As late entrants to a niche dominated by active funds, thematic ETFs were sideliners in Europe until quite recently. The global pandemic has changed that. By turning our societies on their heads, it highlighted the strong potential of megatrends and themes to shape our future. Themes such as Cloud Computing, Semiconductors or Remote working started to resonate with investors. Since ETFs offer democratised access to expert selection in such themes, thematic ETFs made their way into more and more investors’ portfolios. Consequently, after a record 2020 in terms of flows, the year 2021 promises to propel thematic ETFs in Europe to new heights, with YTD flows as of 30 June 2021 of $10.2 billion, bringing the total invested assets to $41.3 billion across 82 ETFs according to our internal classification1.

In this quarterly thematic review, we will look at the space and analyse the first half of the year and the past quarter through the lens of performance, flows and new launches of thematic strategies. For all of our calculations, we will use the WisdomTree Thematic Classification that we have previously introduced in a series of blogs in which we discussed how to classify and select thematic funds.

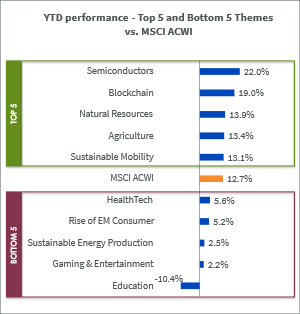

Winners and losers

As we noted in our recent paper on Thematic investments, themes tend to rotate in flows and performance over time due to their individual narratives. YTD trends in 2021 serve here as a bright example.

Progress with vaccination and the stronger prospects of economies reopening put global equities on a stronger footing, with the MSCI All Country World (ACWI) returning 12.7% to 30 June 2021. At the same time, concerns over rising inflation and rotation from growth stocks into more cyclical sectors took their toll on some of the high growth tech-focused themes that were shining in 2020, like Cloud Computing. Overall, only five themes out of our collection of 31 themes tracked by products in Europe outperformed the MSCI ACWI in the first half of the year.

Looking at the Top 5 best-performing themes year-to-date in Figure 1, we note that two themes from the “Technological Shifts” top the list. In contrast to the lacklustre performance of the other tech-focused themes, YTD winners fared better amidst a broader tech sell-off that started around mid-February this year. The “Semiconductors” theme has been supported by the global chips shortage that started back in 2020, while “Blockhain” was buoyed by the very strong performance of bitcoin and ethereum in Q1. The other three themes in the Top 5 represent the “Environmental Pressures” cluster. The climate change narrative and the inevitable need for energy transition have pushed the “Sustainable Mobility” theme as well as “Sustainable Energy Storage” that comes sixth in performance YTD. Meanwhile “Agriculture” and “Natural Resources” might have benefited from the run-up in the commodity prices.

Figure 1. Q2 and YTD performance of Top 5 and Bottom 5 themes vs MSCI ACWI

Source: WisdomTree, Morningstar, Bloomberg. All data as of 30 June 2021 and based on WisdomTree’s internal classification of thematic funds. Performance is based on monthly returns from Morningstar. Please refer to Footnote 2 for the details around the calculation of performance for a given theme.

Historical performance is not an indication of future performance, and any investments may go down in value.

Turning to Q2, we note a strong comeback of the tech-focused themes. Mid-May marked the bottom of another drawdown YTD for several themes from the “Technological Shifts”. Since then, the strategies rebounded fast and “Cloud Computing” raced ahead with a 17.3% return for the quarter closely followed by “Cybersecurity”. It seems the performance of bitcoin in Q2 was again the major factor behind the underperformance of “Blockchain” over the same period. However, the only theme that has had negative performance in Q2 and YTD is “Education”, which might have been influenced by the pending overhaul of the education sector in China.

“Sustainable Energy Production” and “HealthTech” are the most notable names within the Bottom 5 by YTD performance. Both themes performed strongly in 2020. The success of the former was supported by brighter prospects of government commitments around the world to combat climate change. The latter would have been expected to be a clear beneficiary of the global pandemic. However, halfway through 2021, nothing reminds us of their 2020 performance glory, but what do flows have to say about the investor sentiment?

Flows are set to outpace 2020

After a quiet period post-global financial crisis, themes from the cluster “Environmental Pressures” saw an obvious revival in 2020, with around $25 billion in 2020 invested across ETFs and open-ended funds in Europe. This compares to $28.7 billion allocated to themes from the “Technological Shifts” cluster. Just six months into 2021, “Environmental Pressures” themes have gathered around $31 billion across both wrappers, with $5.1 billion allocated to ETFs. This falls only $134 million short of last year’s annual figure for the ETFs. Meanwhile, “Technological Shifts” attracted around $20.8 billion, with around $4 billion invested into ETFs. 2021 is well on its way to set a new record for flows in thematics in Europe across wrappers with $69.6 billion in flows as of 30 June 2021 vs. $66.4 billion for the whole 2020.

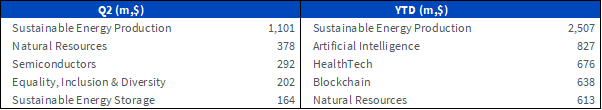

Figure 2. Top 5 Flows in Europe – ETFs (dark blue) vs Open-ended (OE) funds (teal)

Source: WisdomTree, Morningstar, Bloomberg. All data as of 30 June 2021. Data based on WisdomTree’s internal classification of thematic funds.

Historical performance is not an indication of future performance, and any investments may go down in value.

Looking at the theme level flows in Figure 2, “Sustainable Energy Production” is a clear winner for flows both YTD and in Q2 with around $10.8 billion inflows as of 30 June 2021, despite being a performance laggard YTD. “HealthTech” is another underperforming theme, but it comes second for flows, with $4.7 billion YTD. The inflows figures paired with the YTD performance might suggest that investors are sticking with the long-term potential of the themes.

Q2 figures for open-ended funds point to an increasing focus on sustainable themes. However, “Artificial Intelligence” and “HealthTech” still gathered a lot of interest in Q1 across both wrappers. Notably, “Blockchain” was the only theme in the Top 5 that has attracted more flows in ETFs than in open-ended funds, with $638 million and just $28 million respectively. A few other themes, in which ETFs claim the dominance in flows YTD include “Cybersecurity”, “Semiconductors”, and “Cloud Computing”.

While the “Demographic & Social Shifts” cluster gathered fewer assets than others, $6.5bn in open-ended funds and $1bn in ETFs, it is worth noting that the “Equality, Inclusion & Diversity” theme has gathered the most assets in 2021 with almost $1.1 billion YTD. Within ETFs, the theme attracted $202 million in Q2 alone.

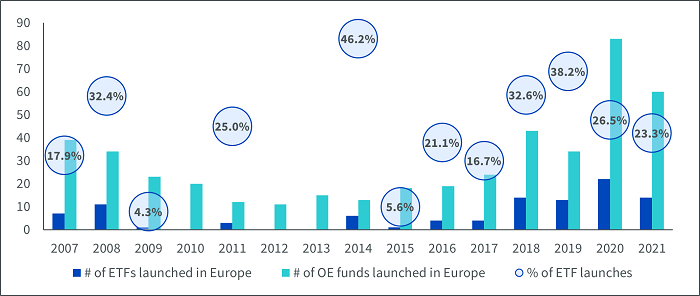

Launches point to steady growth

Strong flows data YTD is further supported by the number of launches in the thematics space. In the first half, we have already seen 14 new thematic ETFs and 60 new active funds. For the whole of 2020, only 22 ETFs and 83 active funds were launched.

It is interesting to note that ETFs represented less than 25% of the launches YTD, while they represented between 30% and 40% in 2018 and 2019. The global pandemic may have attracted a higher focus from active managers to the space. In any case, these figures suggest that the thematic space is steadily growing. This trend, however, is not limited just to Europe. In Asia, ETF providers are rapidly ramping up their thematic offering with 55 and 53 new ETFs within the “Environmental Pressures” and the “Technological Shifts” clusters respectively, for a total of 115 new launches.

Figure 3. Historical launches of thematic strategies in Europe.

Source: WisdomTree, Morningstar, Bloomberg. All data as of 30 June 2021. Data based on WisdomTree’s internal classification of thematic funds.

Historical performance is not an indication of future performance, and any investments may go down in value.

We will be closely watching the space in Q3 and will summarise our findings in the next WisdomTree Quarterly Thematic Review. Stay tuned.

Footnotes

1 All AuM (Assets under Management), flows and launches data is presented based on the WisdomTree’s internal classification of thematic funds and aggregated using fund level data from Morningstar and Bloomberg. For all figures year-to-date (YTD) refers to the year-to-date period as of 30 June 2021.

2 Performance of a theme. For any given theme, we consider each month all the ETFs and open-ended funds classified in that specific theme that have published a monthly return for that month in Morningstar. We then calculate the average of all those monthly returns to compute the average monthly return for that theme. So, the monthly return for January 2020 for the theme may include 19 funds, while the February 2020 return may comprise 21 funds (if two funds classified in that theme have been launched in the meantime). By collating monthly returns for the theme, we get the theme’s average historical performance. Therefore, the theme’s average historical performance incorporates every ETF, and open-ended fund focused on this theme. The theme’s average historical performance is not biased towards surviving funds or successful funds. Every fund alive in a given month is included irrespective of its future survival or success. Investments that try to focus on multiple themes and, therefore, classified either at Cluster or Sub-Cluster Level are not included.