Donald Trump’s election victory has brought renewed focus on international trade policies and their potential impact on the global technology industry. Emerging economies such as Taiwan, South Korea, and China are particularly attentive to potential developments on this front, given their respective considerable trade surpluses with the United States and their critical roles in the global technology supply chain. Given the increased likelihood of policy shifts, especially regarding tariffs, we think it’s essential to understand how these changes might influence the approaches of technology industries in these regions.

Trump's Trade Policy and the Global Tech Ripple Effects

During his first term as president, Trump emphasized bringing manufacturing back to the United States, often leveraging tariffs as a tool to encourage domestic production. His protectionist stance aimed to reduce the country’s trade deficit and strengthen US industries. The tariffs imposed between 2018 and 2019 impacted a range of products and had ripple effects across business confidence levels, global trade dynamics, and ultimately on global economic growth.

The use of tariffs has been shown to lead to increased US inflation and interest rates. According to the US Federal Reserve, the tariffs of 2018-2019 contributed to a 0.3% increase in core inflation during that period. These factors can influence foreign exchange rates, global capital flows, and affect equity market valuations, particularly in emerging markets. The timing and scope of tariffs remain critical in determining their overall impact, as they can significantly influence the extent and immediacy of economic disruptions.

Event Analysis and Implications for Taiwan, Korea, and China Tech

Event 1: US Tariffs Targeting Only China

If the US focuses tariffs solely on China, the direct impact on Taiwan and South Korea might be limited. Over the past few years, companies from both regions have diversified their production bases, moving significant manufacturing operations from China to India, Mexico, countries in the Association of Southeast Asian Nations (ASEAN) region, and also back to their domestic markets to mitigate risks associated with US-China trade tensions. This shift began during Trump’s earlier tenure and has continued, and this has allowed Taiwanese and Korean companies to mitigate some tariff risks.

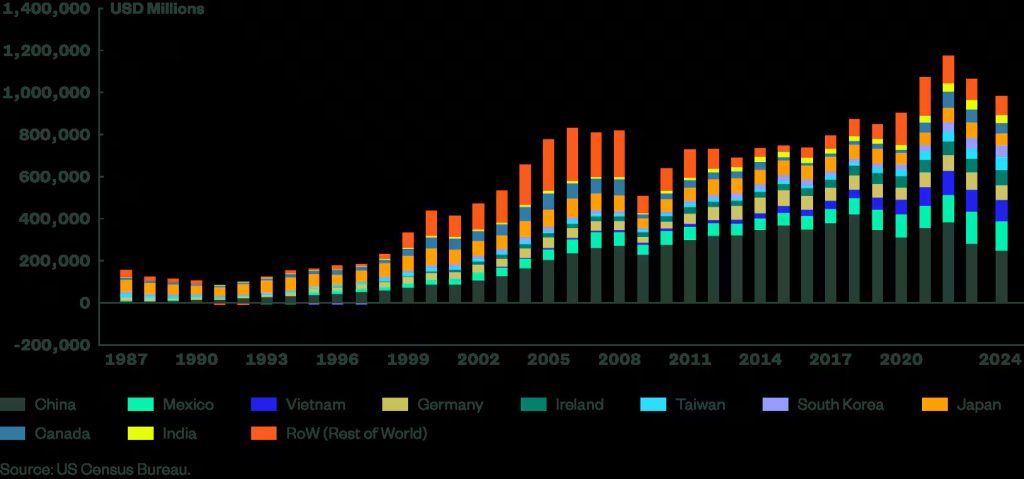

However, the broader macroeconomic effects cannot be ignored. Tariffs on China could disrupt global trade and economic growth as China maintains the largest trade surplus with the US (Figure 1), indirectly influencing Taiwan and Korea’s technology sectors. Additionally, potential retaliatory measures from China could create further uncertainty and instability. As technology products are highly sensitive to global economic conditions, any slowdown could affect demand and production cycles.

For China’s technology sector, tariffs pose immediate challenges if trade rerouting is curbed — a move the Trump administration may pursue. Products that continue to be manufactured within China, especially mid-to-low-end electronics and home appliances, would likely face increased costs when exported to the US, putting pressure on profit margins and reducing their competitiveness in the US market. However, it is also crucial to remember that domestic consumption drives a significant portion of China’s technology industry; therefore, the effectiveness of China’s economic stimulus measures will be crucial in mitigating the threat from tariffs. In the long term, the push for US-China decoupling might encourage China’s technology sector to become more self-reliant, potentially benefiting the domestic industry. Nevertheless, such a transition may not happen swiftly enough to offset the immediate tariff pressures facing the industry.

Figure 1: Top 10 Economies Running Trade Surpluses with the US

Event 2: US Tariffs on Most Imports

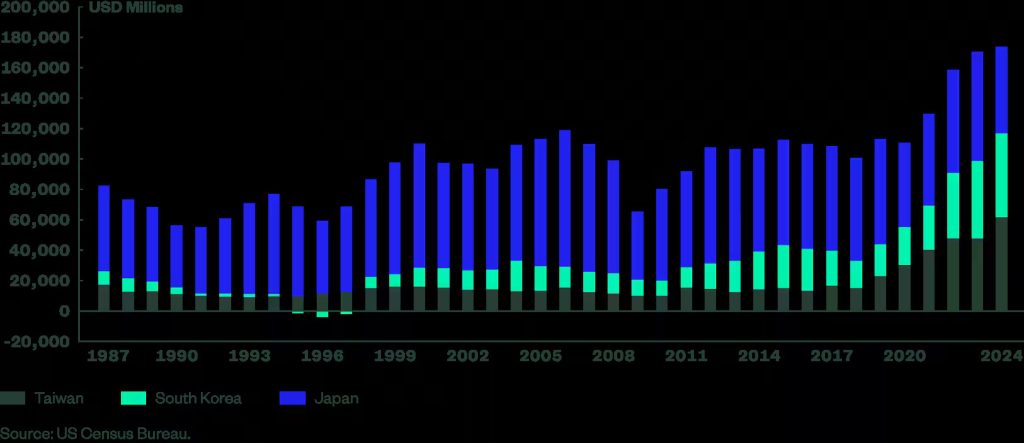

A scenario where the US applies tariffs more broadly would have more severe implications, including undermining global corporate confidence, weakening macroeconomic growth, and creating instability across global markets. Taiwan and South Korea, highly export-oriented economies with growing ties to the US (Figure 2), could face direct challenges. The US accounts for approximately 20%-30% of global electronics consumption, but lacks a fully developed supply chain for many technology products and components. Any significant disruption in this market could reduce demand for technology products from these countries. Furthermore, tariffs could lead to increased costs for American consumers and businesses, which in turn harbors the potential for consumption to weaken.

Figure 2: South Korea and Taiwan Are Increasingly Exposed to US Exports

Event 3: Changes to the CHIPS and Science Act

President-elect Trump’s critique of the CHIPS and Science Act signals a potential shift from subsidies and incentives to tariffs as a means of promoting domestic semiconductor production. In a recent interview, Trump suggested imposing tariffs on imported chips to encourage companies to build plants in the US, stating, “You don’t have to pay the tariff. All you have to do is build your plant in the United States.”

For Taiwanese and Korean technology firms, this shift could necessitate a rethinking of their capital investment strategies. Companies like Taiwan Semiconductor Manufacturing Company (TSMC) have already begun investing in US facilities, but the current capacity is not sufficient to meet all US demand. Increased tariffs could pressure these firms to accelerate their US expansion plans, potentially without the full benefits initially offered by the CHIPS Act — this would have a knock-on impact on company profitability.

Events Timing:

Event 1 is likely to occur sooner than Events 2 and 3, as existing investigations make it easier to impose tariffs on China. In contrast, universal tariffs and legislative changes are complex and would take considerable time to implement.

The Bottom Line

Some believe that the impact of a Trump 2.0 administration could be minimal due to the global technology industry being better prepared for tariffs and supply chain disruptions. However, we cannot underestimate the potential impact of renewed US-China trade tensions. Since the US and China together account for over 40% of global gross domestic product (GDP) and half of global technology product demand, significant policy shifts could profoundly affect the industry and the global economy. We remain optimistic about long-term technology trends like artificial intelligence (AI) advancement and digital transformation, which are expected to continue to drive innovation. However, we must also acknowledge the near-term challenges, the cyclical nature of the industry, and its high sensitivity to economic fluctuations, which suggest that these potential policy shifts will require close monitoring and careful navigation.