When constructing our Biorevolution strategy, we worked alongside futurist Dr Jamie Metzl, who is a member of the World Health Organization’s expert committee on human genome editing. We believe that we are on the precipice of a remarkable period, which could last a few decades, where we challenge and ultimately evolve how we do things, such as:

- How we handle human health care

- How we grow food for an expanding global population

- How we generate novel materials, chemicals and energy from biological sources

- How we think about storing massive amounts of data with higher density and fidelity than we have in the past

Dr Metzl recently published the book Superconvergence: How the Genetics, Biotech, and AI Revolutions will Transform our Lives, Work and World. Over the summer, we will publish a series of blogs that draw attention to some of the ideas presented in the book.

Key Takeaways

- The concept of ‘fixing a gene or genes’ makes intuitive sense, but seeing a live company with an approved therapy makes it a lot more concrete.

- Duchenne muscular dystrophy is a devastating disease for those impacted, so giving those suffering more options is remarkable.

- In June 2024 the FDA issued an expanded approval for a gene therapy from Sarepta Pharmaceuticals for its treatment for Duchenne muscular dystrophy.

- Sarepta Pharmaceuticals has a gene therapy for Duchenne Muscular Dystrophy which costs more than $3 million.

- There are indications that insurance providers will cover the approved therapy from Sarepta Pharmaceuticals to help those suffering from Duchenne muscular dystrophy.

- Related ProductsWisdomTree BioRevolution UCITS ETF – USD Acc, WisdomTree Artificial Intelligence UCITS ETF – USD Acc

Find out more

When constructing our Biorevolution strategy, we worked alongside futurist Dr Jamie Metzl, who is a member of the World Health Organization’s expert committee on human genome editing. We believe that we are on the precipice of a remarkable period, which could last a few decades, where we challenge and ultimately evolve how we do things, such as:

- How we handle human health care

- How we grow food for an expanding global population

- How we generate novel materials, chemicals and energy from biological sources

- How we think about storing massive amounts of data with higher density and fidelity than we have in the past

Dr Metzl recently published the book Superconvergence: How the Genetics, Biotech, and AI Revolutions will Transform our Lives, Work and World. Over the summer, we will publish a series of blogs that draw attention to some of the ideas presented in the book.

The bottom line

Thematic investing, in a sense, is about storytelling. Superconvergence does a great job conveying the narrative behind the WisdomTree BioRevolution ESG Screened Index.

Preparing for a blockbuster gene therapy

As we started 2024, we were very excited about the prospects in the biotechnology area of the equity markets. Our thinking was simple – this is an area with the potential to impact so many lives and an area that we, as a global society, want to see advances in. After years of relatively lacklustre investment performance, our view was that the space was due for a rebound.

For the better part of the first eight months of 2024, our view has not proven correct. Biotechnology equities have performed in fits and starts, but we have not seen any sort of sustained rally in the space. At the beginning of 2024, it was true that the market was tending to look at the policy of the US Federal Reserve, hoping for policy rate cuts, and as we write these words roughly halfway through August 2024, the market is looking at this very same thing.

However, the companies are continuing to make progress.

The case of Sarepta Therapeutics: A $3 million drug

Given the hurdles that biotechnology companies need to clear to develop and produce successful therapies – it’s amazing that we have these medicines. There are so many risks, and many don’t fit into company fundamentals or financial statements.

Sarepta Therapeutics has focused on Duchenne Muscular Dystrophy (DMD). This is a rare, debilitating disease that impacts a few hundred thousand people worldwide. It is caused by a mutation on one of a mother’s X-chromosomes, and leads to difficulties in the body producing dystrophin, which protects muscles from degrading in the presence of enzymes1.

Sarepta developed Elevidys, a gene therapy that, simply put, inserts a gene that seeks to alleviate the issue in the production of dystrophin. It’s a great example of a genetic cause being determined and researchers getting to a point where they can, essentially, ‘fix’ the problem.

The cost of this therapy is $3.2 million. The Food & Drug Administration (FDA) expanded the initial approval of this therapy in an announcement on 20 June 2024. Importantly, approval and expanded was not approved because people receive this therapy and are cured. This is a severe disease, it is a rare disease, so as there is a genuine lack of other options, the FDA wants to ensure the treatment option is on the table2.

In the US market, for a medical therapy with a multi-million dollar price tag, many would be thinking – is it covered by insurance? There are indications that some of the large insurers and Medicaid have written policies on the label and that, if it is prescribed, they won’t be fighting against allowing the therapy by resisting payment3.

Translating projections into realities

As we look at companies in the biotechnology space, it becomes clear that there are so many ways to fail. There is no guarantee a therapy can be developed. There is no guarantee that such a therapy can move through all of the phases and secure FDA approval. Then, one has to consider if insurance providers will pay for the therapy. While all of this is happening, there’s always the chance that a different company will find a different, more effective approach, taking away the potential market. Or negative side effects are discovered along the way.

Every therapy requires talented people working extremely hard with massive investments of time and money over many years. Most will never achieve revenues of billions of dollars, essentially ‘blockbuster status.’

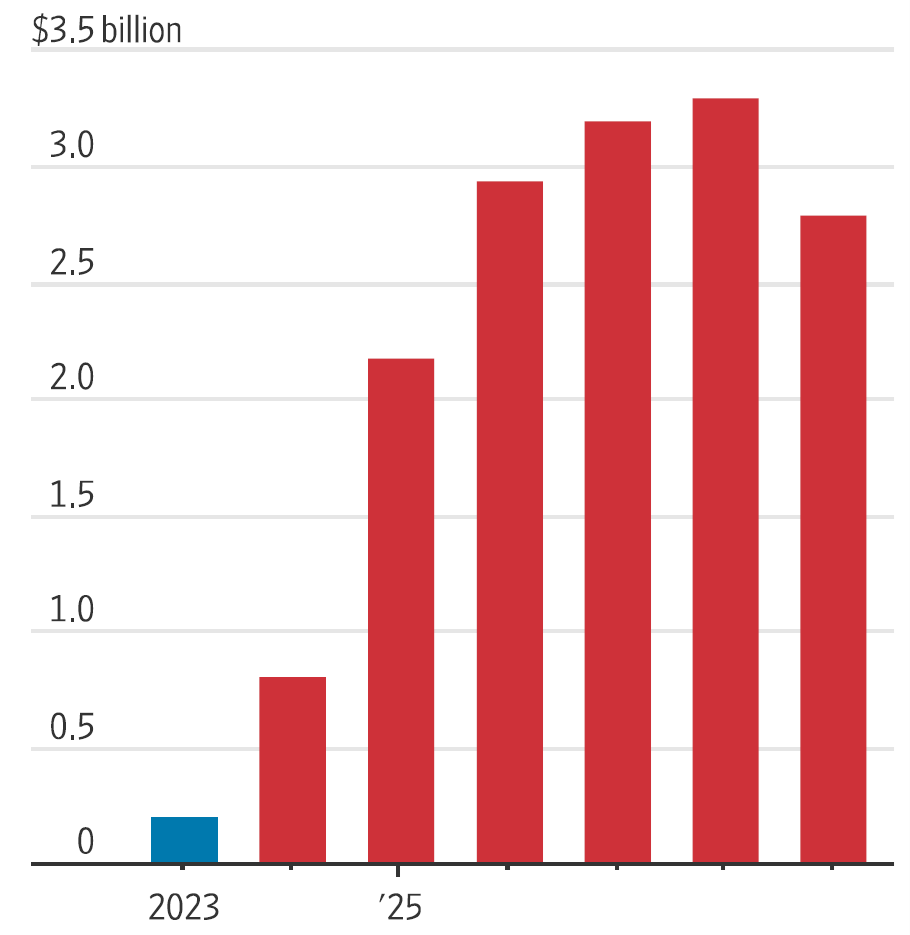

Elevidys, as we write these words in August 2024, is a long way from actual blockbuster status. However, if things go according to analyst projections (shown in Figure 1), the therapy could lead to a few billion in revenue in only a couple of years. The number of people in the US with DMD is a known quantity, as well as the typical number of increasing cases over a given year. As designed, this is currently a one-time therapy. It is therefore reasonable to consider different sorts of potential revenue estimates.

Figure 1: Elevidys projected sales (full years, up to 2029)

Note: 2024-2029 are analyst projections on FactSet.

Source: Wainer, David. “A $3 Million Gene-Therapy Maker at a Bargain Price.” Wall Street Journal. August, 19, 2024. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

It’s possible that, with so many risks on the horizon with any individual biotechnology stock, it makes sense to consider the so-called ‘biggest risk’ at any single time. In 2024, Sarepta investors were focused on securing the expanded approval from the FDA. This approval was secured, and the share price reacted, positively, roughly 30% on the news. Since then – and of course from 20 June 2024 until the second half of August there has been market volatility – shares have given up a portion of these gains4.

The WisdomTree BioRevolution UCITS ETF (WDNA)

Think of all the ways in which an analyst would have to evaluate Sarepta Pharmaceuticals in recent years:

- There is the overall science of DMD and the probability that a therapy can be developed.

- There is then the probability that the therapy delivers well enough through the various phases of the clinical approval process with the FDA to be approved5.

- There was the recent discussion of ‘expanded approval’ which occurred about one year after the initial approval6.

- While all of this is happening, the usual financial analysis of revenues, expenses, cash flows – that is all still there.

- There is also the progress in different markets beyond the USA that needs to be considered because it can dramatically impact the size of the addressable market.

Investors have the option to look at any single company, of course, but one of the reasons we developed the WisdomTree BioRevolution UCITS ETF (WDNA) is to recognise that diversification could be of particular importance in this very high-risk space. As of 16 August 2024, there were 89 individual equity holdings. Sarepta was one of these, weighted at roughly 1.6%7.

One company at a 1.6% weight is not going to drive a portfolio of nearly 90 equities toward any particular result, but we would note that the story of Sarepta and Elevidys is an important illustration of where we believe we are in the biotechnology space. We believe that the convergence of what we are seeing in areas like artificial intelligence and cloud computing is contributing to allowing us to pursue more paths of interesting research, faster, and that we will keep hearing about more and more potential gene therapies. For those investors with the appropriate degree of patience, the coming years could get very interesting.

1 Source: Wainer, David. “A $3 Million Gene-Therapy Maker at a Bargain Price.” Wall Street Journal. August, 19, 2024.

2 Source: Wainer, August 19, 2024.

3 Source: Wainer, August 19, 2024.

4 Source: Wainer, August 19, 2024

5 Source: “FDA Approves First Gene Therapy for Treatment of Certain Patients with Duchenne Muscular Dystrophy.” FDA Press Release. June 22, 2023

6 Source: “FDA Expands Approval of Gene Therapy for Patients with Duchenne Muscular Dystrophy.” FDA Press Release. June 20, 2024

7 Source: https://www.wisdomtree.eu/en-gb/etfs/thematic/wdna—wisdomtree-biorevolution-ucits-etf—usd-acc