Investors may have opportunities to capture excess returns as the market value of ESG assets rises

By Michele Gambera, Co-Head of Strategic Asset Allocation Modeling, Investment Solutions, with Ryan Primmer, Head of Investment Solutions and Louis Finney, Co-Head of Strategic Asset Allocation Modeling, Investment Solutions

Highlights

- Investors are accustomed to considering risk and return as the two dimensions that guide asset allocation. As a result of our study, we find that two additional elements – time and preference – are needed to augment this process in an ESG world.

- The time element refers to the duration of the ESG transition underway as governments and companies enact regulations, new technologies, and investments to reduce pollution in line with the principles of the Paris Agreement and fulfill sustainable development goals relating to social responsibility and governance.

- The preference element refers to the weight an investor places on prioritizing sustainability in an investment portfolio, either due to regulatory requirements or the objectives of the investor or organization and its board.

- Our findings suggest that if investor preferences for sustainability are in line with the prevailing constraints for the investable universe, the tracking error and any trade-off in returns will be minimal; if the investor has very strong preferences and constrains the investable universe materially, there will be higher portfolio risk due to lower diversification. This results into higher required alpha to keep risk-adjusted returns the same.

Asset allocators are increasingly facing a novel challenge when constructing portfolios: Striking a balance between environmental, social, and governance factors and traditional performance objectives to achieve success on both fronts. This paper provides an asset-allocation framework for investors incorporating these factors into their investment process.

Having performed an exhaustive academic literature review and our original data analysis, we find no material negative trade-off in terms of risk and return for investors who utilize less restrictive ESG approaches. In fact, those investors may enjoy alpha opportunities in addition to producing positive externalities.

Over a very long-term horizon, as companies become aligned with the ‘net-zero’ goal and other sustainable initiatives, we expect risk and returns of conventional ESG strategies to gradually parallel non-ESG strategies due to market efficiency as we expect ESG to become the norm and investors to properly discount the risks of non-compliance.

Investors are accustomed to considering risk and return as the two dimensions that guide asset allocation. As a result of our study, we find that two additional elements – time and preference – are needed to augment this process in an ESG world. These fresh considerations are poised to have a transformative impact on the traditional pillars of asset allocation.

Time

The time element refers to the duration of the ESG transition underway as governments and companies enact regulations, new technologies, and investments to reduce pollution in line with the principles of the Paris Agreement and fulfill sustainable development goals relating to social responsibility and governance.[1]

During this transition period, ESG-oriented strategies are likely to be well-positioned to capture potential gains from new technologies compared to traditional benchmarks. Active investors that incorporate ESG analysis into their approach may disproportionately benefit, as we discuss below.

Preference

The preference element refers to the weight an investor places on prioritizing sustainability in an investment portfolio, either due to regulatory requirements or the objectives of the investor or organization and its board. For these investors, the issue is how to optimize portfolios to address risk and return in concert with ESG. The impact depends heavily on the magnitude of ESG constraints.

In short, if the constraints are very restrictive, shrinking the investable universe materially, then investors must accept portfolios that are less diversified and hence may have less favorable risk-adjusted returns. If the constraints are less binding and allow factor exposure in line with the main ESG benchmarks, we believe the long-term impact on investment performance is minimal.

Specifically, the main ESG benchmarks are designed to match factor exposures with traditional benchmarks, so that the tracking error between ESG and traditional benchmarks is very small.

In addition to positive and negative screening based on ESG characteristics, investors can express preferences through engagement and impact investing, as we will discuss later in the paper. Regulation, which we treat as a subset of preferences, also reshapes the investable universe.

Thus, the modified framework for incorporating ESG consists of the following:

– Return

– Risk

– Time

– Preferences

Little work has been done on the integration of asset allocation and ESG. Our contribution, informed by a review of the available literature and original empirical analysis, will hopefully help our clients clarify if and when a trade-off exists in including sustainability into their asset allocation. We aim to establish a framework that is sufficiently general in design that allows the inclusion of most key issues while also being parsimonious.

The four dimensions of Asset Allocation with ESG

When optimizing an asset allocation, one can take ESG scores from a vendor to each asset class and then optimize across return, risk, time and ESG score. The weight in the optimization given to ESG proxies for the preference: if an investor is not interested in ESG, the weight will be zero and the optimization will be the traditional mean-variance; if the investor has great interest in ESG, the weight parameter in the objective function will be large and skew the allocation towards highly rated assets. Time relates to the focus the investor places on earning alpha from the ESG Transition period.

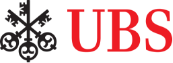

The use of ESG scores to redefine the investment universe results in a four-dimensional problem with return, risk, time and ESG score as variables, rather than the classic two-dimensional risk/return frontier.

Relatively light constraints (blue line) under this approach leave this new frontier close to the unconstrained efficient frontier (dark grey). Very strict ESG constraints (light grey) will reduce the investable universe, leading to less efficient portfolios and a lower efficient frontier. It is however possible that a conventional ESG investor, over the next few years, may enjoy early-adopter gains from owning assets that everyone wants, leading to a higher (green) efficient frontier for a limited time.

Interest in ESG is growing among investors

Recent practitioner research in the financial planning world shows that there is a substantial interest in ESG among financial advisors, in part because younger clients are often more sensitive to issues of environmental and social justice. Sustainable investing may even be a key to retaining the assets of baby boomers as they are gradually transferred, via inheritance, to the younger generation.2

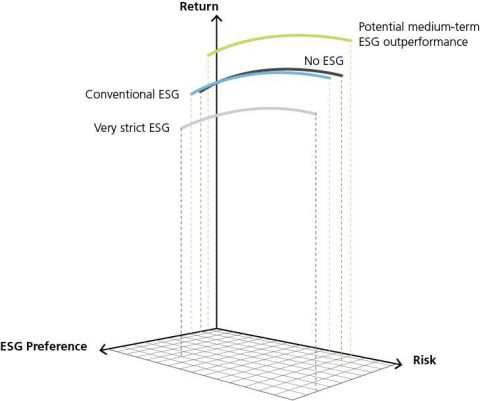

Overall, global sustainable equity fund flows accelerated in 2019 after years of steady growth, indicating growing interest and acceptance. These inflows have stayed intact in 2020 despite COVID-19 uncertainties. To date, the majority of ESG assets under management have been found in Europe. It’s worth noting, however, the increasing momentum in global flows which reached USD 40 billion in 2020 (a new record) despite the broader market risk aversion and outflows.

Charts in USD the amount of money invested in active and index ESG mutual funds from 2017 through 2020

Global momentum towards sustainability brings ESG to the forefront

A global trend to de-carbonize our economies and create a more sustainable global emissions footprint is currently underway.

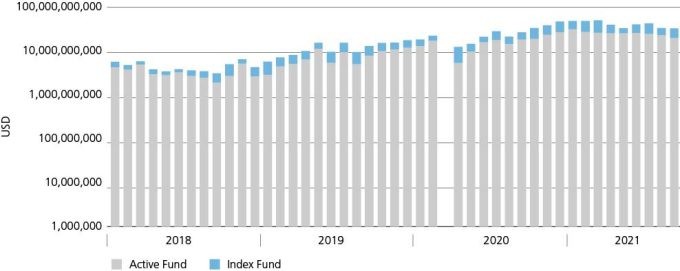

Momentum is increasing as countries and companies pledge to decarbonize to meet consumer and government concern over rising global temperatures and to reduce emissions in alignment with the Paris Agreement. Meeting these pledges and emission targets will require trillions of dollars in capital expenditure, to be invested globally across a range of industries and technologies.3

But sustainability is not only about the environment: the Associated Press investigated shrimp producers in Asia who were using captive workers while other press articles covered producers of expensive skiing jackets in Europe, whose suppliers of goose down were treating geese very harshly. No firm wants to be the subject of these press reports, as beyond the reputational damage there are crucial moral and legal issues. Thanks to ESG, sourcing and supply chains are treated much more attentively and a transition to higher traceability of inputs is happening in agriculture and manufacturing.

Estimates the amount of money that must be invested between 2016 and 2050 in various types of low-carbon industries.

** Includes investments in power grids, energy flexibility, electrification of heat and transport applications as well as renewable hydrogen. “Energy efficiency” includes efficiency measure deployed in end-use sectors (industry, buildings and transport) And investments needed for buildings renovations and structural changes (excluding modal shift in transport). Renewables include investments needed for deployment of reneable technologies and power generation as well as direct end-use applications (e.g. solar thermal, geothermal) USD throughout the report indicates the value in 2015

At the same time, regulators in some countries have pushed companies to disclose information about how they are addressing sustainability risks. New EU regulations will require financial services firms to report on how sustainability risks are included in their processes, giving investors more knowledge to express their preference for sustainable investments. A new EU-wide classification system (the Taxonomy) aims to provide businesses and investors with a common language to identify economic activities which are considered environmentally sustainable in order to inform investment decisions.

The United Nations’ Principles for Responsible Investment (PRI), a voluntary set of investment principles for incorporating ESG issues into investment practice, has been signed by over 3,000 large investors including UBS. The PRI offers six principles for responsible investment, including a commitment to incorporate ESG and promote corporate sustainability disclosures. Some investors focus on investing companies that help to solve the challenges facing the globe, as defined by the UN’s 17 Sustainable Development Goals (SDGs).

Altogether, the importance of ESG in investing is likely to keep growing at an increasing pace.

To read the full analysis of the four dimensions of Asset Allocation with ESG, download the full report:

2Tucker and Jones (2020).

3UBS Asset Management (2020),https://www.ubs.com/global/en/asset-management/insights/sustainable-and-impact-investing/2020/investing-in-an-esg-world.html