From American titans to new international players

Two years after the explosion of mainstream artificial intelligence (AI), new players are redefining the possibilities and market narrative.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec

Almost two years ago, AI frenzy took hold of global equity markets, giving new impetus to the technology sector and creating market enthusiasm around the US Magnificent Seven. A triad of factors has driven this investor hype.

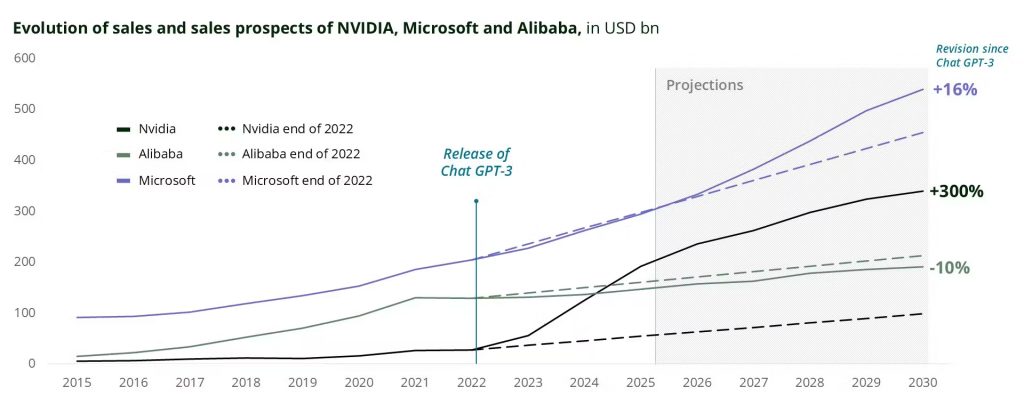

Firstly, the demand for formidable computing power. Secondly, only a handful of companies are able to provide this computing power. And finally, these companies rely heavily on a GPU graphic card produced solely by Nvidia. This exceptional situation led to a 300% upward revision of the growth prospects of Nvidia (black curve on the graph) with the company’s sales expected to double within two years and triple within five years.

At the same time, the prospects for tech companies less directly involved in providing the ‘picks and shovels’ of this new gold rush (computing power) have stalled. The emergence of new players could now disrupt the status quo.

DeepSeek and Mistral AI have received significant media attention for their much-reduced costs but other less well-known names, such as Qwen 2.5 from the Chinese company Alibaba and the Canadian company Cohere could also make a splash.

The door to invest in new entrants may be opening, but even for the incumbents, the disruption is good news. The fall in AI-model development costs will mean an increase in future adoption rates and therefore, increased productivity gains linked to AI. With only 25 to 35% of companies using AI, there is significant room for improvement if the price falls. This ‘democratisation’ of AI could also ensure a robust demand for computing power benefiting many players, both established and new.

Is it possible that AI will become so commonplace it turns into a commodity? The question is worth asking, given this shift would, undoubtedly, have a significant impact on the relative valuations of AI manufacturers vis-à-vis AI users and application providers.

At the same time, the ‘DeepSeek moment’, which hinted at cheaper and less energy-intensive AI, may have changed the perception of an American AI hegemony without foreign competition. It could also help make Chinese technology ‘investable’ again.

Developments in AI, and the perception surrounding them, have potentially far-reaching effects on the future profitability of our investments. So, let’s be … intelligent!

llamcorper mattis, pulvinar dapibus leo.