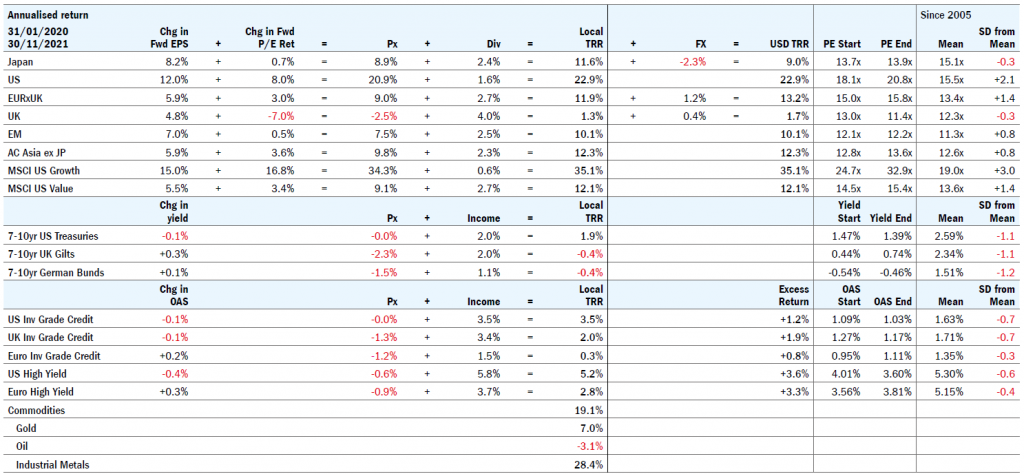

After the shock Covid-19 recession of 2020, global economic growth bounced back in 2021. Earnings soared more than was forecast, and the prospect of monetary tightening emerged with inflation proving less transitory than hoped. Taking the Covid period in its entirety, equity returns have been strong and government bond returns have been weak, with credit outperforming government bonds, and industrial metal price rises boosting commodity returns (Figure 1).

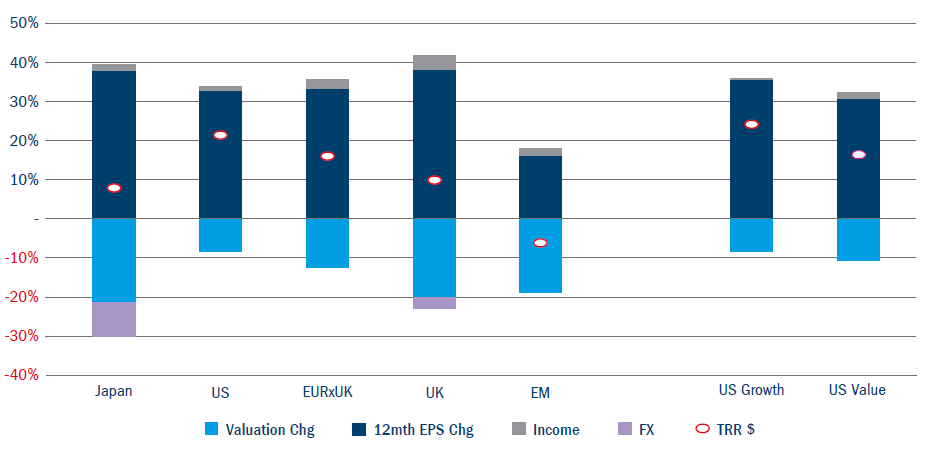

Equity returns can be broken down into some combination of the dividend, changing expectations around future earnings power, and changes in what people will pay for a given level of earnings power – or valuation change. The latter tends to dominate short-run returns, but over the long run it is changes to the earning power of firms that tend to matter. Huge returns from soaring stocks with no discernible change in earnings power tend to unnerve, while large increases in earnings power that go unrewarded by the market intrigue.

So how does the Covid period break down? Stocks in every major region of the world except the US saw their expected earnings power grow at a mid-to-high single-digit rate; in America the growth rate was around twice this pace. Digging a little deeper we can see that US Value performed much like other regions of the world, and it was only US Growth stocks that stand out as exceptional.

Figure 1: Asset class annualised returns 2020/21

Source: Bloomberg and Columbia Threadneedle, 13 December 2021

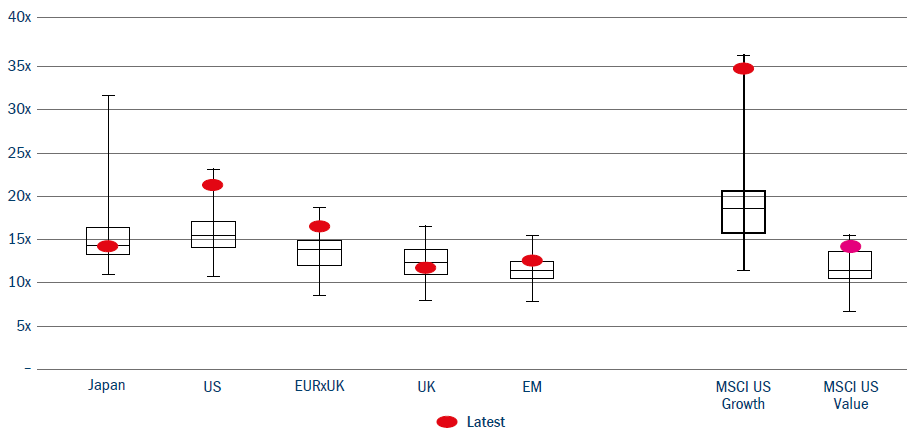

Much of this will sound familiar; much of it was a 2020 story. That year ended with very high valuations and depressed earnings in most parts of the world. At the beginning of 2021 we were looking for earnings to rebound strongly, but also for markets to derate meaningfully. This played out well in a range of markets. For example, the forward price-to-earnings (PE) ratio of the Japanese market fell from 18x to 14x between December 2020 and November 2021, delivering a 22% headwind for stock returns and capping local currency total returns at 10% for the period despite a 38% increase in earnings expectations. The Japanese market’s forward PE valuation came back down to levels that sit below their 15-year average.

The only major part of the global equity market not to have faced a doubledigit valuation headwind over 2021 has been US Growth stocks (Figure 2). The forward PE ratio for the US market as a whole trades at more than two standard deviations higher than their 15-year average (Figure 3). We feel the dispersion of valuation across major markets is unusually large at this time, and means that sweeping statements about stocks looking rich or cheap feel even less applicable than usual.

High valuations clearly pose a medium-term challenge to returns in some markets, and this equity valuation challenge is one of three principle tests that face global markets (absent geopolitical upsets), the others being the transitoriness or otherwise of inflation, and the way in which Covid continues to change the nature of economic activity. All are interlinked.

Figure 2: Equity market returns 31 December 2020-30 November 2021, broken into component parts

Source: Bloomberg and Columbia Threadneedle, 13 December 2021

Figure 3: 30 November 2021 equity market forward PE multiples against 15-year history

Source: Bloomberg and Columbia Threadneedle, 13 December 2021.

As William Davies, Deputy Global CIO,1 and Adrian Hilton, Head of Global Rates and Currency,2 have said elsewhere, we are looking for inflation to fade in 2022. The Commodities team is looking for oil to pass the $100 mark during 2022, and for the demand attached to the transition to net zero to push base metals prices higher. These pressures, as well as continued upward pressures on rents and wages across developed economies, should be enough to prevent the deflationary roll-off attached to supply chains becoming unblocked from taking inflation too low. But the task of facing down runaway inflation will appear less urgent to markets and central banks, and as such we can understand (if not warm to) the miserable valuations offered by government bonds, which price some, if not many, increases in interest rates over 2022.

Despite the large absolute numbers, fiscal deficits around the developed world will shrink in 2022, delivering a headwind to economic growth. Economic momentum attached to Covid recovery and the still large stocks of savings built up over the past couple of years should be enough to prevent these fiscal and monetary headwinds from taking the economy into recession, but growth will likely decelerate as we go through the year.

A fading reflationary macroeconomic backdrop characterised by fiscal and monetary headwinds and high commodity prices may sound a tough environment for firms to deliver profit growth. But bottom-up stock and bond analyst colleagues across Columbia Threadneedle speak with firms daily to help inform their detailed financial projections; in aggregating these up we see the prospect of earnings growth in the region of 10% coming through at the market level.

Where does this leave things? We see there is a clear market downside risk in the event that inflation turns out to be persistently higher such that it would demand concerted central bank interest rate rises to arrest it. The biggest losers in such a downside scenario would likely be longduration equities and bonds. We recognise that uncertainties are meaningful and the scale of drawdowns that might be attached to scenarios other than our base case of receding inflation are potentially substantial. But the healthy earnings outlook and low yield environment justifies the valuation of many equity markets, and keeps me invested. The combination of modest earnings growth and undemanding valuations in some markets, and structurally high growth for firms disrupting the economic landscape albeit with more demanding valuations, makes for a decent outlook.