-2.54%

in the 2nd quarter of 2022 for the A EUR Share class.

-2.54%

in the 2nd quarter of 2022 for JP Morgan GBI Global (EUR).

-3.38%

versus -6.60% for the reference indicator.

Carmignac P. Global Bond was down –2.54% in the second quarter of 2022, on par with the –2.54% decline in its reference indicator*.

The bond market today

The market environment in the second quarter was largely unchanged from the first:

- The war between Russia and Ukraine hasn’t let up, adding further uncertainty, inflationary pressures (e.g. through higher food and energy prices), and economic growth worries as a result of embargos (primarily on oil) and possible disruptions in the supply of natural gas, minerals, and fertilisers.

- Inflation isn’t coming down; the timing of peak inflation keeps getting pushed back month after month.

- In response, Central Banks are stepping up the pace of policy tightening in order to prevent inflation expectations from becoming unanchored. The Fed has begun its cycle of rate hikes and even accelerated the process in June. It’s also shrinking its balance sheet by selling bonds. The ECB is struggling to keep pace but announced it would end its asset purchases in July (after scaling them back gradually in Q2), and is expected to carry out its first rate hike at its July meeting. Most other central banks have embarked on the same trajectory. This trend of monetary policy tightening around the world marks a real shift away from the policy of the past 15 years.

Looking specifically at the eurozone, inflation came in at over 8% in May year-over-year, but with stark country-by-country differences (22% in Estonia, 10% in Spain, 6.5% in France, and 8.5% in Germany, for example). Inflation in the currency bloc isn’t expected to peak until this autumn, unless the timing gets pushed back again, as it has been several times in the past year or more. The ECB has therefore begun pulling the strings on monetary policy, but while also attempting to mitigate the effects of the tightening on sovereign credit spreads. Even though it’s logical that the most indebted countries would be hit hardest by the end of the asset purchases, in mid-June the ECB – in light of the magnitude and speed of the jump in spreads – had to promise it would introduce a mechanism to limit and potentially cap the increase in risk premiums. Inflation is even more alarming in the US, where price appreciation in the services sector and the upwards pressure on wages are continuing apace. The US job market is running hot, and this trend looks set to last.

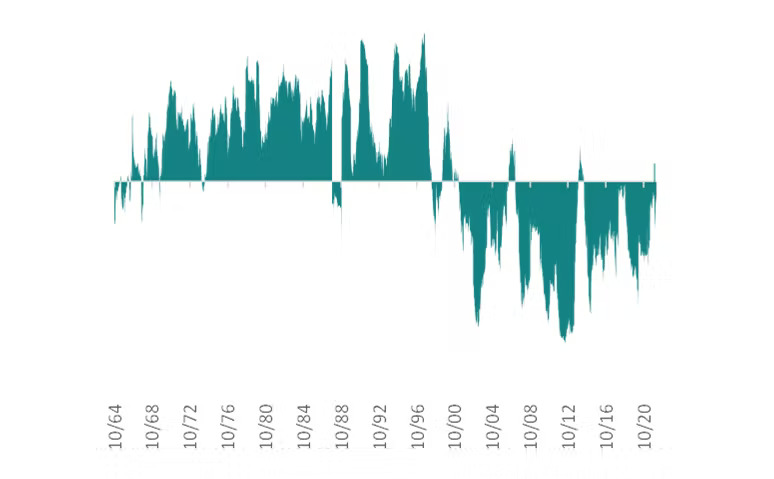

In the credit market, corporate bond prices were impacted by fears about a recession and the possibility that Russia could cut off natural gas supplies. The spread on the high-yield sector widened 240 bps during the quarter, and that on investment-grade issues rose by 45 bp. Individual sectors also faced specific headwinds; businesses highly sensitive to interest rates (like those in the real estate sector) were hit by the increase in borrowing costs. Also during the second quarter, the correlation between equity prices and sovereign bond yields reversed, and consequently, so did the correlation between the high-yield names and sovereign bonds, as shown in the following graph.

In the forex market, the currencies of commodity-producing countries depreciated. The prospect of a recession weighed on metals prices. The euro lost nearly 5% of its value in the second quarter on worries that Russia would cut off natural gas supplies. The yen sank further under the Bank of Japan’s refusal to bend on its quantitative easing program – notwithstanding the inflationary pressures that are starting to surface.

How is the fund performance explained?

The Fund’s performance in Q2 can be divided into two distinct phases. In phase one, which lasted until early June, our portfolio held up relatively well against the market downturn thanks to our low modified duration, credit protection (through CDS Xover indices), and exposure to USD. Few major changes were made to our portfolio in this phase – we kept its modified duration in the conservative range of 2.5–3.5, we maintained our USD exposure at around 25% of the Fund’s assets, and we had protection on around 20% of our credit holdings. With this positioning, the Fund was able to take full advantage of the euro’s decline in the first two months of Q2.

That was phase one. In phase two, the about-face in bond yields and spreads caught our portfolio off guard. The low modified duration meant we couldn’t benefit from the decrease in interest rates, and our credit exposure – initially 10%, but increased in June through the unwinding of some of our credit protection – weighed heavily on our returns. The Fund shed nearly 2% in just two weeks and ended the quarter in negative territory. Investors apparently no longer believe central banks will be able to carry out their rate hikes, even though central bankers consistently stress that combating inflation is their top priority. Two weeks of worries about economic growth have wiped out six months of inflationary fears. Compounding the problem is the reduced amount of liquidity in the market (a typical pattern at the close of H1, but this time it also reflects the withdrawal of central banks), which has created dislocations in some credit market segments. Cash bonds and credit derivatives are no longer correlated, for instance, and prices have fallen dramatically for some issuers and in some sectors.

What is our outlook for the coming months?

We currently believe that central banks won’t let their guard down just yet – the Fed and ECB “pivot” that market participants are expecting to happen soon (too soon in our view) – and have positioned our portfolio accordingly. At the end of Q2, we still had low sensitivity to interest rates and especially to core sovereign yields. Central bankers nevertheless seem fully aware that their stance could have a potentially significant impact on growth. We increased our credit exposure slightly, by roughly 10 percentage points, and have adopted a defensive positioning on the forex market (through long positions on JPY and CHF).