Reviewing the performance of our inflation hedges in the Asset Allocation team after a turbulent year.

Despite headline numbers coming down in early 2023, sticky inflation remains a concern for investors. We believe inflation should be tackled with strategic allocations in multi-asset portfolios, with dynamic allocations where appropriate. Let’s see how this approach fared in 2022.

Assessing our inflation toolkit for UK investors

“Inflation is like toothpaste: once it’s out of the tube, it is all but impossible to get it back in”: the words of Karl-Otto Pöhl, former president of the German Bundesbank, in 1980[1]. Following two years of stubborn inflation across the world driven by, among other factors, supply constraints from the pandemic and a war in Europe, this analogy rings true today.

At the start of 2022, we wrote a series of blogs detailing the tools we had available to our portfolios to deal with high inflation. In the first of these blogs, Chris Teschmacher explained that it has historically been very difficult to predict the path of inflation, and that we therefore believe it is better to prepare for a range of different inflation outcomes. Now that a year has passed, and with inflation still at high levels, let’s revisit these tools and see how they fared in 2022.

Diversifying bond exposure

A frequent topic of discussion in the Asset Allocation team in the past year has been the disappearance of a trend to which investors have become accustomed in the 21st century: that when equities have periods of weakness, bonds have tended to come to the rescue. In this environment, we have not favoured a wholesale abandonment of our allocation to bonds.

Whether we are in a new regime for bond-equity correlations is yet to be determined, but in the meantime, we believe that in the event of a global recession or tail-risk events, bonds still have an important role to play in portfolios from a risk-mitigation perspective. However, we do believe that in a rising inflation environment, central banks will adjust monetary policy with different trajectories, which can lead to a divergence in regional bond markets. As such, we believe it is important to diversify regional allocations to sovereign bonds to ensure you are not overly exposed to idiosyncratic country risks.

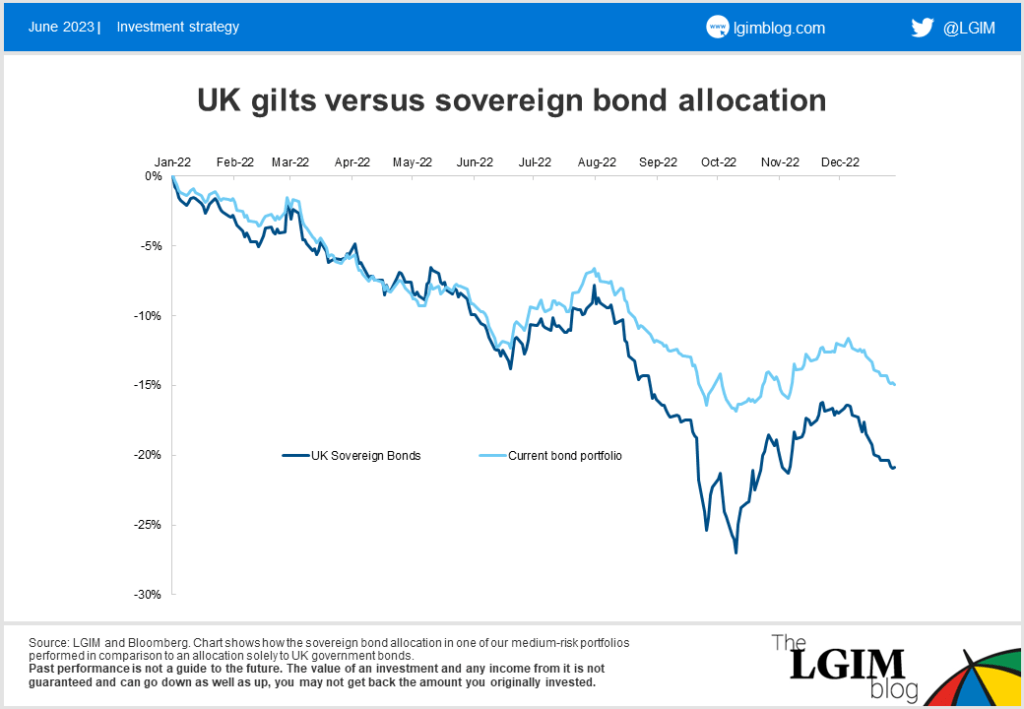

The below chart shows how the sovereign bond allocation in one of our medium-risk portfolios performed in comparison to an allocation solely to UK government bonds. UK gilts suffered a particularly torrid year, exacerbated by the fallout from the so-called ‘mini-budget’ at the end of September.

While our bond allocation was affected by the fallout from the mini-budget due to our UK exposure, you can see that the blow was softened by our allocation to other regions, including strategic allocations to US, European and Australian bonds, and in 2022, dynamic allocations to South Korean and New Zealand bonds.

We also benefited from the fact that we were able to dynamically increase our exposure to UK gilts and index-linked gilts following the news of intervention from the Bank of England after the mini-budget.

Allocation to foreign currencies

Structurally allocating to foreign currencies can help to mitigate the impact of domestic inflation.

History tells us that inflation differentials play an important role in determining exchange rates, and when domestic inflation rises faster than other countries, you tend to see weakness in that country’s exchange rate. This is something which the UK has fallen victim to in the past, and that we saw again in 2022, with UK CPI surpassing 11% at the end of October[2].

This, and other factors, led to weakness in sterling versus many of its global peers in 2022. This was particularly versus the US dollar, which was boosted by the fact that the US Federal Reserve raised interest rates further and faster than the UK (even though the Bank of England did actually hike rates first in the cycle), seeing the dollar increase c. 12%[3] versus the pound over the year, despite weakening in the fourth quarter.

Exposure to the dollar and other foreign currencies was therefore a major boost for our portfolios over the year. This was particularly the case for our higher-risk portfolios, which tend to have greater exposure to foreign currencies than our lower-risk portfolios.

Blending long-run and short-run inflation hedges

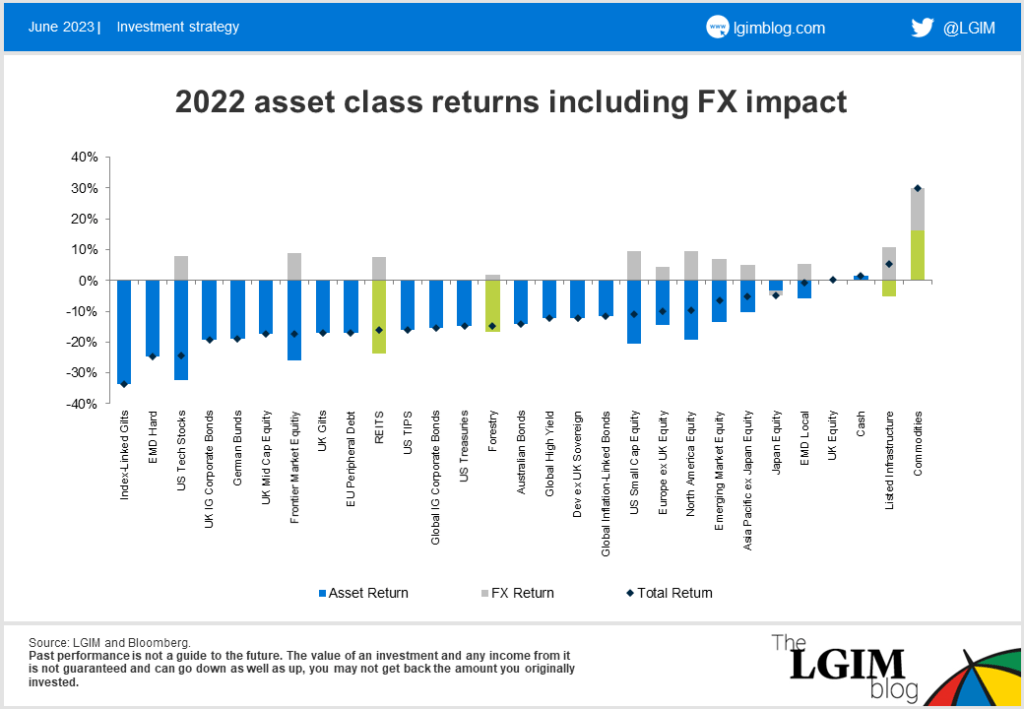

When assessing which asset classes are good hedges for rising inflation, it is important to distinguish between hedging for short-term surges and longer-term periods of high inflation. Index-linked bonds and commodities – an alternative investment – tend to be good hedges for short-term inflation, whereas equities and other alternative investments such as listed infrastructure and REITs tend to be better hedges for long term inflation.

In the table below, we have highlighted in green some of the alternative investments that we hold in our portfolios to show the potential benefit that diversifying a portfolio with assets such as these can have when bond and equity returns are weak.

We saw very strong returns for commodities in 2022, boosted by the supply constraints caused by the Russian invasion of Ukraine; listed infrastructure also performed well. Meanwhile, other alternatives such as forestry and REITs were in the middle of the pack. The same can be said for global inflation-linked bonds.

However, UK index-linked gilts can be seen at the bottom end of the spectrum, given they tend to have a longer duration than their peers, which typically results in a greater price impact for the same fall in yields. We have had a long-held negative view on index-linked gilts because of supply and demand dynamics having led, in our view, to less attractive valuations than their peers. We held this view until the last quarter of 2022.

The bottom line

Flowing through all these themes is our ‘prepare, don’t predict’ mantra, and the importance of diversifying exposure across different asset classes. With central banks still battling to get inflation under control, and uncertainty over the path for global growth, we believe that this will continue to remain important for investors as we tread through 2023.