Global stock markets have suffered heavy losses this week due to persistently high inflation and concerns about weak company earnings. With year-on-year price rises in the US hitting a 40-year high of 9.1% in June, the prospect of central bankers in America raising interest rates by a significant amount later this month seems increasingly likely.

US markets

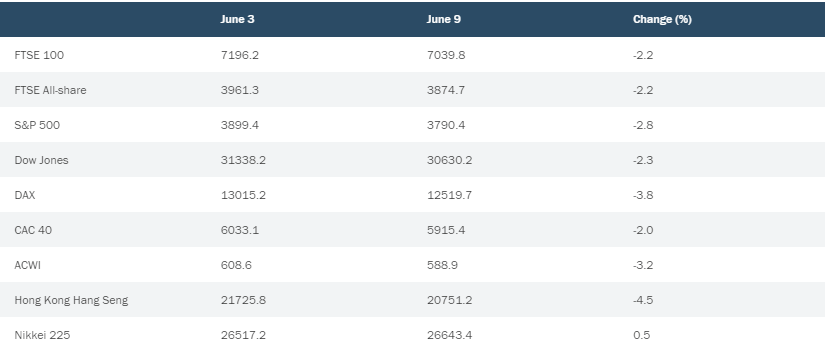

On Wall Street, the Dow Jones Industrial Average ended trading on Thursday 14 July 2.3% down for the week so far, with the S&P 500 losing 2.8%. Confidence among small businesses in the US fell to its lowest level in nearly a decade, latest data showed – a strong indication that the American economy is on the verge of a downturn.

Europe

Asia

In Asia, the Hang Seng index in Hong Kong slumped 4.5% this week as Beijing introduced new lockdowns in response to another Covid-19 wave. The virulence of the Omicron variant has severely tested China’s zero-Covid policy and rolling restrictions have significantly hampered economic activity this year.

Japan’s Nikkei 225 index of leading shares bucked the downward trend to report a 0.5% gain by Thursday’s close. Victory for the ruling party in national elections last weekend was welcomed by investors, while the strong dollar has also helped keep the value of Japanese multinationals high.

Note: all market data contained within the article is sourced from Bloomberg unless stated otherwise, as at 15 July 2022.