It’s the third quarter and still no recession. Has it been postponed or averted?

Inflation is coming down and after hiking in July, the US Federal Reserve (Fed) appears close to finishing its hiking cycle. The absence of recession, despite earlier warnings, is leading to increased optimism among investors that the US is heading for a soft landing. We are seeing articles questioning the signal from the inverted yield curve. Perhaps the yield curve is suggesting a benign disinflation, which would allow the Fed to cut rates without the pain of rising unemployment? However, based on the historical lags between inversion and recession, we are at least a year away from concluding it is a false signal.

Still, we can’t deny the activity data have been better than we expected, and we have pushed out our estimated timing of the US recession to the fourth quarter. Interestingly, data from the other regions have been closer to our more downbeat forecasts, which means the developed market downturn is now expected to be more synchronised rather than led by the US. We remain well below consensus on growth and believe that the recession we forecast should create sufficient slack to tame inflation pressure next year.

We think the main cause of the recession will be the lagged impact of restrictive monetary policy and tighter lending standards. We don’t believe the recent rally in markets will lead to self-fulfilling growth momentum (if we are wrong on this point, we’d worry about the implications for more sustained inflation). We also see a number of other headwinds. Corporate margins are being squeezed from high unit labour costs and debt servicing costs are rising. This is reflected in early signs of a rise in corporate bankruptcies.

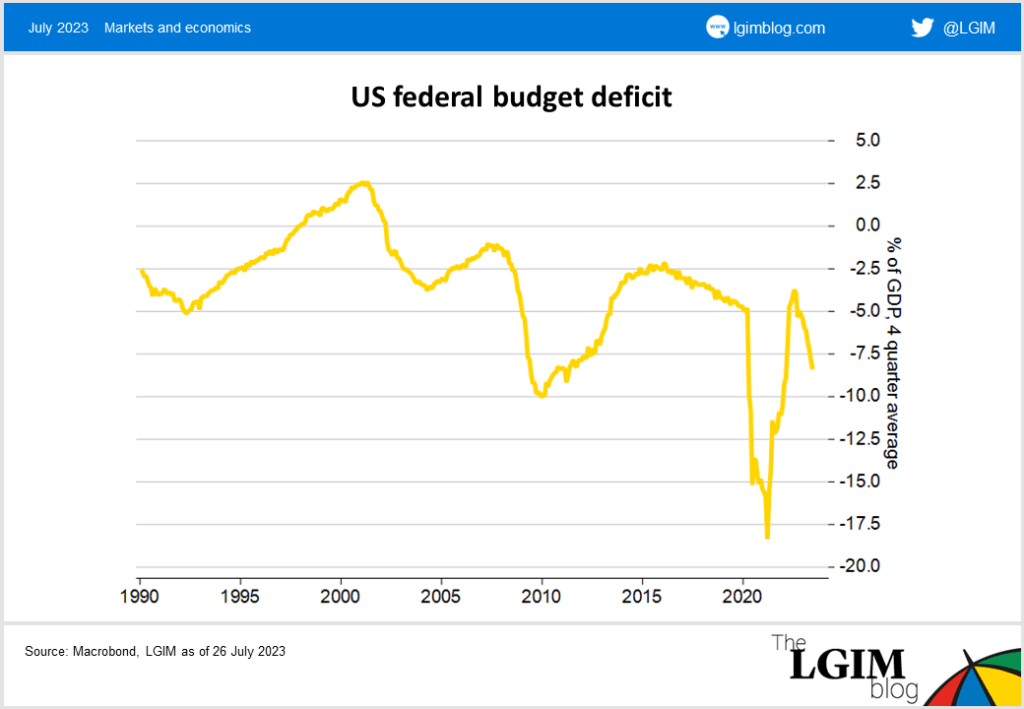

Ballooning deficits

One factor which has delayed the recession has been a fiscal splurge in recent quarters both at the federal level and state and local governments. The sharp widening of the federal budget deficit is surprising and alarming for this stage in the economic cycle amid historically low unemployment. The growth in fiscal spending is set to hit an abrupt end as part of the deal to raise the debt ceiling.

The US household sector is also beginning to feel the strain. Spending has been supported by excess saving from the pandemic, but this is now largely exhausted. The ability to tap credit is being adversely affected by high mortgage rates, deterring refinancing activity and tighter lending conditions for consumer credit. This means the household saving rate is likely to rise.

In addition, student loan repayments are due to resume in the autumn, taking almost 0.5% off disposable incomes, though there are some policies in place to smooth the shock. Payrolls have been remarkably resilient, but as hiring weakens this final support for household incomes is set to be undermined.

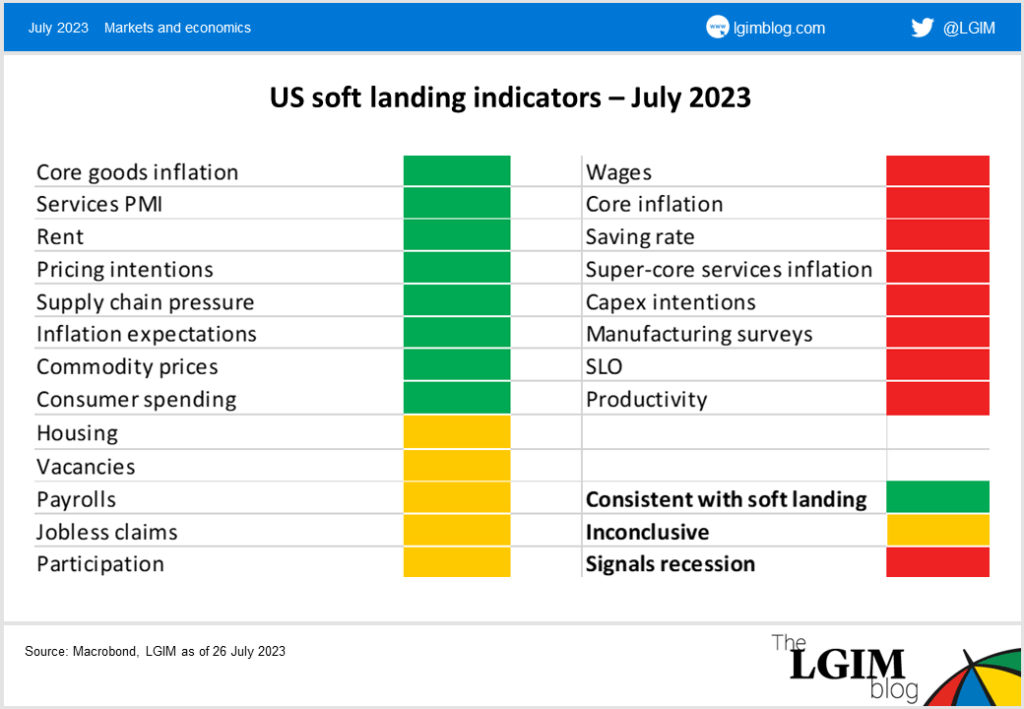

Soft-landing indicators

As well as our recession indicators, which continue to flash red, we’ve been tracking a separate set of indicators to see if the chance of a soft landing is increasing. There is some overlap, but the soft-landing indicators are higher frequency and more contemporaneous.

Overall, the signposts are sufficiently ambiguous for both soft landing and recession camps to hold firm in their views. It should be noted that as some of the high-flying indicators cool (especially the labour market ones) it could look like a soft landing at first before transitioning to recession.

Recession still ahead

Despite the delay to the onset of recession we are still looking for a peak to trough decline in output of around 1.5%. There remains considerable uncertainty around the magnitude of the downturn, but we continue to believe it will be tough to stay on the narrow path of a soft landing. Inflation should cool further as rent inflation eases, but we worry that services sector inflation is likely to prove sticky unless unemployment rises.

Our return to target inflation and expected Fed rate cuts through 2024 are both conditional on the recession we forecast materialising.