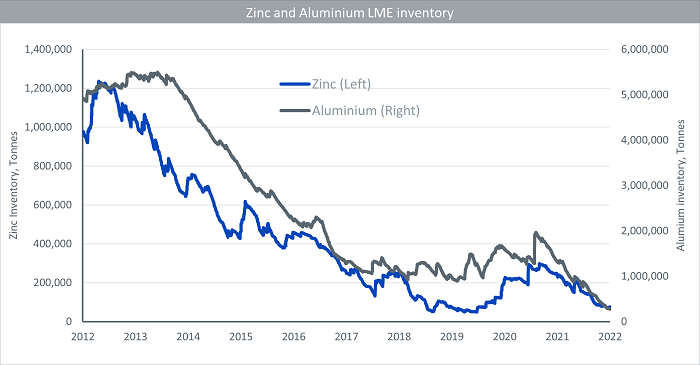

Inventory in decline

Supply of both zinc and aluminium is already looking tight. London Metal Exchange (LME) inventory of zinc has pared back to pre-covid levels and sits at only 6% of the level seen at the peak in 2012. You would have to go back to the 1990s to see LME inventory of aluminium as low as it is today.

Source: Bloomberg, London Metals Exchange. WisdomTree. Jan 2012 – August 2022.

Historical performance is not an indication of future performance and any investments may go down in value.

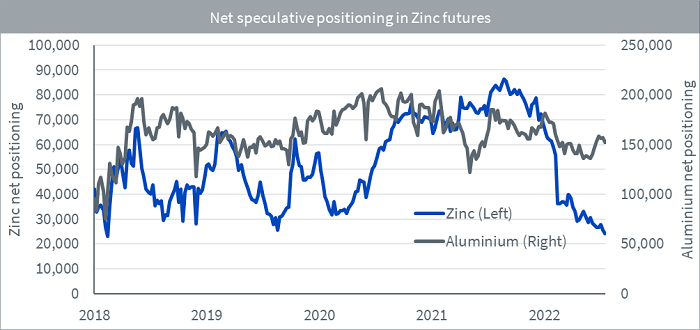

Underappreciated story

While zinc prices popped higher on the day Nyrstar announced its closure, the metal’s tightness appears to be an underappreciated story. Net speculative positioning in zinc futures is at the lowest it has been since 2018 and more than 1.5 standard deviations below the 4-year average. Positioning in aluminium is also below average but not as extreme.

Source: Bloomberg, London Metals Exchange. WisdomTree. Jan 2018 – August 2022.

Historical performance is not an indication of future performance and any investments may go down in value.

Energy transition to boost demand for both metals

Both metals are essential for the energy transition that is required to meet global climate goals. Aluminium is needed to lighten vehicles to reduce their energy needs and is a key element in electrical infrastructure, solar panels and wind turbines. Zinc coatings protect solar panels and wind turbines and prevent rust. A 10MWh offshore wind turbine requires 4 tonnes of zinc, while a 100MWh solar panel park—enough to supply 110,000 homes—requires 240 tonnes of zinc1.

The EU is focused on energy security today as it tries to wean off Russian energy dependency. It will be pushing the energy transition harder as a result.

Zinc backwardation underscores tightness

Zinc is also one of the most backwardated base metals2. Backwardation is when front-month delivery futures prices are higher than the second or third-month delivery prices. That is also an indication of market tightness, i.e. that people are willing to pay more for immediate delivery rather than wait a couple of months, indicating they need the metal soon and it is in high demand. Investors in rolling futures strategies tend to benefit from markets in backwardation: as the futures approach spot prices as time passes, the price should rise (assuming the curve shape remains the same).

Conclusion

The energy crisis in Europe and elsewhere is driving supply challenges in the base metals market. There have been notable smelters shuttered in zinc and aluminium. Zinc stands out as a metal with low speculative length, indicating an underappreciated story.