Most Asian markets gain during the month while China remains under pressure

Summary

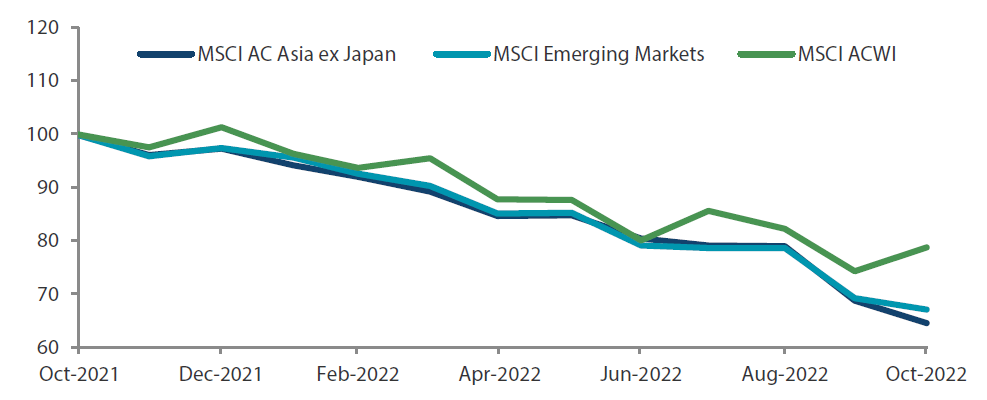

- The MSCI AC Asia ex Japan Index fell in October, returning -6.1% in US dollar (USD) terms, despite a better-than-expected earnings season and cautious optimism that the US Federal Reserve (Fed) would slow its pace of interest rate hikes. Most Asian markets gained during the month, though Hong Kong and Taiwan stocks were volatile and the China market continued sliding.

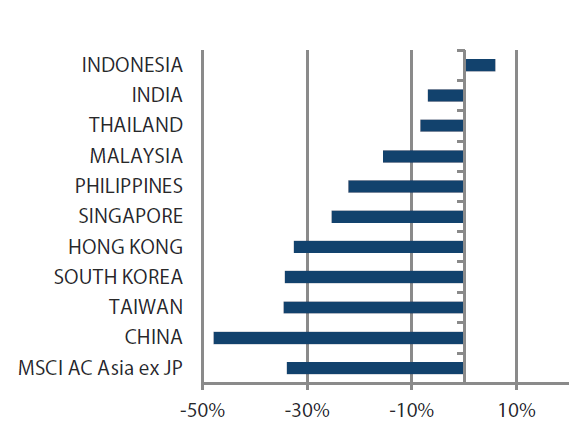

- China slumped 16.8% as the Communist Party Congress did not provide much fresh market impetus, especially for the embattled property sector. The country’s delayed economic data release showed a mixed recovery in the third quarter (3Q), with unemployment rising and retail sales weakening in September despite the GDP picking up in 3Q. Taiwan’s (-5.1%) industrial production posted a surprise 4.8% year-on-year (YoY) decline in September, the worst performance since March 2019.

- The ASEAN region fared better on the whole thanks to gains by the Philippines and Malaysia. Malaysia’s parliament was dissolved during the month, paving the way for elections in November. In the Philippines (+9.1%), the national government’s budget deficit in September narrowed slightly by 0.6% YoY, as growth in revenues outpaced that of expenses.

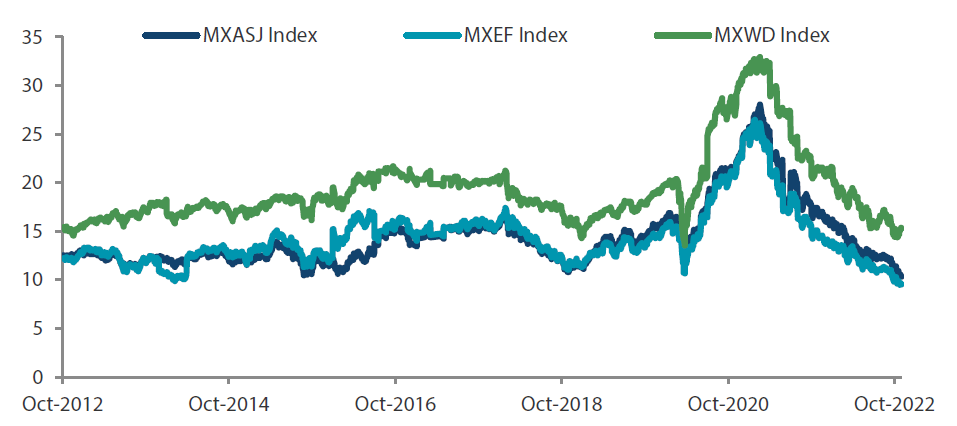

- The markets are now preoccupied with guessing the Fed’s next move and when inflation might ebb sufficiently for the central bank to hold/ease interest rates. We believe that it will take time for the tight labour conditions to ease, and the markets may likely remain in the doldrums longer than currently anticipated. Nonetheless, a handful of Asian markets are marching to their own beat, with local equities pricing in most of the negatives; in our view they are trading at reasonable or attractive valuations for long-term investors.

Market review

Weaknesses in North Asian markets weigh on overall performance

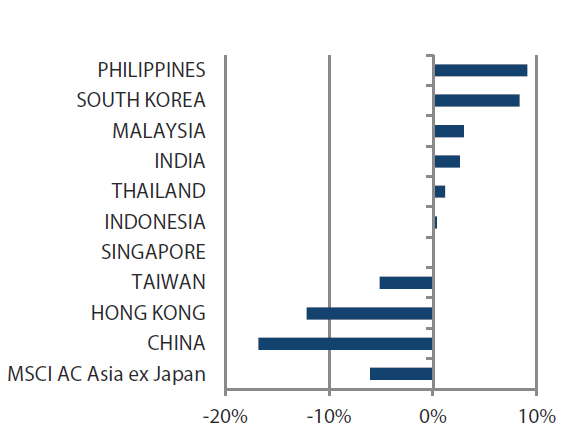

The MSCI AC Asia ex Japan Index fell in October, returning -6.1% in US dollar (USD) terms, despite a better-than-expected earnings season and cautious optimism that the Fed would slow its pace of interest rate hikes. This is because inflation remains high around the world, with the annual US inflation rate hitting 8.2% YoY in September. Most Asian markets gained during the month, though Hong Kong and Taiwan stocks were volatile and the China market continued sliding.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Soft economic data in China and Taiwan

China slumped 16.8% as the Communist Party Congress did not provide much fresh market impetus, especially for the embattled property sector. President Xi Jinping, who further consolidated power following a Politburo shake-up, stood by China’s zero-COVID policy. The country’s delayed economic data release showed a mixed recovery in 3Q, with unemployment rising and retail sales weakening in September despite the GDP picking up in 3Q. The People’s Bank of China kept its benchmark lending rates steady for a second month. Hong Kong (-12.2%) booked a larger trade deficit in September and saw its headline CPI rise 4.4%.

Taiwan’s (-5.1%) industrial production posted a surprise 4.8% YoY decline in September, the worst performance since March 2019. Exports also fell in September for the first time in more than two years. Adding to these woes are the new US curbs on supply chains linked to China’s semiconductor industry. Meanwhile, South Korea (+8.3%) pledged around USD 35 billion to prop up its credit markets, easing concerns about rising default risks in key sectors including real estate. The Bank of Korea raised its benchmark policy rate to 3%, nearing the terminal rate of around 3.5% that the policy committee foresees.

India market gains modestly despite rising cost and rupee weakness

India rose 2.6%, despite retail inflation accelerating to a five-month high of 7.4% YoY in September. The Indian rupee also fell to its lowest on record against the dollar during the month, and the currency’s weakness has triggered concerns about the rising costs to import commodities, including crude oil.

Philippines and Malaysia lead the ASEAN region

The ASEAN region fared better on the whole. Singapore ended the month flat as the Monetary Authority of Singapore tightened monetary policy for the fifth time in a year, allowing a further strengthening in the Singapore dollar to help dampen inflation. Indonesia (+0.3%) enjoyed a trade surplus of around USD 5 billion in September, which beat forecasts. Bank Indonesia also hiked its seven-day reverse repurchase rate by 50 bps to 4.75%. Thailand (+1.2%) and Malaysia (+2.9%) saw inflation easing slightly. Malaysia’s parliament was dissolved, paving the way for elections in November. In the Philippines (+9.1%), the national government’s budget deficit in September narrowed slightly by 0.6% YoY as growth in revenues outpaced that of expenses.

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 31 October 2022 |

For the year ending 31 October 2022

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Interest rate direction remains a key factor

The Goldilocks economy that investors had grown accustomed to over the past couple of years is now firmly in the rear-view mirror. Positive real rates, or a shift in that direction, seems unnatural to investors who have been lulled by benign economic conditions. Asset markets are now preoccupied with guessing what the Fed is seeing—when will inflation ebb enough to hold/ease interest rates? We believe that it will take time for the tight labour conditions to ease, and the markets may remain in the doldrums longer than currently anticipated. Nonetheless, a handful of Asian markets are marching to their own beat, with local equities pricing in most of the negatives; in our view they are trading at reasonable or attractive valuations for long-term investors.

China maintains guidance on key policies

The 20th National Party Congress affirmed President Xi’s preeminent position in China’s Communist Party and granted him a third presidential term; as such, his grip on power remains firm. President Xi has made clear that a formal departure from the dynamic zero-COVID policy is unlikely, though “dynamic” could now extend to some form of relaxation (such as reduced quarantine). He also reiterated a focus on “high quality development” and the need to

bolster capability and innovation in areas critical to China’s national interests. We remain positive on areas that are broadly aligned with these strategic imperatives—energy security, greater self-sufficiency, improving cost of living and domestic consumption.

President Xi also reiterated the desire for the a “complete reunification of the Chinese nation”—a euphemism for China’s desire to take Taiwan under its fold. If Russia’s invasion of Ukraine has taught us anything, it is to never completely discount such a possibility. Nonetheless, this is not our base case for the foreseeable future, where our concern is the demand headwinds affecting consumer technology, which is a mainstay of Taiwanese exports. This latter concern also extends to South Korea. As such, we continue to like healthcare and energy infrastructure stocks in these markets.

Riding on longer term growth potential in India and ASEAN

Both ASEAN and India stand to benefit from a China Plus One strategy, as well as sizeable, and enduring, domestic demand trends accelerated by rapid digitalisation of these economies thanks to COVID-19. Higher energy prices have aided the terms of trade in Indonesia and Malaysia, even as cheaper Russian energy cargos are finding their way to India. Favourable demographics owing to large and skilled labour resources augur well for the medium-term growth prospects in these countries. Better national, and corporate, balance sheets also imply reduced (not zero!) stress from the rising cost of capital overseas. As such, we reiterate our positive views towards banks, renewable energy businesses, electric vehicle materials and consumption.

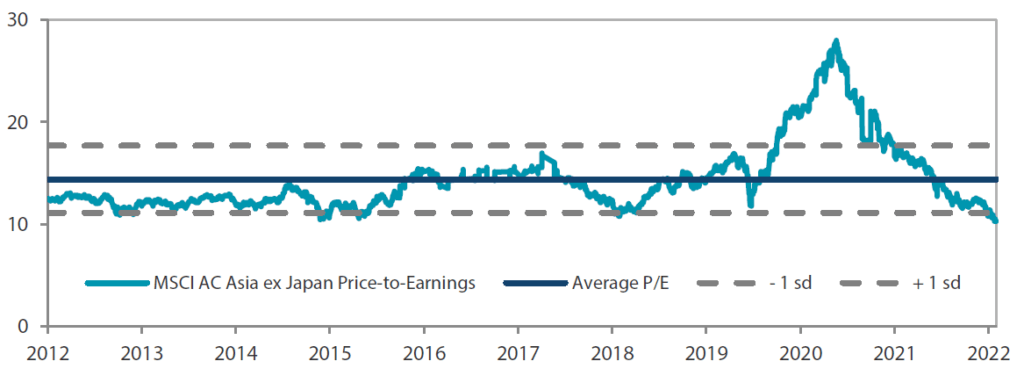

Chart 4: MSCI AC Asia ex Japan price-to-earnings

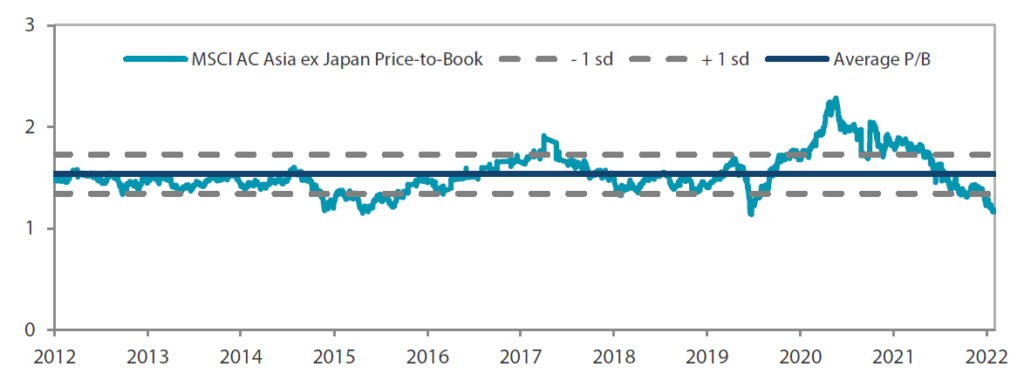

Chart 5: MSCI AC Asia ex Japan price-to-book

Important disclaimer information

Please note that much of the content which appears on this page is intended for the use of professional investors only.