Japanese stocks are a bright spot in an otherwise uninspiring global equity market.

Asset allocation: bonds look better value

Conflicting signals have left bonds and equities struggling for direction. Markets have been unsettled by the Chinese economy’s travails. Recent data shows that domestic consumption remains depressed thanks to a weak property sector while authorities have failed to offer enough stimulus to shore up growth. At the same time, the US economy’s resilience appears to have led to a reappraisal of how soon the US Federal Reserve might start to ease policy, driving up real interest rates, which in turn has weighed on equities. Investors have concluded that the Fed is likely to keep rates higher for longer in the face of surprisingly strong data. In our view, though, economies are starting to feel the pinch from tighter policy we expect growth to slow to anaemic levels.

Partly for this reason, we continue to hold an overweight in bonds – with US Treasury bond yields above our 3.5 per cent fair value estimate, US government debt looks increasingly attractive.

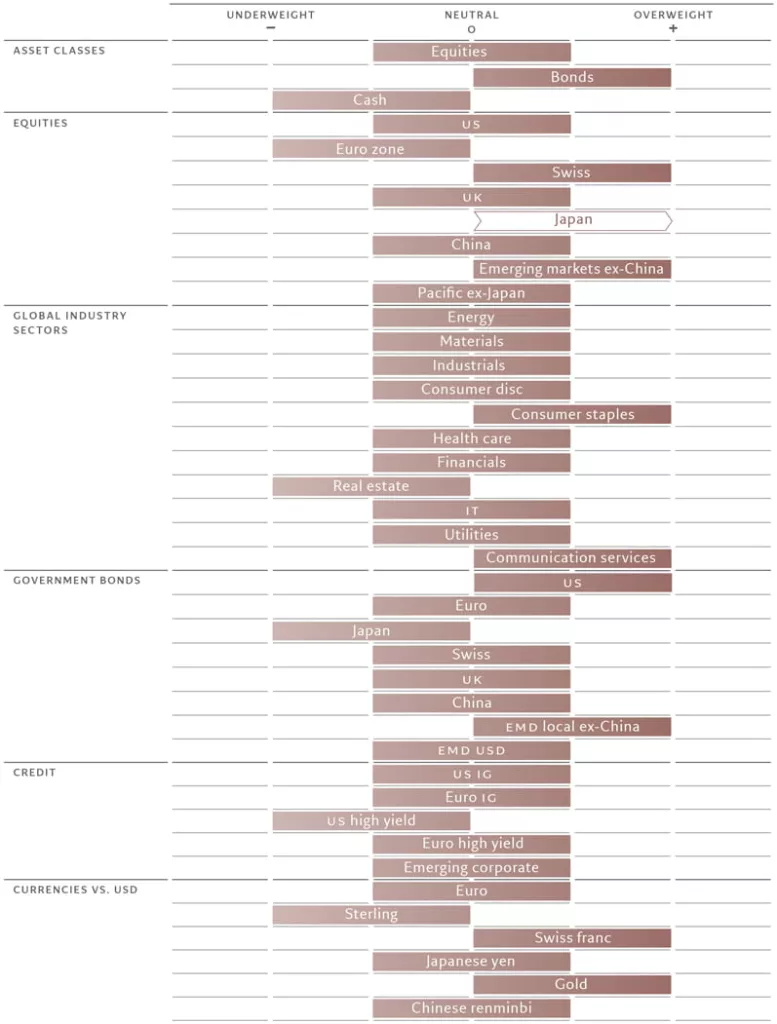

At the same time, we remain neutral on equities. US, European corporate earnings have remained strong thanks to surprisingly resilient economic growth, but we are doubtful this can continue. Earnings growth is likely to slow, particularly in Europe, as higher interest rates and rising wages eat into profit margins. And all the while higher real yields have started to put downward pressure on equity multiples. Meanwhile, labour market conditions are likely to tell increasingly on equity markets, particularly their returns relative to bonds – historically the one follows the other closely (see Fig. 2).

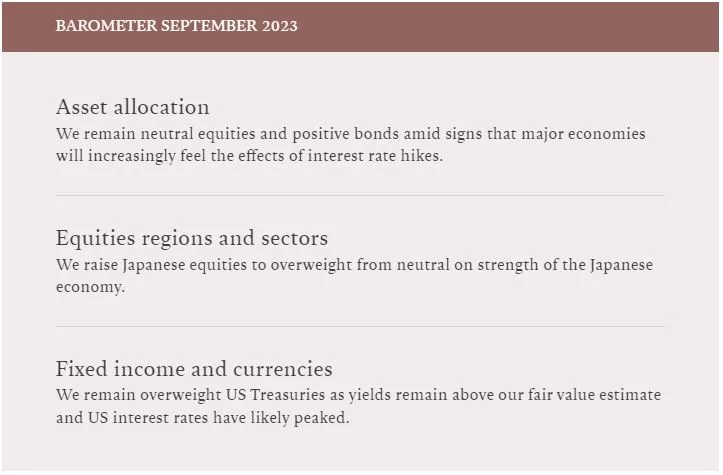

Fig 1. Monthly asset allocation grid

September 2023

Our business cycle indicators have turned modestly negative overall.

While the US economy continues to surprise on the upside, consumption, which has underpinned growth, is likely to slow as households’ excess savings decline. Meanwhile, leading indicators suggest private sector capital spending is about to fall. And though there continues to be disinflation, with the headline CPI dropping to 3.2 per cent, inflation risks are tilted to the upside – companies have been able to pass higher prices through to consumers without denting demand.

Europe’s growth is flagging, with both services and manufacturing struggling as rate hikes stifle credit growth. Japan remains the strongest developed economy. We expect it to grow above potential this year and next, thanks to accommodative monetary policy. However the industrial sector continues to struggle and is unlikely to rebound if global trade slows.

We have downgraded our growth forecast for China for the current year to 5.4 per cent from 5.8 per cent. July data were weak, particularly retail sales, suggesting growth has flattened after a solid first half to the year. Nor is there likely to be a significant recovery soon. Chinese households are accumulating savings, while the property market is struggling – floor space sold is being sold at prices that have reached new cyclical lows and 50 per cent below the long-term trend. More broadly in emerging markets, however, the picture is healthier. Developing economies are proving more resilient than developed markets, and given that emerging economies are further along the inflation cycle, they should be the first to start easing monetary policy, though that’s likely to be offset to some extent by slowing trade.

Our liquidity indicators remain unchanged overall: the developed world is on balance tightening conditions while emerging markets are easing, leaving our signals neutral in aggregate. In the US, the Fed’s quantitative tightening programme – the running down of its bond holdings – has been offset by the government’s substantial budget deficit. In part, this counterbalancing effect is down to technical factors linked to how the deficit is being financed. But this should prove temporary, paving the way to tightening liquidity conditions in the months ahead.

Elsewhere, monetary conditions in Europe continue to tighten but remain loose in Japan. And although China is gradually shifting towards an easier monetary stance , policymakers there are pursuing a relatively modest course of “irrigation rather than flooding” in an effort to avoid the moral hazard of bailing over-leveraged local governments and property developers. There is a risk its measures prove too little, too late.

Fig. 2 – Jobs vs stocks

US job openings vs performance of global equities relative to bonds

Our valuation metrics show that equities remain the only asset class that looks expensive.

We expect corporate earnings growth across developed markets to be well below consensus – so while equity multiples have come down, stocks trade at above our fair value forecast. And relative to bonds, equities are expensive in the US for the first time since 2001, with the US equity risk premium at 3.2 per cent. Meanwhile, US bond yields have reached levels not seen since 2008, with the 10 year note yielding as much as 4.35 per cent in August .

Our technical indicators highlight a weakening trend for equity markets, with net investor positioning on S&P 500 futures at its most bullish levels for some time, limiting the scope for further gains in stocks.

Equities regions and sectors: Japan beckons

Investors are rediscovering Japan. Inflows into the country’s equity market from non-domestic investors are the strongest they’ve been in a decade.

Both a strong economy and changes to domestic investment rules suggest that there is considerable scope for this demand to grow. As a result we upgrade Japanese equities to an overweight from neutral.

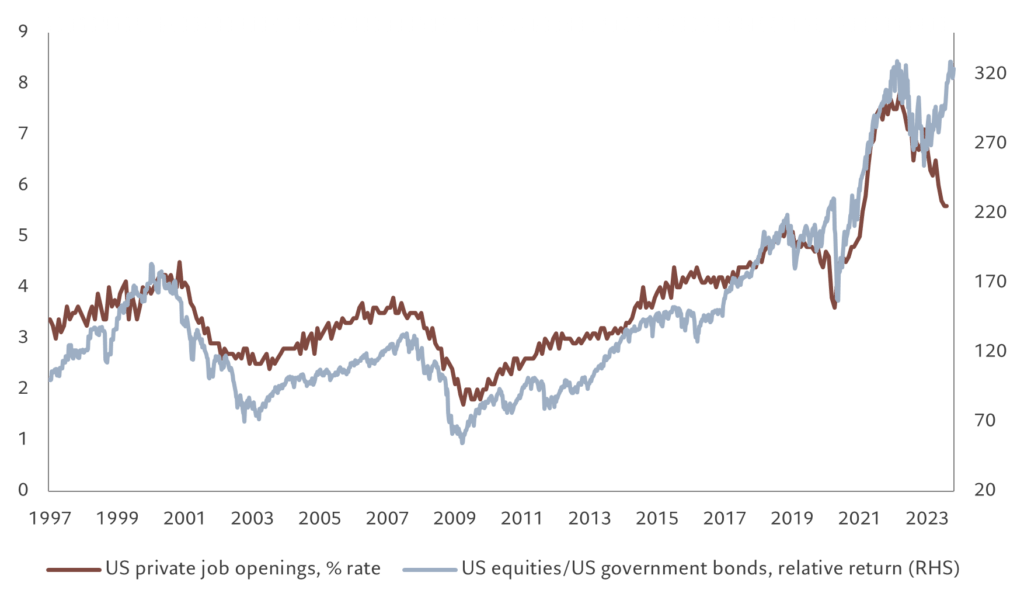

Japan is the only major developed economy whose growth prospects remain strong. Indeed, our forecasts have it growing above potential. We expect earnings per share growth to be the strongest among developed markets, at 7.2 per cent in 2023 and 6.2 per cent the year after.

A weak yen has helped underpin Japanese corporate earnings on top of robust domestic recovery. Valuations for Japanese stocks remain fair while and foreign investors remain under-invested even if they have raised their allocations in recent months.

Japanese stocks’ dividend yield went decisively higher than that of the US in 2018 and stock buybacks have been increasing every year since 2009 with the one exception of 2020. At the same time Japanese firms have very strong, positive cash flow and large cash balances, while those in the US have large amounts of debt. After a long period of deflation, inflation looks set to force Japan Inc. to put those cash balances to more efficient use.

Fig. 3 – Japanese attractions

Japan vs US real GDP growth, earnings and dividend yield, and real bond yield, %

Elsewhere, we remain neutral US stocks. Although US equity valuations have come down somewhat during the past month, the market remains relatively expensive, certainly relative to bonds. For instance, the 12-month forward earnings yield on the S&P 500 is 5.4 per cent, while three month US T-bills offer 5.5 per cent and the Bloomberg corporate investment grade bond index delivers 5.8 per cent. Investors in US stocks aren’t being sufficiently for the risk they take.

Separately, we maintain our overweight in emerging markets, ex-China. Interest rate cuts across the region should lift valuations for emerging market stocks, while Latin America also offers good fiscal dynamics, particularly in Brazil and Mexico. We remain positive on quality stocks, which supports our overweight in Swiss equities. As for Europe overall, we are underweight – economic growth in the region is starting to be weighed down by tightening monetary conditions and a collapse in credit growth. We are forecasting European corporate earnings to contract 2.1 per cent this year, well below the market consensus for 3.3 per cent growth.

We remain overweight communications services. The sector has delivered strong earnings upgrades. For instance, during the past three months, media and entertainment has delivered the strongest earnings upgrades for the year. We also remain overweight consumer staples. This defensive sector has been relatively resilient recently even as consumers start to be squeezed by high rates and high inflation. On the other hand, we are underweight real estate. The sector remains structurally challenged in the wake of the pandemic. Valuations look attractive but bad news abounds.

Fixed income and currencies: finding value in Treasuries

The Fed should soon be able bring an end to its most aggressive tightening campaign in four decades. That is the picture that emerges from our business cycle indicators. Our analysis shows that interest rates in the US may now have peaked at the current range of 5.25-5.5 per cent. That is, in our view, sufficiently high to bring inflation down to the central bank’s target of 2 per cent within the next two years.

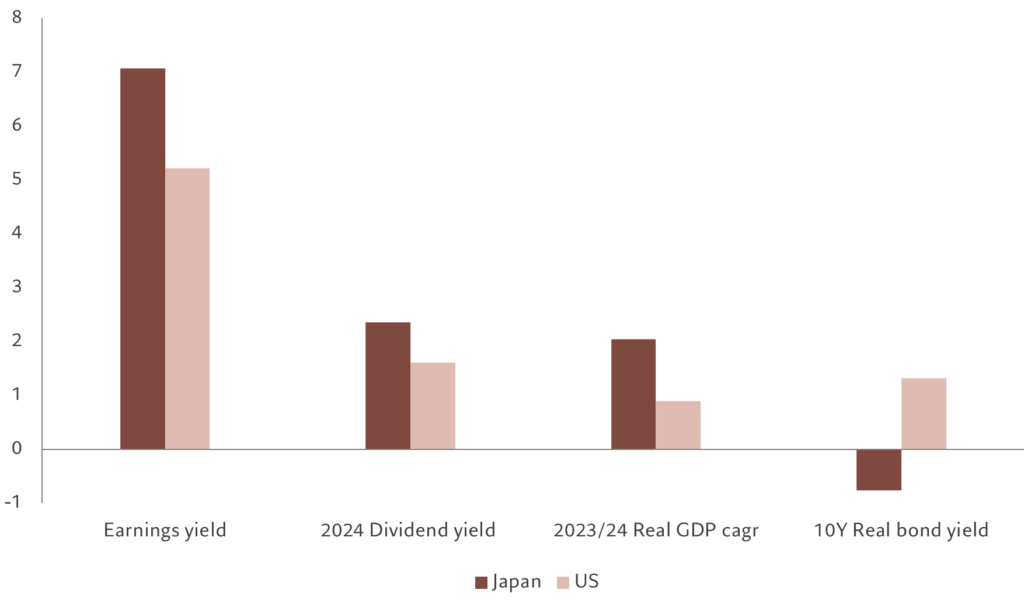

US government bond markets do not discount this scenario. Even if benchmark US Treasury yield have recently declined from a 16-year peak, they remain at 4.1 per cent, 60 basis points above what we consider to be fair value. US bond yields adjusted for inflation, meanwhile, have recently hit their highest level in 14 years (see Fig. 4). All of which leads us to retain our overweight stance on US government bonds.

Fig. 4 – High real return

Inflation-adjusted 10-year US government bond yield

We also retain our overweight position in emerging local currency debt outside of China.

Brazil and Chile have started cutting interest rates as inflation in these markets is falling faster than previously anticipated; we see similar trends unfolding in other emerging economies over the coming months.

Crucially, emerging market local currency debt also provides exposure to emerging currencies, which on our fair value measure are undervalued by around 18 per cent.

We remain underweight Japanese government bonds. The Bank of Japan is likely to phase out its unconventional stimulus measures in the coming months, with the central bank having recently stated that its 2 per cent inflation target is “now clearly in sight” as the economy continues its post-Covid recovery.

Within corporate bonds, we retain our underweight stance on high yield debt. Spreads on US high yield bonds currently stand at less than 400 basis points, a level which we think is too given our expectations for a slowdown in US economic growth.

We expect the default rate to rise as high leverage levels and falling profit margins complicate businesses’ balance sheets. Investment grade bonds on both sides of the Atlantic do not look attractive either.

In the US, the extra yield they offer relative to cash has fallen to multi-decade lows of just 30 basis points, which means investors get virtually no compensation for taking additional risk.1

In foreign exchange, we remain overweight in the Swiss Franc. The currency should benefit from additional interest rate hikes from the Swiss National Bank and remains a reliable hedge against any deterioration in economic conditions.

We are also overweight gold. A weakening dollar, rising central bank allocations and a peak in real rates should support the precious metal.

We are underweight sterling. The UK economy faces a bigger threat from stagflation than any other developed economy despite the Bank of England raising interest rates 14 times since 2021 to the highest level since 2008.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Global markets overview: stocks run out of steam

Global stock markets ran out of steam in August, finishing the month down some 2 per cent, in local currency terms. Investors were concerned about slowing economic growth in China and the possibility of US interest rates staying higher for longer.

The earnings season offered some hope, particularly in the US, where companies reported smaller-than-expected drops in profit. With reporting season in the US nearly over, some 79 per cent of S&P 500 companies have beaten analyst forecasts on earnings, according to Refinitiv I/B/E/S data. In Europe, where the season is only half way through, the situation has been less upbeat. Only 53 per cent of the STOXX 600 companies which have already reported second quarter earnings beat forecasts.

This was reflected in stock market performance, with European stocks down around 3 per cent in August and the US market losing a more modest 1.7 per cent.

Losses were seen in virtually every major equity region, with the exception of Japan, which finished flat in local currency terms. A weaker yen and an improving economic outlook have proved a boon for Japanese companies and their share prices.

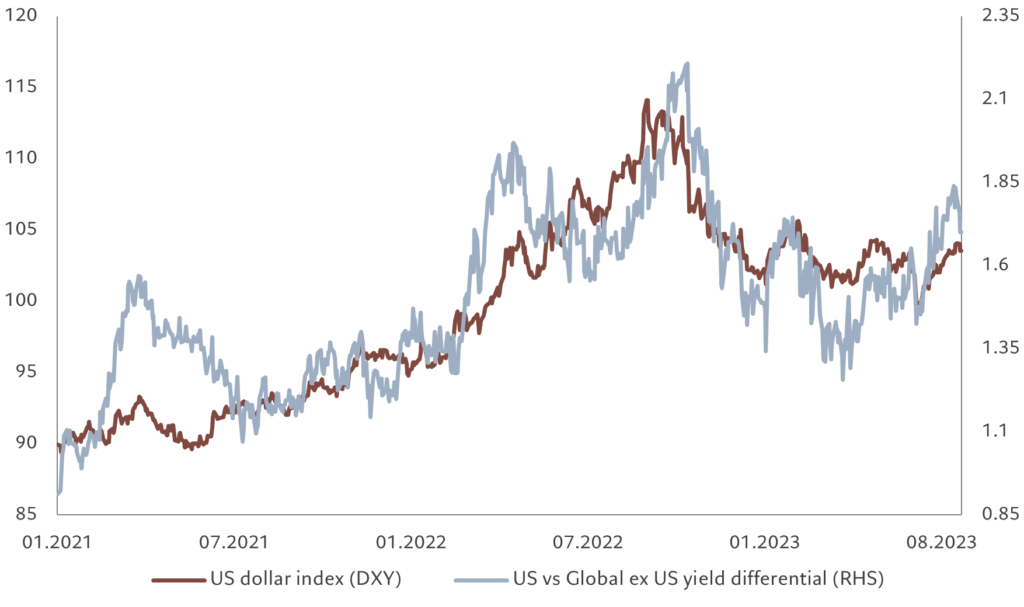

Fig. 5 – Dollar and US rates

avourable yield differentials lift the dollar in August

Among sectors, energy stood out as the only one not in the red, boosted by higher oil prices. Elsewhere, tech stocks snapped their recent rally as investors fretted about extended valuations. However, inflows into the sector remained strong.

In developed government bond markets, US Treasuries delivered the weakest performance, down about 1 per cent, as investors began to price in the possibility that the Fed has not yet finished raising interest rates and that it may keep rates at current levels for longer than previously anticipated.

Higher US yields helped lift the dollar (see Fig. 5), which gained 1.7 per cent in August against a trade-weighted basket of currencies.

That in turn weighed on emerging market local currency bonds, which lost 2.7 per cent. Concerns about China’s economic growth also weighed on sentiment and performance.

In brief