Can an allocation to alternatives improve the long-term risk/return trade-off in a portfolio without automatically sacrificing returns? Portfolio Strategist Mario Aguilar, and Matt Bullock and Sabrina Geppert from Janus Henderson’s PCS team investigate…

Key takeaways:

- Material losses in a portfolio can seriously impact long-term returns, with recovery dependent on a market rebound that is materially greater than the market decline experienced.

- The “fear of missing out” (FOMO) often drives decisions, leaving investors facing the risk of a mis-timed entry and exit, with a permanent impact on their final portfolio value.

- Mitigating losses during difficult market periods via a well-diversified portfolio that includes alternatives can potentially help investors to achieve better longer-term results.

The volatility in financial markets in 2022 unsurprisingly saw the Janus Henderson Portfolio Construction & Strategy (PCS) team spend significant time with clients discussing ways to hedge portfolios against future drawdowns. A common response from investors during these discussions was: “Downside protection will cost me and I have the time to ride out the volatility.”

This made us think…how can we show that these concepts are one and the same? That the best way to “ride out the volatility” is through downside risk management?

There are several reasons why managing downside risk is critical for the longer-term investor:

- Win by not losing – The more you lose, the harder it is and the longer it takes to recapture losses. Limiting the downside during difficult market periods can potentially enhance longer term returns.

- Minimise the impact of (unfortunate) timing – Many investors hope to benefit from market timing, yet unexpected market moves can wreak havoc on our portfolios. Risk management techniques are critical to minimize the risk of mis-timed investments.

- Alternatives can enhance long-term risk adjusted returns – Risk management is not just about hedging. Alternatives can reduce downside risk and holding them does not necessarily mean lower returns.

Win by not losing

The more you lose, the harder it is to recapture losses

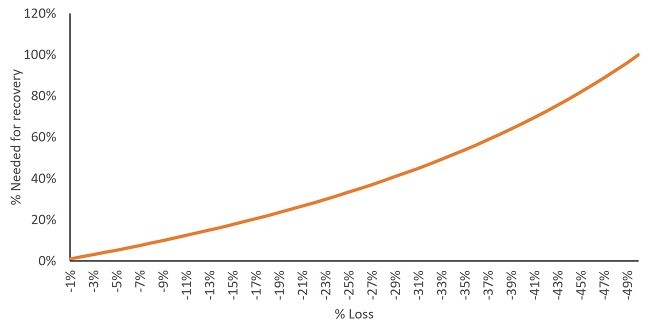

Let us assume we invested US$100, the market dropped 25% and the investment is now valued at $75. To stage a full recovery and get back to $100, we need that $75 to gain 33% to achieve breakeven. For a 50% decline, it requires a 100% return to reach our starting point – and it gets harder the further down you go.

Even as a long-term investor, material losses in a portfolio can seriously harm long-term returns. Recovery depends on a market rebound (plus income/dividends) that is materially greater than the market decline experienced to get back to breakeven. Either an investor extends their investment timeframe to account for the losses, or they take on increased portfolio risk to try and quicken the recovery time.

Limiting downside losses, even slightly, can disproportionally benefit the upside potential of a portfolio.

Figure 1: The route to recovery gets steeper, depending on the fall

Minimising the impact of timing

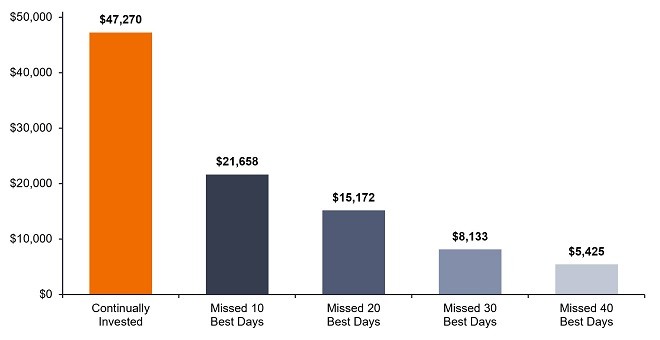

Timing the market is a highly uncertain strategy. The old adage that “time in the market beats timing the market”, rings as true today as it always has. The PCS team have highlighted this point in previous papers, but it is important to emphasise what happens if your timing is wrong. Figure 2 shows the impact to a portfolio if you miss the best days in the market.

Figure 2: Trying to time the market can have significant consequences for performance

Only with the benefit of hindsight can we identify when the best days occurred. Yet the success of market timing is predicated on buying or selling at the most opportune moments. One can appreciate why that would be impossible to do with any consistency.

Regardless, we know that investors attempt to do this, in many cases driven by the behavioural aspects of investing. The “fear of missing out” (FOMO) often drives decisions, leaving investors facing the challenge of deciding when to sell during the good times and when to buy during the bad. The most likely outcome is a mis-timed entry and exit, with a permanent and material impact on your final portfolio value.

The alternative is for investors to use strategies that offer genuinely diversified drivers of performance, which can help to offset periods of market weakness – which are often very difficult to anticipate.

Alternatives as a strategic exposure

What is the impact to long-term performance of holding alternatives? And do the benefits outweigh the costs? These are pertinent questions for anyone considering alternatives for their portfolios.

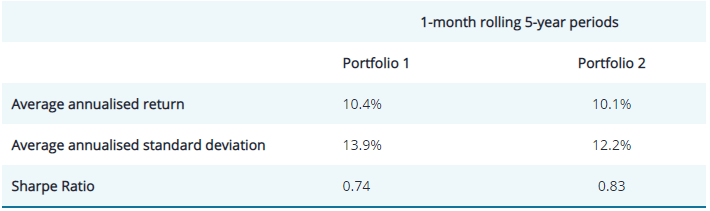

To answer them, we analysed 319 rolling five-year periods between January 1990 and September 2022[1]. Overall, the results suggested that using alternatives as a strategic position in a broader portfolio indeed lowered overall risk, while limiting the potential drawdown – and with a negligible impact on returns.

To determine this, we modelled two portfolios:

Portfolio 1: 100% in equities[2]

Portfolio 2: 80% Equities and 20% alternatives[3]

First, we measured the impact on the portfolio’s risk and return. Figure 3 shows the average annualised return, standard deviation, and Sharpe Ratio across the 319 investment periods used for our sample. The impact to risk is noticeable, but negligible to return. The conclusion is that adding alternatives improved the risk/return trade-off during these periods; however, it did not automatically mean sacrificing return.

Figure 3: the Alternatives effect (the impact on risk & return)

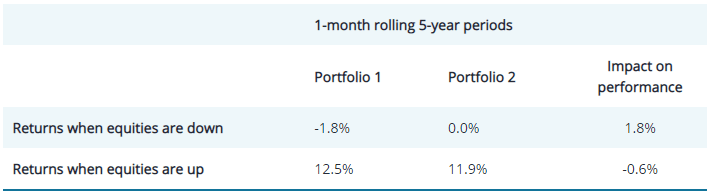

Next, we considered what impact the addition of alternatives had on performance during the best and worst five-year periods (Figure 4):

Figure 4: the Alternatives effect in up- and down-markets

The results showed that during the worst five-year periods (when markets were down), alternatives practically inoculated the model portfolio from losses. During the best five-year periods, there was a relatively minor reduction in performance. The overall net impact was positive, the stabilisation effect during down markets significantly outweighing any lost performance during periods of market strength.

Conclusion

Mitigating losses during difficult market periods via a well-diversified portfolio that includes alternatives can potentially help investors to achieve better longer-term results. There is no way to know for certain when markets could drop, or when they might rally, and the risk of missing out on performance in a bid to avoid losses can have a material impact on the value of a portfolio over time.

We have argued here that investors should consider the relative risks and rewards from being invested for the long-term, rather than trying to time the market. However, even for long-term investors, periods of market uncertainty could coincide with the end of a planned investment strategy, such as at retirement. This could have a serious impact on the final value of our investments, leaving many left nursing permanent losses, or having to re-adjust to a lower level of wealth than expected (or required).

Our research shows that adding an allocation to alternatives can potentially help to reduce the impact of market volatility on a portfolio, without a significant material impact to long-term returns. Keeping in mind that different alternatives offer varying levels of diversification and risk, would it not be better to have them and not need them than finding out too late that we needed them, but do not have them?

Please note:

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. The information in this article does not qualify as an investment recommendation. Marketing Communication.

[1] The analysis looked at 319 five-year periods between 1 January 1990 and 30 September 2022, using two different theoretical portfolio models (detailed below).

[2] We use the S&P 500 Total Return USD Index as the equities portfolio.

[3] We use the HFRI Fund Weighted USD Index as the proxy for alternatives.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.