Inflation drivers are pointing down, eliminating the need for, but not the risk of, a mild recession.

There are very big improvements in the drivers of inflation in the US economy that the market really hasn’t recognised. These improvements have been achieved without a recession. So, if there is a recession, then we expect it will be very mild, and the US may be able to get away without a recession at all.

As a consequence, the Federal Reserve (Fed) are going to cut rates much earlier than people think, with our forecast of a reduction of more than 1% in 2024.

Similar factors are at work in the UK and Eurozone, but the economic indicators are lagging or lacking and so our confidence in our forecasts is lower, especially in the Eurozone.

The increasing chance of an economic soft-landing and lower interest rates mean that we are less negative on equities. However, the expected shift in inflation and interest rates expectations will benefit bonds most directly.

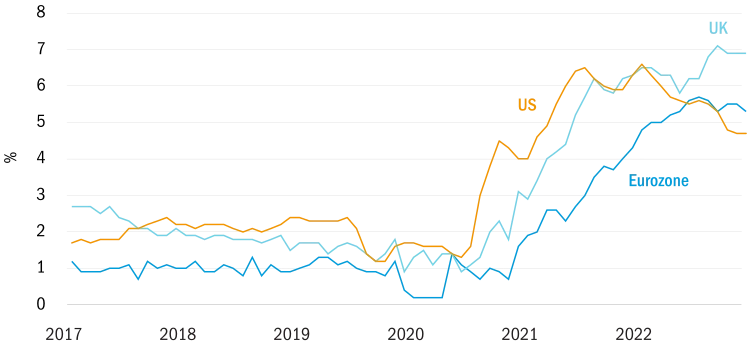

UK core inflation dips but remains an outlier

The US has seen big improvements in the drivers of inflation without a recession

While higher oil prices might reverse the collapse of headline inflation, core inflation is headed down. It has been running at lower rate over the past six months and just 2.4% annualised over the last three months. So, you could argue that the US is already at its target.

There are good reasons to believe that that improvement is sustainable, with rent, a key component, heading lower. However, we do still need a decline in wage inflation, which has clearly peaked but remains too high. Wage inflation needs to be at 3-point-something to be consistent with the Fed’s target of 2% inflation.

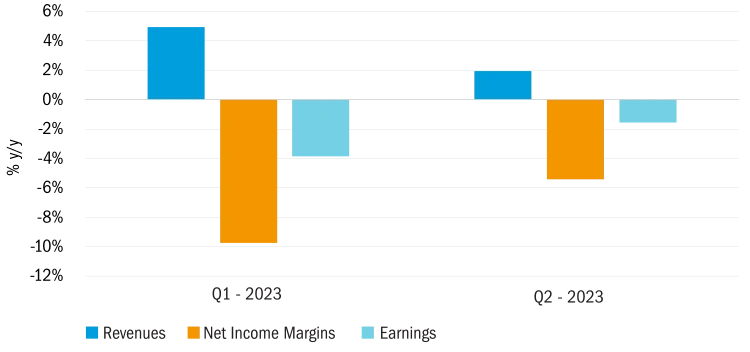

A key factor in this reduction in inflation has been a contraction in corporate profit margins, which has offset some of the inflationary wage pressures. That leaves the way clear for the Fed to start cutting interest rates next year. Lower inflation would reverse the squeeze on real wages and so boost the consumer.

However, there are a series of significant events around the start of October that are going to make the US economy look quite wobbly:

- Student loan repayments restarting

- Big auto strike ongoing

- Expect a government shutdown due to legislative gridlock.

While these one-off factors might tip the US economy into a mild recession, they do not change our main forecasts, indeed a mild recession will only act to damp down wage inflation.

Margin Squeeze in the US

S&P 500 ex-Energy Quarterly Earnings Change (%y/y)

Europe faces a major weak patch

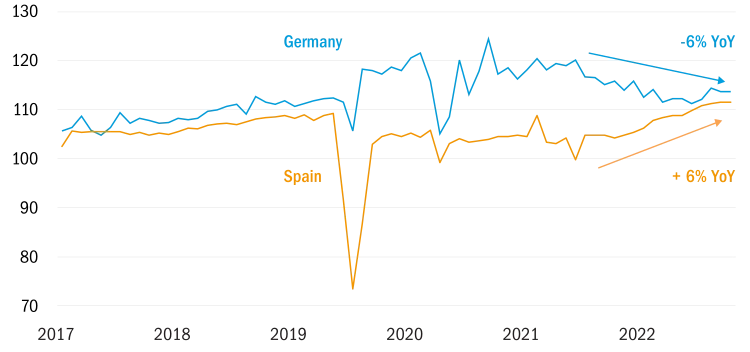

Europe’s largest economy, Germany has been pushed into recession by the weakness of its key manufacturing sector, which has been reflected in its consumer sector. While the consumer sector in southern countries, like Spain, is buoyant, the relative scale of these economies means that Germany drags the overall figures down.

We see scope for similar factors to come into play in the Eurozone, to lower inflation and sustain the consumer, as we have in the US. Therefore, we forecast no more than a mild recession overall, with the ECB shifting to cutting interest rates next year as inflation comes under control.

However, the Eurozone is clearly lagging the cycle led by the US, so adjustment and recovery have further to go. The diversity of the Eurozone’s economies also makes economic indicators more difficult to read, to confirm that these positive factors are in progress. As a consequence, our confidence in this forecast is lower.

North-South divide in retail spending

Volume of retail sales %yoy

UK is an outlier on inflation, but improvement on the way

The UK has been an outlier on inflation, as core inflation continued to rise in 2023, while it peaked in the Eurozone and fell sharply in the US. The latest figures at least confirm that core inflation has peaked, albeit still lagging the progress in Europe and especially the US.

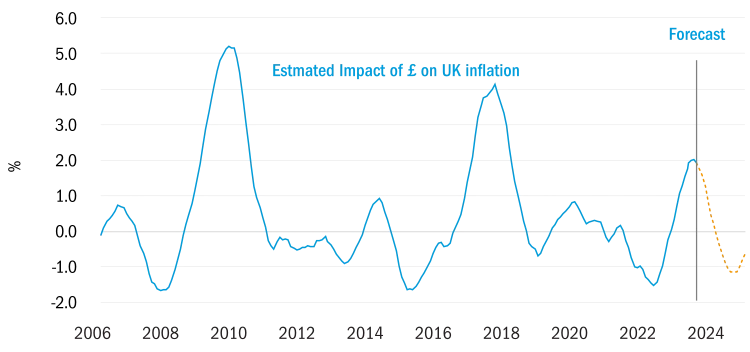

However, the reason I think that UK inflation is going to improve, both absolutely and relative to other countries is that weak Sterling has been a major contributor to the poor inflation outcome in 2023. My estimate is that it takes three months for moves in the currency to start affecting inflation and a year for the full effect to come through. We can see that clearly in manufactured goods as well as imported food prices. So, the reversal of last year’s sterling weakness will take 2% off inflation by end of this year and cut another 1% by the end of 2024.

A modest pick-up in unemployment will cap domestic inflationary pressures. So, I’m quite optimistic about the outlook for UK inflation. This means that the Bank of England will be able to cut interest rates in 2024.

A peak in mortgage rates will ensure that the problem in the housing market will be contained, compared with previous cycles. I forecast an average house price fall of 10% – half of which has already happened.

Boost to inflation from weak £ in 2022 set to reverse

A shift of inflation and interest rates expectations would directly benefit bonds

We like bonds and we expect them to deliver positive returns as inflation falls and interest rate cuts follow in 2024.

Our expectation of a soft landing, with a mild recession is the key reason to be a little bit less cautious on equities than we have in the past. We see the contraction period is over and we’re seeing a turn in expectations. That’s much earlier than would normally be expected. I think we’re seeing a significant improvement in the outlook for earnings in the US.

We continue to like Japanese equities as the economic outlook improves and corporate governance means that shareholders will see more of the gains in profitability.

Food price inflation set to tumble