Rate hikes, a negative European winter, and an end to China’s economic slowdown are three key areas demanding focus for the rest of the year. Here, the multi-asset strategy team shares their insight on these areas.

Highlights

There are three key questions across the three major economic regions we believe will drive cross-asset performance over the final third of 2022:

Question #1: Will the Fed signal any inclination to reverse course on interest rate hikes?

Answer #1: No. The Fed is likely to continue to communicate that rates will stay in restrictive territory to quell inflationary pressures.

Question #2: How negative will Europe’s winter be, from a growth perspective?

Answer#2 : Quite poor – and it’s too soon to look through the economic damage.

Question #3: Will China’s economic slowdown end?

Answer#3 : Yes. But stabilization will only be enough to help domestic assets and commodities – not enough for major positive spillovers to the rest of the world.

In this update, we will provide a more detailed overview of our base case outcomes across these questions and how this informs our positioning. There is currently an unusually elevated amount of uncertainty surrounding these macroeconomic issues, as much hinges on the geopolitical and policy courses charted by Russia and China. As such, it is particularly important to explore potential deviations from our expectations and manage risk in the current environment.

Will the Federal Reserve pivot?

No. Services inflation, which is relatively sticky, is poised to remain well above target at year end even as core goods and commodities provide some near-term relief in headline inflation. In our view, the level of inflation will simply be too high at year end for monetary policymakers to entertain cuts.

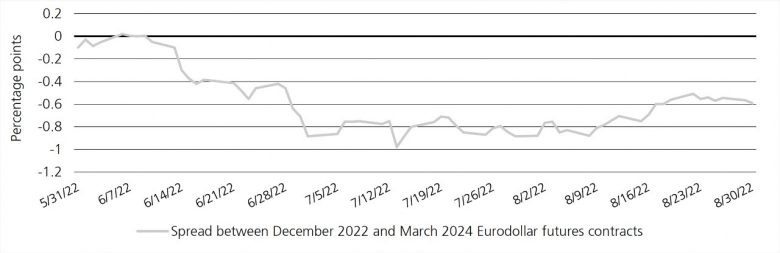

Fed officials are telegraphing that interest rates need to rise to and stay at a level that puts downward pressure on growth in order to quell underlying inflationary pressures. The ongoing shrinkage of the central bank’s balance sheet will also be adding incremental monetary tightening. Chair Jerome Powell’s recent speech at Jackson Hole reinforced that the campaign to bring rates higher is a sprint, but the process of getting inflation lower is a marathon. Markets are starting to accept this message, but there is still more scope to remove interest rate cut expectations. The amount of easing anticipated by markets between December 2022 to March 2024 has roughly halved from 100 basis points in mid-July to the mid-50s currently.

Exhibit 1: Markets priced out as much as half expected interest rate cuts

Line chart depicting percentage point Eurodollar future contracts spreads between December 2022 and March 2024.

The Fed’s goals are not in conflict – unemployment is very low, and inflation is still very high. In our view, evidence of a material slowdown in both inflation and labor demand is needed to convince monetary policymakers that tight monetary policy is no longer appropriate.

Labor market metrics are showing few, if any, signs of cooling. The nascent upward trend in initial and continuing jobless claims appears to be abating. Measures of pay increases the Federal Reserve focuses on (such as the Atlanta Fed wage tracker and the Employment Cost Index) remain hot, at levels that imply the growth in labor income will put a high floor under inflation. And in the near term, US data should be buoyed by the decline in gasoline prices, which frees up funds for more discretionary purchases elsewhere.

There are two ways in which this view could be invalidated: if the US labor market deteriorates rapidly (which would be bearish risk assets and bullish government bonds) or if the Fed signals a higher tolerance for above-target inflation (vice versa). Both of these outcomes are unlikely in our view, particularly the latter, given the central bank’s concern with ensuring inflation expectations do not become unhinged to the upside.

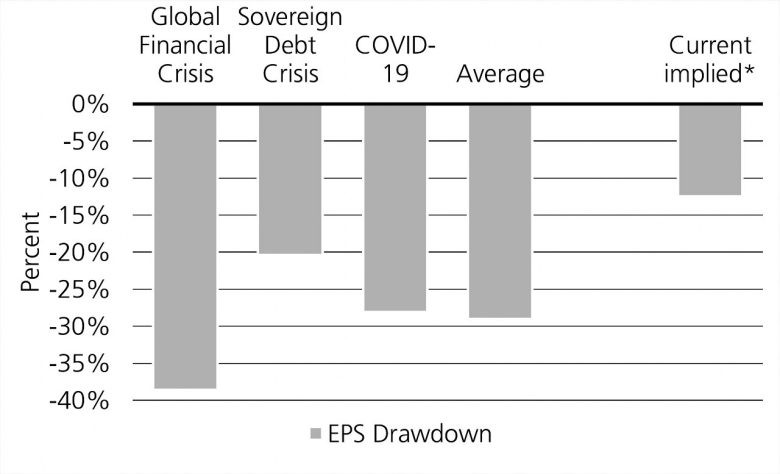

Exhibit 2: European equities pricing in a much smaller profit impact than during other recessions. Maximum drawdown in European forward EPS estimates during recessionary periods

*Note: Current implied EPS drawdown uses average level of forward P/E ratio from 2007-present period to calculate estimate for EPS.

Bar graph with Percent on y-axis and categories as previous recessions’ EPS Drawdowns.

How negative will this winter be for Europe’s economy?

Quite poor, with real consumption and industrial production likely to retreat. And while the energy challenges gripping the continent are well-known, they remain difficult to quantify and therefore difficult to appropriately price.

Worst-case economic scenarios may be avoided in light of Europe’s success to date in securing alternative sources of natural gas, and also preemptive measures to reduce energy use. However, one implication of companies reducing some operations now in light of high energy prices is that this drag on activity may manifest sooner.

Right now, the quandary for investors looking at European assets is that the range of estimates for how negative this winter will be from an economic and earnings perspective is quite wide. We believe that investors will be able to eventually look through some of this economic damage before it occurs.

But right now, the outlook is a dense fog that is preventing this. We are awaiting a valuation or policy catalyst to become more constructive on European assets.

Importantly, we expect strong fiscal support from European governments to ensure that this temporary, seasonal problem does not metastasize into a full-fledged negative credit cycle or prolonged mass unemployment.

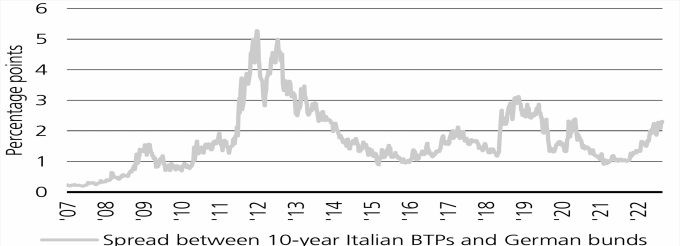

Exhibit 3: Markets pricing higher fragmentation risk on aggressive ECB tightening

Line graph depicting the spread between 10-year Italian BTPs and German bonds.

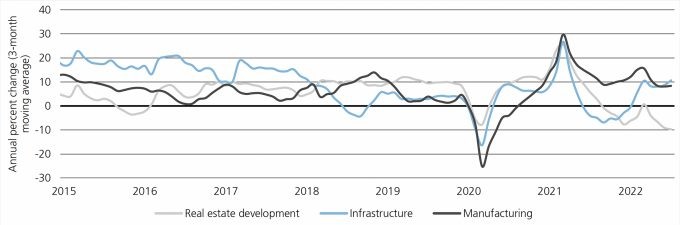

Exhibit 4: Chinese property sector a major drag on fixed asset investment

Line graph, with three separate lines for real estate development, infrastructure, and manufacturing, depicting 3-month average annual percentage change.

Meanwhile, the European Central Bank (ECB) is on track to continue with aggressive rate increases, in large part due to skyrocketing energy prices but also due in part to this fiscal support, which is likely to have an inflationary cost. Yet this tightening is also increasing the fiscal fragility of more indebted European nations and putting more upward pressure on their borrowing costs compared to perceived safer nations like Germany – which in turn weakens the euro and exacerbates inflationary pressures. This feedback loop may lead to a situation in which the ECB needs to make use of its new transmission protection instrument in a muscular way to ensure financial markets do not effectively deliver too much tightening for the European periphery relative to the core.

Yes, this will certainly be a difficult winter for the European economy. But longer term, we are optimistic that this energy crisis is not a harbinger of another lost decade for Europe after last cycle’s sovereign debt crisis – but rather the catalyst for governments to underpin activity in progressing towards energy security and decarbonization.

Will China do enough to reverse its economic slump?

Yes. But this stabilization of activity will not have substantial positive spillovers for the rest of the world, in our view. China’s recovery will be fragile and vulnerable to an abrupt retrenchment as long as the zero-COVID-19 policy is intact.

It has been difficult for investors to try to call the bottom in Chinese activity based on policy announcements throughout 2022. The enduring weakness in the property sector has overwhelmed the positive impulses in other areas of the economy, such as infrastructure investment, and also weighed on sentiment. But there has been more urgency in Beijing’s provision of stimulus recently. Between elevated youth unemployment and the mortgage payment boycott, social and economic concerns have become intertwined. Importantly, some recent policy measures appear to be more directly aimed at solving the liquidity trap revolving around the real estate sector.

However, our view is that optimism should remain tempered because we believe that China will be quite reticent to reverse course on its overarching policy of cooling imbalances in the property market. Stimulus will not be as strong as it was in the expansion following the global financial crisis, in which Chinese policy dictated the cyclical ebbs and flows in economic activity around the world.

The risks to our short-term view are two-sided. We could see more of the same – insufficient policy support – from China, which would support our more positive view on global duration, but undermine portions of our bullish thesis on commodities. On the other hand, this round of stimulus may be perceived as quite potent. In our view, the US dollar, which screens as quite expensive on a valuation basis, would likely come under selling pressure – but on the other hand, commodities would likely perform even better than we anticipate.

Asset allocation implications

The Federal Reserve’s commitment to restrictive policy puts a ceiling on the valuation of risk assets, while the resilient US economy is providing a sturdy floor. This leaves us tactically neutral on equities, where we are somewhat cautiously positioned and focused on efficient relative value expressions for different economic regimes.

The Fed is raising interest rates to further reduce economic momentum. By comparison, other central banks, including the ECB, are responding to a backdrop that is more stagflationary in nature. This combination is supportive of more US dollar strength, in our view. It may also support US equities vs. the rest of the world on a currency-hedged basis. This is because the two biggest threats to risk assets, in our view, would be either a global recession or a longer-lasting, more aggressive Fed tightening campaign – and both of these would likely be positive for the US dollar.

We are selectively embracing cyclicality through commodities and energy equities. Oil remains supply-constrained, and the current policy baseline – between the end of releases from the Strategic Petroleum Reserve and scheduled European sanctions on Russia – is baking in another negative supply shock in Q4 and into 2023.

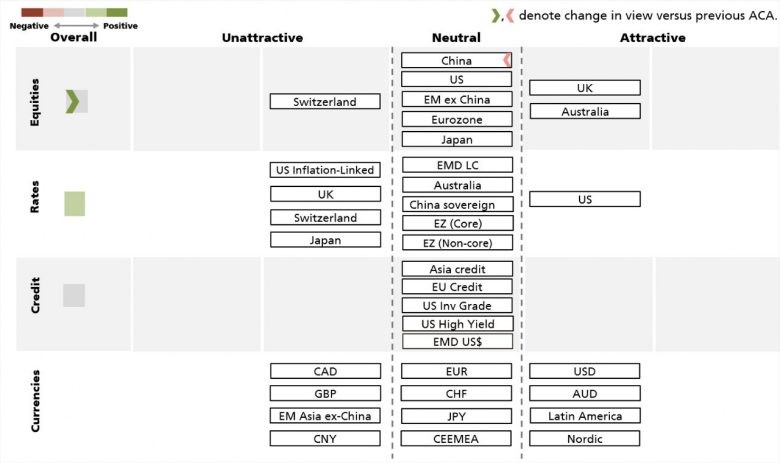

Asset class attractiveness

Chart depicting asset class attractiveness, categorized by Currencies, Credit Rates, and Equities, based on Unattractive, Neutral, and Attractive

Asset class attractiveness (ACA)

The chart shows the views of our Asset Allocation team on overall asset class attractiveness as of 29 August 2022. The colored squares on the left provide our overall signal for global equities, rates, and credit. The rest of the ratings pertain to the relative attractiveness of certain regions within the asset classes of equities, rates, credit and currencies. Because the ACA does not include all asset classes, the net overall signal may be somewhat negative or positive.