During the energy transition metal supply shortfalls may push prices higher, while miners will be under pressure to make their deposits stretch further

Metals scams seem to be increasing, after German copper producer Aurubis reported a shortfall in its copper inventories in August that it linked to theft1. That follows global commodity trader Trafigura booking a USD577 million charge last February2 on discovering some nickel cargoes it had paid for did not contain the commodity.

These scams throw a spotlight on the pressure point of the green transition. Decarbonising the global economy requires huge amounts of copper and other strategic metals for upgrading power grids, as well as building electric vehicles, wind turbines and solar farms.

Supply, however, could struggle to keep up. For example, the supply of copper will expand to roughly 30.1 million tonnes by 2030, according to McKinsey. Yet demand will outstrip it, reaching 36.6 million tonnes and leaving a shortfall of about 6 million tonnes, the consultancy estimates.3

Arguably, that puts pressure on the price of copper and the other metals that the green transition depends on. It also gives the mining companies good reason to seek to innovate, developing new mining and processing technologies.

At VanEck, we manage four ETFs in Europe that track the performance of miners’ shares – Global Mining, Gold Miners and Junior Gold Miners as well as Rare Earths & Strategic Metals – so we follow these trends closely. Indeed, we believe that the shares of mining companies provide an opportunity not only to benefit if metals prices increase due to the green transition but also as mining companies develop new mining technologies to make up the supply shortfall from their existing operations. Investors should however note that the mining sector tends to be cyclical in its nature and be influenced by the level of overall economic activity.

In an inflationary environment, mining company shares may also prove a good hedge against rising prices. While central banks appear to be winning the battle against high inflation, in the 1970s and 1980s it was typically more stubborn than expected. But mining shares could offer a hedge as metals, too, are subject to inflationary forces.

More broadly, mining shares offer valuable risk diversification in a broader portfolio of shares, due to their correlation with underlying metals prices. With equity markets pricing in what economists term ‘immaculate disinflation’, meaning gently falling inflation, it may be wise to diversify against the risk that inflation does not gently subside.

But not everything is rosy for mining stocks in the short term, as China’s cooling economy has weighed down on stock prices in 2023. China is a top metals importer and its economy has proved weaker than expected during the year.

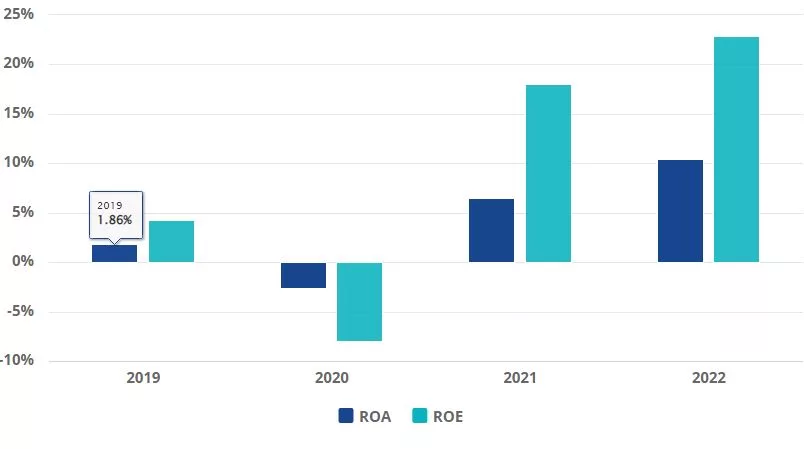

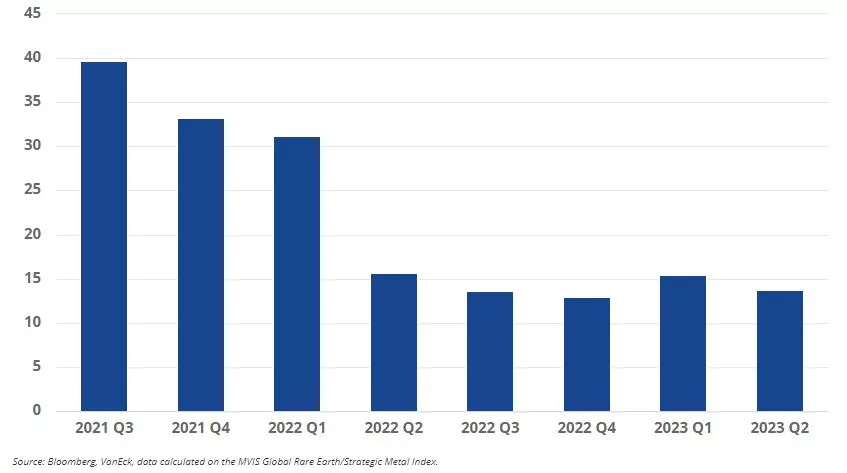

This could be an opportunity to buy into mining shares, though, in anticipation of a medium-term imbalance between supply and demand during the green transition. As the charts below show, the stock valuations of rare earth miners are significantly lower than just a few years ago, while companies’ financial performance is improving.

Returns on Assets and Equity Increase; Yet Share Valuations Fall

Rare Earths Mining Companies´Return Metrics

P/E

\What the metals thieves evidently understand is that the green transition depends on a huge supply of strategic metals. But it also requires innovation from mining companies as they seek to make their mines’ deposits stretch further. One thing is certain – they will be under pressure to improve their performance still further the race to decarbonise accelerates.

1 CNN Business.

2 Bloomberg.

3 Bridging the copper supply gap. McKinsey. February 17, 2023. https://www.mckinsey.com/industries/metals-and-mining/our-insights/bridging-the-copper-supply-gap