WHICH WAY NEXT FOR GROWTH?

The debate that we have over the direction of financial markets is always interesting and often intense. Earlier in the year, we were slightly surprised that some of our research meetings showed near unanimity of opinion. Global economic activity was accelerating, and growth was starting to become more uniform and synchronized. In recent weeks our debates have become more polarized.

As we discussed in Allocation Views last month, we may already have reached the peak rate of growth and question if we are facing a “global economic slowdown ahead.” Our headline from last month might have grabbed readers’ attention, as it was intended to do. It also highlights the reason we have seen greater dispersion among investment outlooks in our recent internal discussion. But does it really matter that peak growth has already been reached?

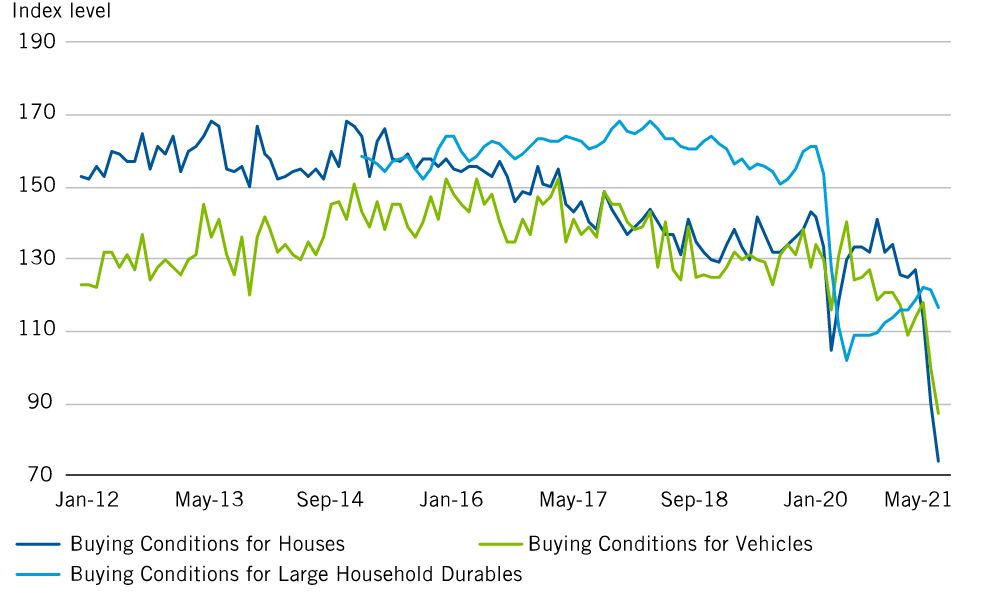

In the United States, it seems likely that growth will remain firmly positive (we don’t foresee a recession any time soon) and continue at a pace that is notably faster than its long-term average, at least until mid-2022. Consumer balance sheets are strong, with at least some of the excess savings build up during the pandemic likely to be spent in the year ahead. However, many of the issues that markets have been most concerned about in recent months—supply chain bottlenecks and elevated prices for certain commodities and goods such as cars—are starting to impact consumer behavior. Survey evidence indicates that households don’t view this to be a particularly good time to make high-value purchases (see Exhibit 1). This appears to be a normal response to elevated prices or shortages of supply. However, might it also lead to a premature slowing of activity overall?

Sources: University of Michigan, Macrobond. Important data provider notices and terms at www.franklintempletonresources.com

Our analysis of previous economic expansions shows that after the first burst of recovery, growth always decelerates—in a simple mathematical sense this is inevitable, but trivial, given the shape of an economic cycle. However, when we look at the relative performance of global stocks against bonds over the past half century and more, we can see a change in market behavior coincident with transitions to slower growth. On average the return potential is lower, and the level of volatility increases. However, a broad range of factors impact markets and together determine the extent to which things change, not just the growth slowdown itself. If the slowdown doesn’t lead to a recession or even take growth below trend, as we currently anticipate, the impact is less severe. However, if it is accompanied by falling inflation, or higher bond yields, both of which we can foresee, then the outlook may be more severe. Indeed, we could describe these factors as being consistent with a policy tightening environment that goes too far and risks the eventual premature end to the cycle.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio. There is no assurance any forecast, projection or estimate will be realized. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Derivatives, including currency management strategies, involve costs and can create economic leverage in a portfolio which may result in significant volatility and cause the portfolio to participate in losses (as well as enable gains) on an amount that exceeds the portfolio’s initial investment. A strategy may not achieve the anticipated benefits, and may realize losses, when a counterparty fails to perform as promised. Currency rates may fluctuate significantly over short periods of time and can reduce returns. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term. Investment in the commercial real estate sector, including in multifamily, involves special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector.