Limited-price indexation pension increases are challenging to hedge perfectly but they may be managed – our blog series explores how this may be done effectively.

Managing limited-price indexation (LPI) liabilities – payments from defined benefit (DB) schemes that increase in line with inflation, but with caps and floors at play – is a notoriously complicated topic. Risk management of DB schemes is tricky enough already but the additional twists and turns of LPI liability management may make running a scheme feel like being caught in a maze.

Historically, LPI has been an ancillary risk, very much secondary to those from under-hedging rates and inflation or from that posed by investments in growth assets, such as equities. However, as schemes get better funded and de-risk into their endgames, LPI risk is becoming increasingly relevant. The current macroeconomic environment, with rampant and volatile inflation, also highlights how much such caps and floors can matter.

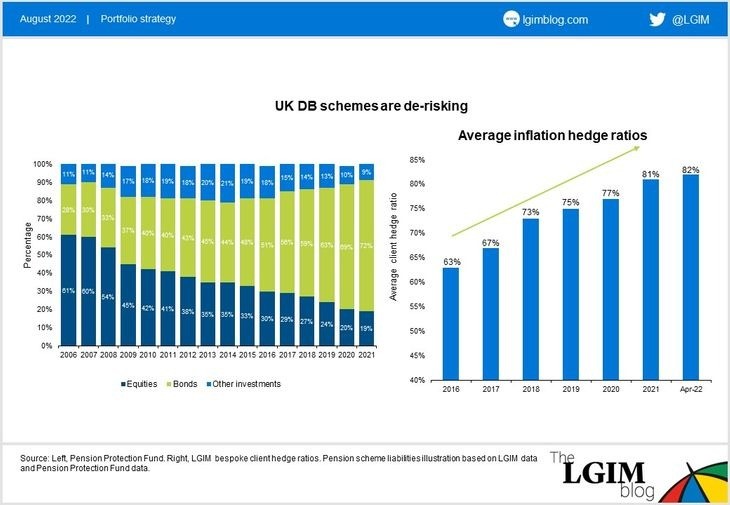

The chart below shows that DB schemes are holding a high percentage of bonds, while inflation hedge ratios are at their highest point in years – each a strong indicator of de-risking activity.

In this blog series we will tackle some of the key issues facing the management of LPI risk, outlining our take on the challenges ahead and offering some potential solutions. The aim of this introduction is to briefly outline the topics we will cover, providing a roadmap for the forthcoming instalments.

Part two – How LPI caps and floors make hedging their risk so complex

While LPI swaps exist that could be used to for hedging purposes, the market for them is highly illiquid. An alternative approach, called ‘delta-hedging,’ involves calculating a dynamic benchmark, or mix, of interest rate and inflation sensitivities that can be hedged with traditional instruments such as gilts, linkers and swaps. We look at why frequent re-evaluation of such a benchmark is important, particularly in volatile markets, and how many schemes run risk due to a failure to rebalance often enough. We also note that even if schemes don’t stick to their benchmark, frequently calculating it allows for better understanding of the risks they are running.

Part three – Rebalancing tolerances

We discuss the importance of separating the recalculation of the liabilities’ sensitivity from the decision to rebalance to that benchmark. In particular, the blog considers transaction costs which discourage overly frequent rebalancing, and sets out a framework for balancing risk against costs. Additionally, it explains how the sweet spot varies with each scheme’s specific circumstances. The framework takes no active view of how cheap or expensive inflation-linked securities may appear, but notes that higher tolerances could be set to allow for manager discretion.

Part four – Back-testing delta-hedging strategies

We demonstrate how to use back-testing to investigate how LPI delta-hedging can sometimes ‘accidentally’ generate alpha (by buying cheap and selling expensive) and in other circumstances destroy it (by doing the reverse). This depends on the cap and floor in question, the frequency of rebalancing and any lags involved. The key to this is that inflation tends to be range-bound, partly due to inflation-targeting policies of central banks, but LDI governance frameworks are not set up for range trading. As inflation tends to ‘mean revert’, there are times when inflation is high/expensive and other times when it is low/cheap.

Part five – Selecting an inflation model for delta hedging

We consider the advantages and disadvantages of various inflation models that can be used for LPI delta hedging. Factors involved include market conditions, the timeframe and likelihood of buy-in or buyout in the near term, realism, and a desire for simplicity. We outline our real-world models of choice, explain when a market-consistent approach or a blend of the two can make sense, and consider the potential implications of high model and parameter uncertainty.

As you can see there is a lot of ground to cover. While LPI risk is an intricate topic, it’s also an interesting one that is increasingly important for schemes to understand. We hope you enjoy the journey!