“The large moves posted by assets in inflationary times seem particularly well suited for a trend-following approach to capture.1”

In our previous blog post outlining enhancements to the WisdomTree Managed Futures Strategy Fund (WTMF), we mentioned the inclusion of a tactical equity model in the Fund, effective June 4, 2021.

When researching this equity component, we were conscious of the potential effects in the Fund’s correlation to the broad equity market, since WTMF is primarily used to diversify, and our goal is to preserve this functionality while enhancing returns.

Managed futures can play an important diversifying role for portfolios—particularly when fears of inflation are increasing. Funds that can go long or short in bond futures, commodity futures, currencies and equities can take advantage of rising prices in commodities or higher interest rates that cause traditional bond prices to fall.

In this blog post, we outline our approach to incorporating a tactical equity model into WTMF.

Investment Universe

The first step in diversification is gaining exposure to a wide variety of markets. WTMF invests in a diversified basket of five equity index futures contracts that span various geographies and size cuts (S&P 500, Nikkei 225, S&P/TSX 60, Euro Stoxx 50 and Russell 2000). Each index is given an equal nominal weight.

Tactical Rotation Model

While having a diversified equity basket is likely to lower correlation, we can further reduce the correlation of our equity model by incorporating a long/short model.

In our opinion, shorting equities should be done with caution, as frequent shorting during a prolonged bull run can have punishing consequences. To prevent excessive shorting, we have incorporated a broad macro signal that indicates when to rotate between a long-only strategy and a long/short strategy.

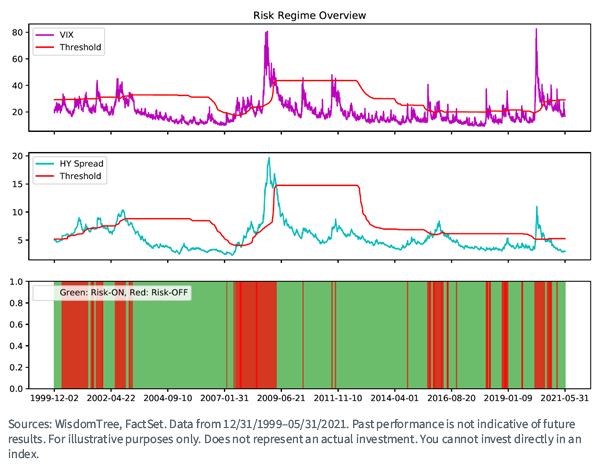

The broad macro indicator is a systematic, data-driven signal derived from both the CBOE Volatility Index (VIX), and the U.S. high-yield credit spread. If either indicator is elevated above its historical threshold, we consider the market to have higher underlying risk. We define that regime as Risk-Off, and rotate to a long/short strategy.

If both indicators are below the threshold, we consider the regime to be Risk-On. In a Risk-On regime, we avoid shorting, as these periods have historically been prolonged bull runs in the equity market.

The methodology is illustrated in the figure below.

We can see in the figure above that this macro indicator would have captured several well-known bear markets, including the dot-com bubble in 2000 and the global financial crisis in 2008. The indicator would have also been triggered during the early stages of the COVID-19 pandemic.

Index-Specific Hedging

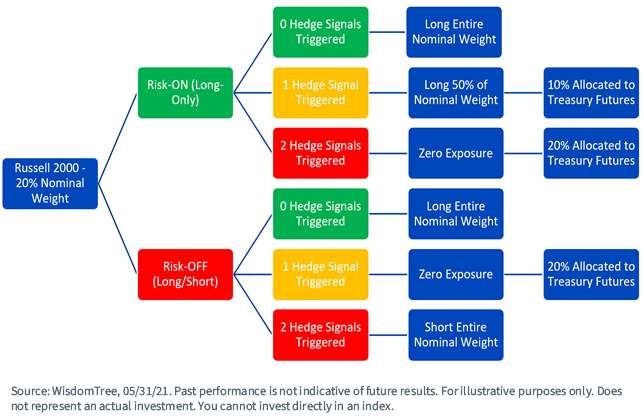

Once the risk regime has been established, we use two index-specific signals to determine whether to hedge equity exposure for a specific index.

Any excess collateral available after reducing equity exposure in the model is allocated to either T-bills, or Treasury futures contracts as additional diversification.

The methodology is illustrated in the figure below using the Russell 2000 contract as an example.

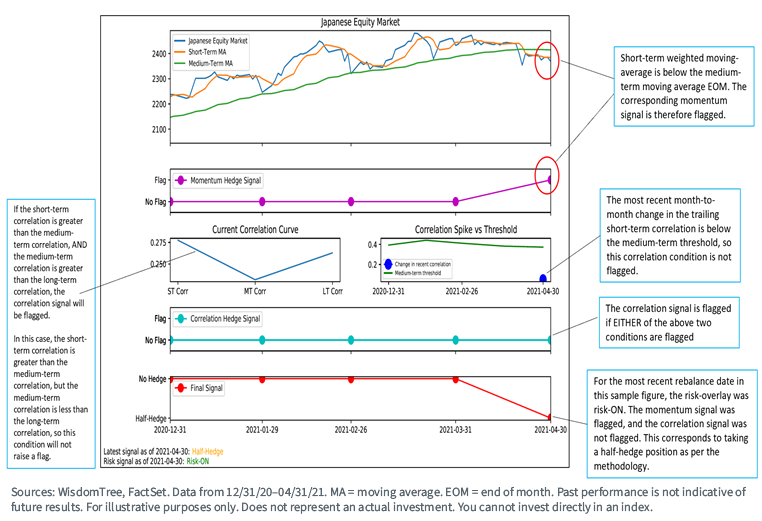

The first hedge signal is a moving-average crossover indicator, using a short-term and a medium-term weighted moving average. The second hedge signal is a correlation indicator derived from the constituents of each market of interest. The correlation signal has two subcomponents, which both look for signs of rising correlation within a specific market.

Research has shown that correlations between constituents increase in times of market stress. An example taken from the WTMF Rebalance Monitor illustrating the hedging signals for the Nikkei 225 contract (corresponding to the Japanese equity market) is shown below.

Historical Signals

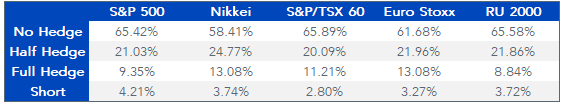

The tables below summarize the positioning in each specific index over a 20-year research period.

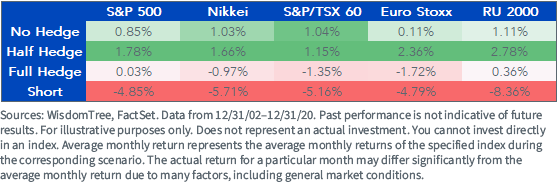

The historical frequencies indicate the model has a predominantly long positioning. Notably, the model does not go short very often, although with relatively high conviction as evidenced in the significantly reduced average return during those periods.

This is consistent with our belief that shorting equities should be done with caution. Based on the model, equity exposure has averaged approximately 75% of the full nominal weight through the entire research period while hedging out tail-risk events.

Frequency

Average Monthly Return

Allocation

The final step in the research process is determining an optimal allocation among the four components of the strategy (equities, commodities, currencies and Treasuries). In WTMF we target a 40% nominal weighting for the equity component. Our target allocation of 40% equities, 40% commodities, 10% currencies and 10% Treasuries aims to optimize risk-adjusted return while limiting correlation to the broad equity market.

Conclusion

We have taken several steps to integrate equity exposure into WTMF, seeking to enhance returns while at the same time preserving the diversifying characteristics that we believe makes the Fund attractive. We use a diversified basket of equity index futures covering different markets. We then employ our tactical rotation model to dynamically reduce exposure to equities, and occasionally take short positions in periods of high conviction. We then allocate any excess collateral to either T-bills or Treasury futures for further diversification. Lastly, we optimize our allocation to equities, considering both the efficient frontier as well as the Fund’s final correlation to the broad equity market.

1H. Neville, T. Draaisma, B. Funnell, C. Harvey & O. Van Hemert, “The Best Strategies for Inflationary Times,” Man Institute, June 2021.

Important Risks Related to this Article

There are risks associated with investing including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The Fund should not be used as a proxy for taking long only (or short only) positions in commodities or currencies. The Fund could lose significant value during periods when long only indexes rise (or short only) indexes decline. The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw” the Fund may suffer significant losses. The Fund is actively managed thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Diversification does not eliminate the risk of experiencing investment losses. Using an asset allocation strategy does not assure a profit or protect against loss. Investors should consider their investment time frame, risk tolerance level and investment goals.