Property investment strategy for the near-term 2022-2023 horizon was already challenging at the beginning of the year before recent troubles. At that time, debate focused on the “new normal” that would emerge as Covid-19 contagion eased combined with potential for economic growth constrained by dwindling labor availability. Now, Russia’s invasion of Ukraine has escalated into one of the worst geopolitical crises in decades, adding more uncertainty to the market and heightening the prospect of ongoing inflation. Meanwhile, Covid-19 fears are again in the offing and threatening to prolong supply bottlenecks combined with the possibility that monetary policy missteps might weaken or even flatten economic growth prospects. We believe investors should revisit their plans by examining vulnerability to these emerging risks.

At the end of 2021, US commercial property investors were contemplating prospects for an easing Covid-19 threat in the year ahead along with still-strong economic growth accompanied by tightening interest rates to quell inflation. As often happens, it’s not turning out exactly as expected.

The coronavirus continues to defy expectations. The delta variant of the virus produced a surge of cases in August and September of 2021 and then eased up through mid-December when the omicron variant took hold. Another surge peaked this year in mid-January with daily contagion showing a slow decline since then. Yet, as March comes to an end, an omicron surge is underway in Asia and a new variant is rising in the UK and Europe. US health officials are watching closely. While it is too soon to regret the cessation of Covid-19 restrictions, the virus is reminding us to stay alert. For property owners and managers that means that return-to-the-office is still uncertain, that consumers may hold back longer before fully resuming travel and restaurant meals, and that Covid-19-related bottlenecks in production and shipping will not be resolved quickly.

The US property sector is also grappling with the beginning of “normalization” in monetary policy. The US Federal Reserve’s (Fed) purchases of securities, which helped to assure capital markets liquidity as the Covid-19 recession took hold, were completed earlier this year. At its March meeting, the Fed’s Federal Open Market Committee (FOMC) announced its first post-Covid-19 interest rating tightening pushing the federal funds rate up to 0.25% above zero. Updated projections show the Fed expecting the federal funds rate to reach almost 2% this year. In December, the projection for 2022 was a 0.9% funds rate.1 That’s a noteworthy change.

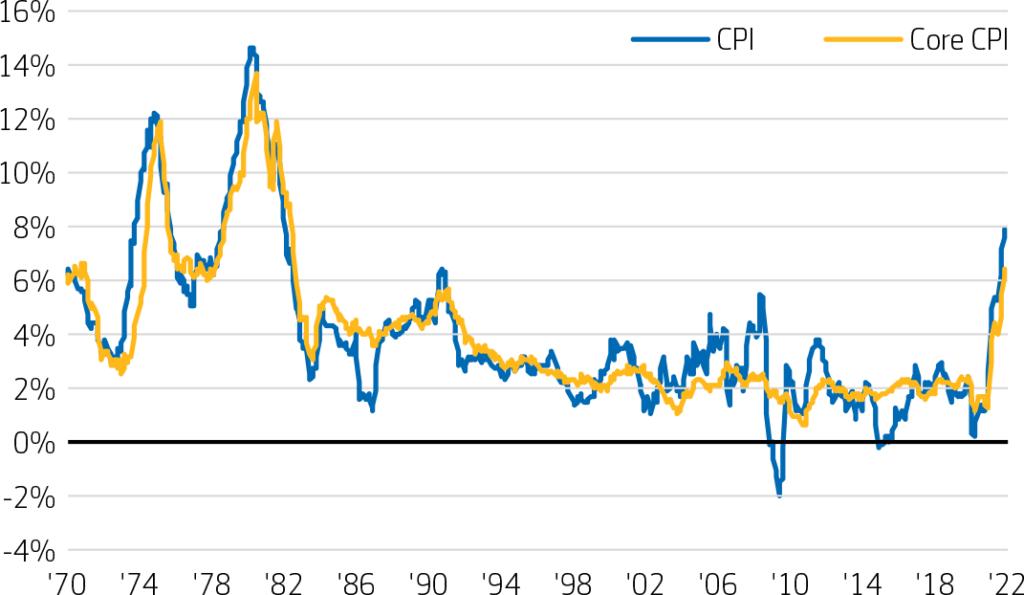

The strength and origins of inflation are complicating the Fed’s task. The most recent data for February shows prices 7.9% above last February. Excluding food and energy, the rise is 6.4%.2 As shown in Exhibit 1, neither of these inflation measures has been this high since 1980, a comparison causing no small amount of concern. Inflation began accelerating in the spring of 2021 as it rose above the 2%-ish pace that prevailed pre-Covid-19. Initially, the rise was dismissed as temporary with its cause largely rooted in supply bottlenecks and consumer spending composition shifts, both coronavirus related. Over subsequent months, the build-up of consumer savings, related in part to federal Covid-19 support policies, was identified as a contributing factor to strength in consumer spending. But again, the savings glut and spending surge were seen as temporary especially as federal aid programs expired. The more recent complication involves the surge in energy and commodity prices due to the war in Ukraine along with suspicion that “temporary” inflation is lasting too long.

Exhibit 1: Consumer Price Index (1970-2021)

In this complex environment, we believe the Fed must tread very carefully to avoid overreacting. As mentioned earlier, the updated projections survey of Fed policymakers shows a notable widening in the range of expectations for tightening and its impact on growth. The three inflation hawks in the survey expect nearly a 300-basis point increase in the federal funds rate for this year, albeit none see that causing recession.1 In other words, policymakers are aiming for a “soft landing” but they disagree on what it will take to achieve it. The diversity of opinion is worrisome and suggests that the probability of compromised economic growth if not recession has increased. Financial markets are taking note as shown in the flattening of the Treasury yield curve though not yet to the point of a recession-warning inversion. Investors are well-advised to take note.

US commercial real estate sector implications

Property investment strategy for the near-term 2022-2023 horizon was already challenging at the beginning of the year before recent troubles. At that time, debate focused on the “new normal” that would emerge as coronavirus contagion eased combined with potential for economic growth constrained by dwindling labor availability. Now, Covid-19 fears are again in the offing and threatening to prolong supply bottlenecks combined with the possibility that monetary policy missteps might weaken or even flatten economic growth prospects. We believe investors should revisit their plans by examining vulnerability to these emerging risks.

Among the four main property sectors, office is the most vulnerable to both prolonged Covid-19 woes and potential weakening in economic growth prospects. Office occupancy has certainly improved since the early days of the coronavirus in 2020 when in-person occupancy dropped below 20%, but only to 39.5% according to early March data from the Kastle Back to Work Barometer.3 Improvement has also been noted in the stabilizing supply of available sub-lease space and in the positive net leasing during the second half of 2021.4 These improvements occurred in an environment of rapid recovery in jobs and strong economic growth. The Fed’s survey is pegging 2022 growth at 2.8% down from 4% in December.1 Office leasing decisions are likely to be more delayed in the months ahead with tenants now worrying about weakening business conditions in the months ahead along with work-from-home challenges.

The retail sector is also vulnerable to both prolonged Covid-19 woes and potential weakening in economic growth prospects. The sector has suffered through an accelerated shakeout of properties and retail tenants most vulnerable to ecommerce as the coronavirus kept shoppers at home. Grocery anchored centers proved to be the most resilient even as many shoppers turned to online grocery sites. Conditions improved in 2021 as federal income support helped buoy retail sales and as waning Covid-19 fear brought some consumers back to restaurants. With no further support programs in the offing, consumers are depleting the savings accumulated last year leaving prospects for retail spending growth dependent on employment and income growth. Weaker economic growth prospects and higher inflation are now producing a headwind for retail in the coming months complicated by possibility of another covid wave. Grocery-anchored strip centers will likely continue as the most bullet proof retail subsector especially in metros enjoying strong population inflows. The most vulnerable are properties carrying significant vacancies in markets with poor economic growth drivers.

For both office and retail, investors with new money to place were perhaps looking forward to some clarification this year in the winners and losers expected for the “new normal”. They will need to wait a bit longer. Investors holding properties will need to update hold-sell analysis to digest the new risk environment. Those with patient money will perhaps push out time horizons and wait out the turbulence.

For industrial investors, the good times might be less good with slower economic growth and inflation slowing down the demand for everything but there is still a tailwind on the sector. Industrial space markets are extremely tight and well positioned to absorb the heightened stress now taking shape. Even with weaker economic growth, logistics tenants are still pursuing restocking of depleted inventories and precautionary stocking of essential materials. Despite the heightened risk, investors are unlikely to find bargains emerge in the industrial sector and current owners should continue to enjoy opportunity for raising rents.

Apartment investors are also well-positioned to absorb heightened stress but with caveats. New construction continues at a strong pace concentrated as usual on high-quality stock, but completions are taking longer because of construction bottlenecks. Overbuilding of new high-quality units is an emerging concern in several metro areas. But overall, overbuilding is not excessive with high-quality property (4 and 5 star) vacancy at a 6.8% average nationally from 10.4% in 2020. Medium-quality properties (3 star) are in tighter supply with vacancy at 4.3%, the lowest in more than a decade. The lowest quality properties in the professionally managed universe (1 and 2 star) are tighter still with vacancy below 4%.4 The very tight vacancy rates for the more affordable subsectors of apartments should serve as a cushion against slower economic growth, rising interest rates, and coronavirus worries. But, as always, rent growth prospects will rely on the absolute strength of local economies.

References

1Board of Governors of the Federal Reserve System. March 16, 2022

2US Bureau of Labor Statistics. Consumer Price Index. February 24, 2022

3Kastle. Kastle Back to Work Barometer. March 16,2022

4CoStar Realty Information, Inc. December 31, 2021

Important disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon AM is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon AM nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, the following wholly or partially owned affiliates may also conduct certain business activities under the Aegon Asset Management brand: Aegon Asset Management (Asia) Limited (Aegon AM Asia).

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM US is also registered as a Commodity Trading Advisor (CTA) with the Commodity Figures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon AM Asia is regulated by the Securities and Futures Commission of Hong Kong (CE No. AVR688) to carry out regulated activities in Dealing in Securities (Type 1) and Advising on Securities (Type 4).

©2022 Aegon Asset Management or its affiliates. All rights reserved.

4615573.1GBL

Exp Date: March 31, 2024