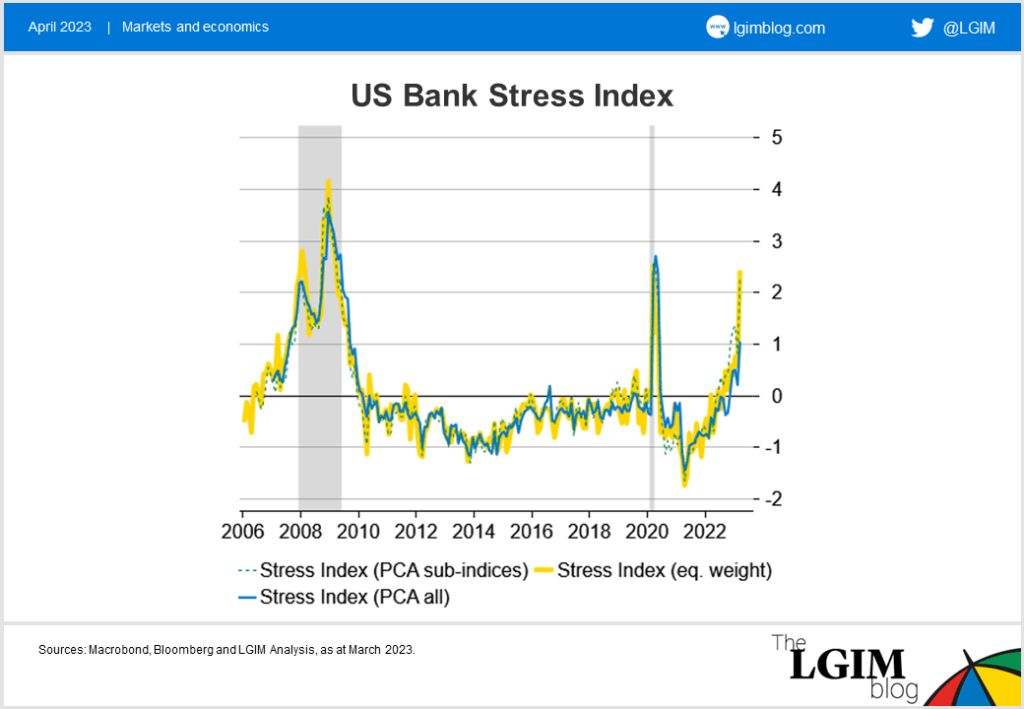

Our US bank stress index is on the rise. We’re not quite at global financial crisis levels, but real-time data suggest a tightening in credit conditions that could act to slow the economy.

Our US growth forecasts are heavily influenced by the Fed’s Senior Loan Officer survey of bank lending practices, but this dataset is only released quarterly. Our newly devised US Bank Stress Index tracks twenty-seven underlying data points related to stress in the US banking system. It helps us to quantify the current banking crisis in real time, and also helps frame current events in the context of previous episodes of financial distress.

It’s currently on the rise…

We calculate one equal weight, and two correlation-adjusted indices to combine the underlying data. All three tell a similar story:

- The 2007-2009 global financial crisis (GFC) represented a build-up in stress that eventually led to a complete systemwide shutdown over a prolonged period

- COVID was a completely unanticipated shock

- Today, the sharp rise in interest rates over the last year has led to losses in banks’ fixed income assets, digital bank runs and a likely tightening of bank lending standards

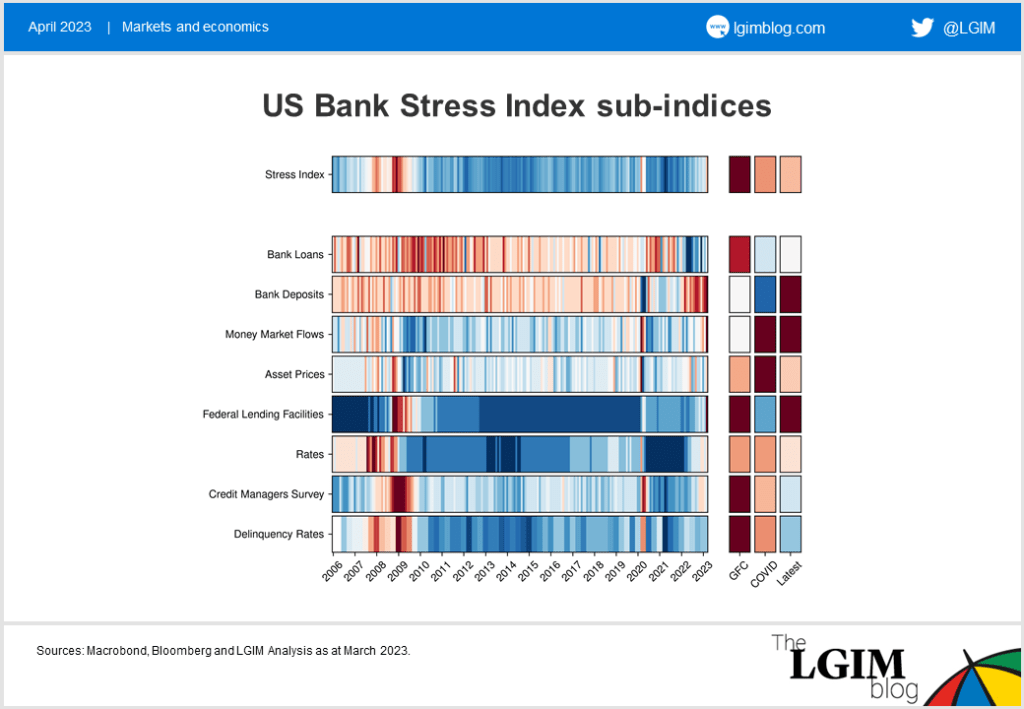

A closer look at the data

We track a collection of mixed frequency data related to the US banking industry. We categorise and standardise the data to create eight sub-indices, which we aggregate into our headline US Bank Stress Index.

At the onset of COVID, government stimulus and precautionary saving led to considerable inflows of cash into ordinary bank accounts and money market funds. Today, banks have been slow to pass on rising interest rates to customers, there has been a loss of confidence following the collapse of Silicon Valley Bank (SVB), and money market funds simply offer more competitive rates of return. This has led to record outflows in bank deposits. This constrains the ability of banks to lend and therefore credit creation in the wider economy.

During times of stress, a bank could issue bonds to raise capital. We now know this is something SVB tried to do. In their run-up to collapse they made use of the Federal Home Loan Banks (FHLB) consortium, available to regional lenders for cost-effective access to capital. FHLB bond issuance has continued to intensify in recent months signalling an increased demand for short-term borrowing.

For more immediate and temporary borrowing, the Federal Reserve’s discount window facility is a primary source of liquidity. Banks have utilised this during both the GFC and COVID crises, and the Fed has more recently initiated the Bank Term Funding Program (BTFP) as a final backstop. Drawdown on these facilities will be a function of deposit flows, loan book valuations and delinquencies. Our heatmap monitors all the above.

If we take our heatmap at face value, it suggests a growing vulnerability in the US banking sector. The consequences for banks’ lending practices combined with already tighter monetary policy from the Fed is consistent with our view that the US is likely to enter recession in the second half of the year and perhaps sooner if the stress intensifies.