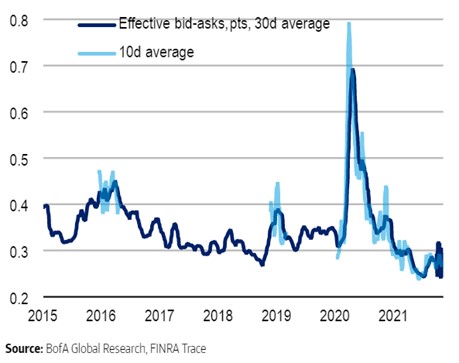

Among the feedback that we often receive is that high yield is expensive and, at times, illiquid to trade. We would push back on this assumption and refer to the underlying data. High Yield at an index level rarely has a bid-offer wider than 40pts and currently this has fallen to a record low of around 25pts (see chart below). This is an important driver of asset class returns, as credit yields are not far off their record lows. As a result, it’s encouraging to see bid-offers, and therefore trading costs as a percentage of yield on offer, also come down.

Banks continue to increase their capital buffers, which feeds through to metrics such as this. More capital intensive activities such as trading can then be given larger balance sheets and subsequently make the space more competitive, lowering bid-offers.

So the next time you hear high yield is expensive to trade, consider these facts – it’s actually never been cheaper.