As outlined in the May 2024 crypto basket rebalance blog, an increasing number of institutional investors are deciding to invest in crypto basket exchange-traded products (ETPs) instead of selecting a single crypto exposure for their portfolios. They do this because they want exposure to this nascent and rapidly growing asset class but do not have strong views about the potential winners within it.

As shown in Figure 1 below, European crypto basket ETPs saw US $155m inflows during the first seven months of this year. We expect this trend to continue for the foreseeable future and potentially gain more traction over the coming years.

Figure 1: Crypto ETPs domiciled in Europe

Key Takeaways

- The building blocks of three crypto basket ETPs that WisdomTree manages did not change during the August 2024 rebalance.

- Year-to-date, Bitcoin has been a key contributor to the strong performance of mega cap crypto basket ETP, and Solana has helped altcoin crypto basket ETP not to lose too much.

- Related ProductsWisdomTree Physical Crypto Market, WisdomTree Physical Crypto Altcoins, WisdomTree Physical Crypto Mega Cap Equal Weight

Find out more

As outlined in the May 2024 crypto basket rebalance blog, an increasing number of institutional investors are deciding to invest in crypto basket exchange-traded products (ETPs) instead of selecting a single crypto exposure for their portfolios. They do this because they want exposure to this nascent and rapidly growing asset class but do not have strong views about the potential winners within it.

As shown in Figure 1 below, European crypto basket ETPs saw US $155m inflows during the first seven months of this year. We expect this trend to continue for the foreseeable future and potentially gain more traction over the coming years.

Figure 1: Crypto ETPs domiciled in Europe

Source: Bloomberg. 31 July 2024. Actively managed crypto ETPs are excluded. AUM = Assets Under Management. 1M = one month. YTD = year-to-date. Historical performance is not an indication of future performance and any investment may go down in value.

Please note that we update the above table on monthly basis and publish it in the WisdomTree crypto monthly report.

Most recent crypto basket rebalance

In advance of the August 2024 crypto basket rebalance, the Crypto Index Committee determined, based on the underlying index methodology, that there was no need to make any changes to the building blocks of the three WisdomTree crypto basket ETPs:

- WisdomTree Physical Crypto Mega Cap Equal Weight ETP (MEGA) that tracks WisdomTree CF Crypto Mega Cap Equal Weight Index

- WisdomTree Physical Crypto Market ETP (BLOC) that tracks WisdomTree CF Crypto Market Index

- WisdomTree Physical Crypto Altcoins ETP (WALT) that tracks WisdomTree CF Crypto Altcoins Index

The building blocks of these three crypto basket ETPs continue to meet minimum inclusion requirements. For inclusion, crypto assets must, at a minimum:

- Be based on permissionless (i.e., public) blockchains

- Have a liquid market, a reliable reference price, and a free-float supply

- Be under active development but established (by having sufficient trading history, volume and satisfying market capitalisation requirements)

In addition to the above-listed minimum rules for a crypto asset to be considered by WisdomTree, the indices that these three crypto basket ETPs track are constructed in accordance with their methodologies. Figure 2 provides a brief overview of key index construction rules, particularly weight philosophy and constraints around minimum and maximum exposures to building blocks.

Figure 2: Index methodologies

Source: WisdomTree. 29 August 2024. These indices rebalance quarterly on the third Friday of February, May, August, and November.

Performance

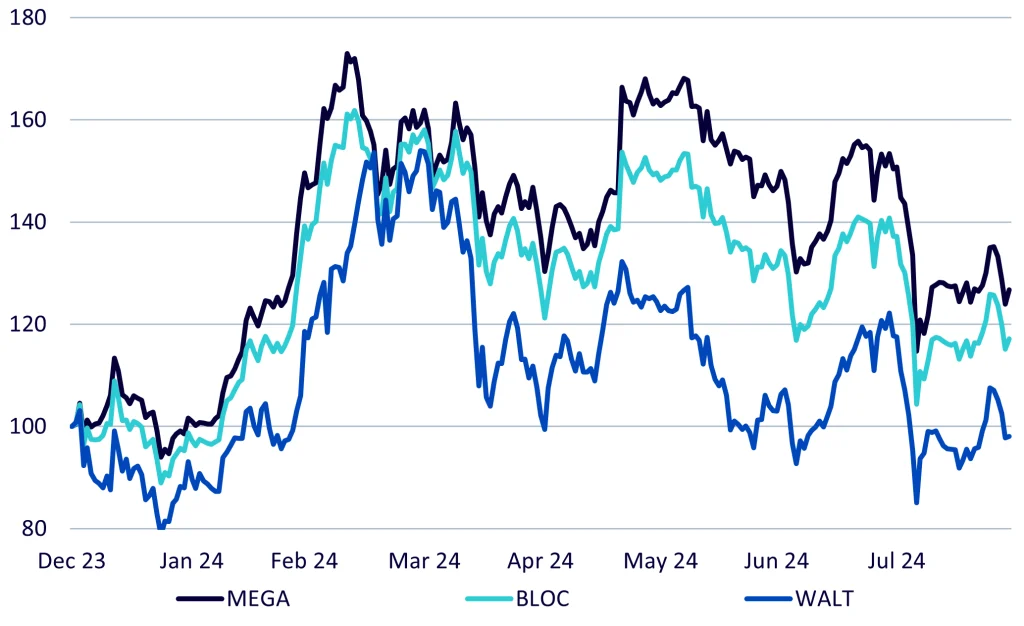

Year-to-date, bitcoin is showing strong performance (+35%1). This is the reason why WisdomTree Physical Crypto Mega Cap Equal Weight ETP (MEGA) has outperformed both WisdomTree Physical Crypto Market ETP (BLOC) and WisdomTree Physical Crypto Altcoins ETP (WALT), and BLOC has outperformed WALT.

Figure 3: Year-to-date crypto basket ETP performance

Source: WisdomTree. 29 August 2024. Historical performance is not an indication of future performance and any investment may go down in value.

In the crypto altcoin space, year-to-date Solana has had the best performance (+27%2) and has helped WALT not to lose too much.

Rebalance turnover

Even though the building blocks remained the same, all three crypto basket ETPs experienced turnover during the August 2024 rebalance as building block weights were adjusted for the indices to comply with their construction rules. For example, the WisdomTree CF Crypto Mega Cap Equal Weight Index reduced bitcoin weight and increased ether weight to make them both equally weighted at 50% each.

For total transparency, the two-way turnovers were:

The slippage costs that the crypto basket ETPs experienced were very much in line with WisdomTree’s expectations and experience.

WisdomTree: an established ETP provider to access cryptocurrencies

WisdomTree offers a curated range of eight physical crypto ETPs with an institutional grade structure that provide spot price exposure to single coins and diversified crypto baskets. Please see the WisdomTree Crypto ETP centre for further details.

1 Source: Messari. 30 August 2024.

2 Source: Messari. 30 August 2024.