Zinc rallies as inventory declines once again

Zinc prices rallied 10.5% between 22/08/23 and 22/09/23 as inventory at the London Metal Exchange (LME) dropped by over a third.

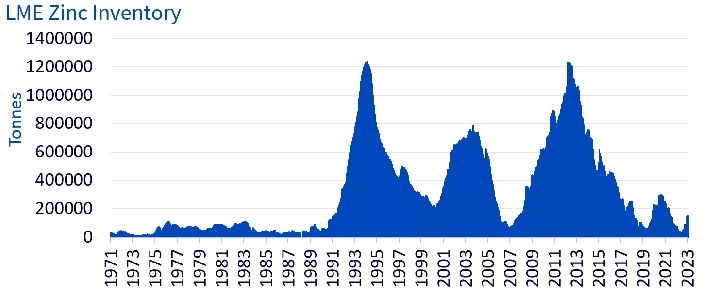

Zinc inventory falls by a third in less than a month

Zinc inventory at the LME had fallen to the lowest levels since 1975 in February 2023 (15,600 tonnes). That appeared to be a dangerously low level for the operations of the exchange and seemed to indicate physical tightness in the metal. While Shanghai Futures Exchange (SHFE) Inventories were low around that time, they expanded significantly, alleviating worries about metal availability. LME inventory also expanding ten-fold to 153,975 tonnes by the end of August which drove close to a 30% drop in price between February and August 2023.

However, inventory is declining once again, falling by over a third (to 101,550 on 25 September from 153,975 tonnes on 31 August 2023).

Source: Bloomberg, 28/08/1971 – 26/09/2023

Historical performance is not an indication of future performance and any investments may go down in value.

Uses of zinc

The primary use of zinc is in the galvanizing process, which protects iron and steel from rusting. Zinc coatings play a key role in public transportation and infrastructure by extending the life of steel used in bridge rails and support beams, railway tracks, and public transportation hubs and terminals.

Additionally, zinc can be alloyed with other metals and used for die-casting into shapes such as door handles, alloyed with copper to make brass, and sometimes other metals to make some types of bronze, like architectural bronze or commercial bronze.

Furthermore, zinc also has applications in energy storage. Zinc-carbon batteries were the first commercial dry batteries, providing a higher energy density at a lower cost than previously available cells.

Zinc in the energy transition

Zinc-ion batteries use a water-based chemistry, potentially avoiding some of the fire problem that users are concerned about with Lithium-ion batteries.

As renewable infrastructure gains momentum, driven by policies aiming to foster the transition away from fossil fuels, such as the Inflation Reduction Act in the US, and REPowerEU in the EU, we expect higher demand for solar and wind turbines. Zinc is used in both of these applications. With large-scale solar power plants estimated to have a workable life of at least 30 years, only zinc coatings can offer low-cost corrosion protection for such lengthy periods. Wood Mackenzie estimates that solar power installations currently account for approximately 0.4 Mt of global zinc consumption, with this number projected to grow to 0.8 Mt by 2040 in Wood Mackenzie’s base case. Under Wood Mackenzie’s scenarios consistent with a 2°C to 1.5°C global warming, consumption growth will range from 1.7 Mt to 2.1 Mt, respectively, by 20401.

Zinc balances

The International Lead and Zinc Study Group (ILZSG) forecasts published in April 2023 point to a supply deficit of 45k tonnes in 20232. However, their numbers showed a realised supply surplus in zinc in H1 2023 (370k tonnes3). They should publish their new forecasts next week following their October 5/6th meeting. It will be interesting to see how they interpret China’s turnaround. Following a disappointing H1 2023, Chinese authorities have been stimulating its economy. Last week, industrial production numbers beat expectations by a large margin (4.5% y-o-y vs 3.9% expected).

1 Solar energy to boost demand for base metals, Wood Mackenzie

3 https://www.ilzsg.org/wp-content/uploads/3.PRESS%20RELEASES/20230823_ILZSG%20August%202023%20Press%20Release.pdf