Equity markets have moved off their highs over recent weeks, as investors have moved to worry about further central bank policy tightening.

As we highlighted moving into August , equity markets were in bull market territory, with investor sentiment at overly euphoric levels and volatility extremely low. Therefore, we are not too surprised to have seen a correction over recent weeks.

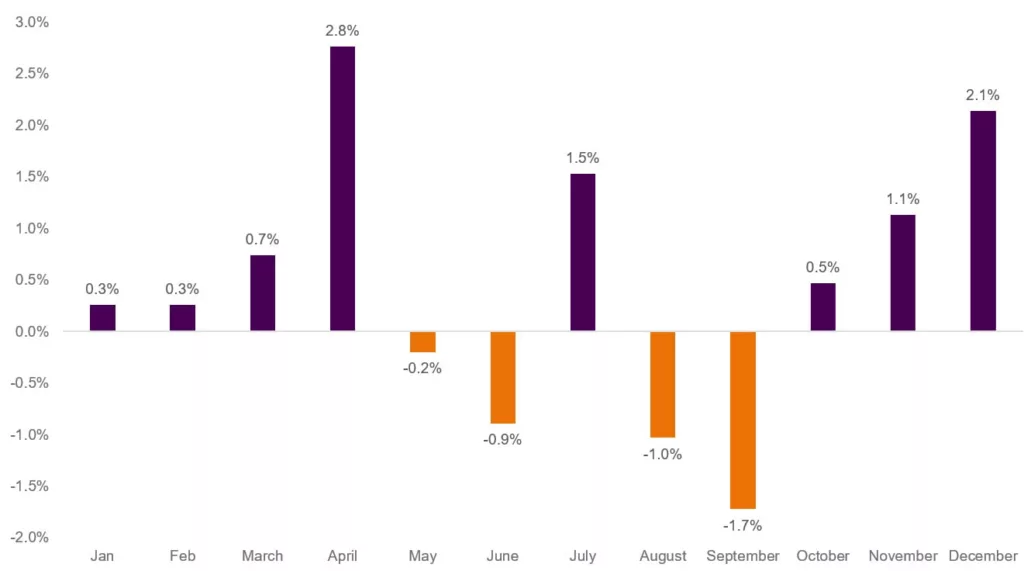

August has historically been a negative month for equity market returns. Looking at the excess returns of equities over cash, since 1986, August is the second worst month of the year for stock market returns (Chart 1).

The year so far has followed a fairly standard pattern of seasonal returns, with equities seeing a pullback from their highs in May before resuming their strength and experiencing an August pullback. This may not be a reassuring message to investors as we head into September, which has the worst average stock market return of any month.

However, recent losses in stocks have seen investor sentiment normalise back to more supportive levels and having just overcome a fairly resilient corporate earnings season in the US, it is not obvious that equities will this year suffer a further September sell-off.

Chart 1: August tends to be a negative month for equity returns

Seasonal equity returns vs cash

Market summary

Global equities recovered ground over last week, helped by a pull-back in bond yields as weak flash Purchasing Managers’ Index (PMI) readings on Wednesday led investors questioning whether central banks will pause rate hikes. Growth stocks outperformed, with tech being the best performing sector in the US as NVIDIA results beat expectation on AI-related sales. Japanese stocks continued to outperform at the regional level, as the yen weakened to around 146 versus the dollar. Weaker economic data saw UK gilts perform particularly strong as bond yields fell globally. Commodities were also strong performers over the week.

Economics summary

Flash August PMI business surveys overall painted a more downbeat picture of activity than in July, with euro area and UK surveys in recession territory. US Federal Reserve Chair Powell’s Jackson Hole comments were on the hawkish side ahead of non-farm payrolls this week.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.