Key takeaways:

- While the S&P 500 Index and healthcare sector have experienced double-digit gains in 2021, small- and mid-size biotech stocks have fallen into a prolonged bear market.

- We believe recent headwinds are largely transitory and don’t outweigh the industry’s long-term growth potential.

- In the meantime, the pullback has resulted in lower valuations. In our view, that could set up biotech for a big rebound.

So far this year, the S&P 500® health care sector, like the broader S&P 500® Index, has enjoyed double-digit returns. But within health care, biotechnology – in particular, small- and mid-cap stocks – have experienced a notably less positive run.

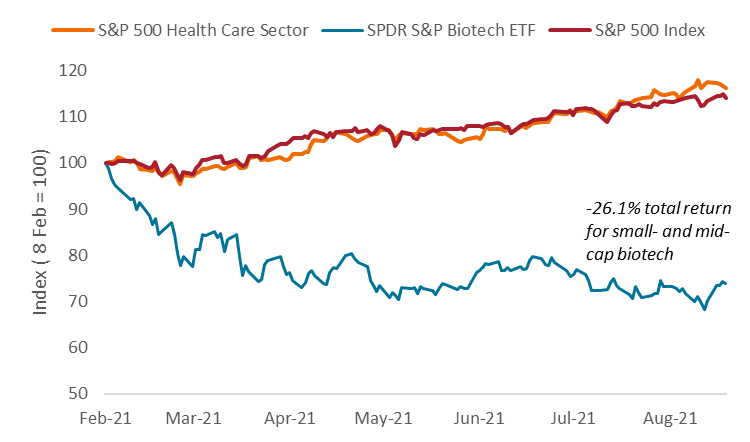

For the year through August 26, the SPDR S&P Biotech ETF (XBI) has fallen 8.6%, compared with a gain of roughly 20% for both the health care sector and the S&P 500.1 (The XBI serves as a proxy benchmark for biotech’s small- and mid-size components.)2 Looking at performance since the industry’s record high on February 8, things are downright gloomy: the XBI has retreated just over 26%, while the health care sector has climbed 17.3% and the S&P 500, 15.1%.3

Exhibit 1: biotech bear market

Small- and mid-cap biotechnology stocks have dramatically underperformed both the S&P 500 Index and the health care sector since February.

The XBI’s underperformance relative to the equity market and the health care sector overall is the widest it has been since the ETF’s inception in 2006. The pullback – officially a bear market (defined as a loss of 20% or more) — is also on track to be one of the longest in history, so far lasting 139 trading days, or nearly three times the length of the XBI’s average bear market.4

What’s behind the underperformance

Biotech’s fall has been even more jarring when compared with the experience of 2020 – when investors rewarded companies developing treatments and vaccines for COVID-19 and enthusiasm for still-unproven medicines seemed to have no limit.

But sentiment toward the industry made a sharp U-turn in early 2021. For one, investors began rotating out of long-duration growth stocks such as biotech and into areas levered to an economic recovery. Market participants also demonstrated a preference for high-quality, large-capitalization stocks over smaller, less liquid peers. In addition, a decision by the U.S. Federal Trade Commission to scrutinize recent mergers and acquisitions (M&A) in pharma dampened appetite for new deals, while worries about drug pricing reform resurfaced as Democrats in Congress looked for ways to fund ambitious spending bills. Finally, the commissioner of the Food and Drug Administration (FDA) departed, creating a vacuum in leadership as the agency faced an influx of COVID-19 drug applications, resulting in delayed reviews and surprising regulatory decisions.

Big losses, big rebounds

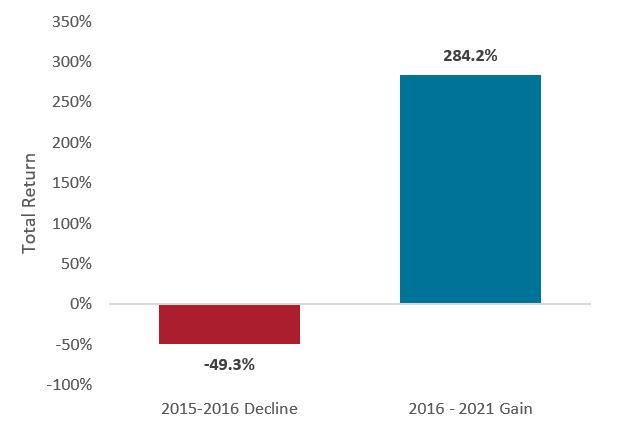

Given the inherent risk and long timelines for drug development, biotech is no stranger to volatility. But thankfully, big drawdowns can also be followed by big rebounds. In 2015-2016, the XBI underperformed the S&P 500 by 35%, the second-largest return gap on record (prompted, in part, by a tweet from then-U.S. presidential candidate Hillary Clinton about “price gouging” in biotech drugs).5 From that bottom in 2016 to biotech’s high this year, the XBI delivered returns of over 280% (see Exhibit 2).

Exhibit 2: biotech bounce-back

Following a major sell-off in 2015-2016, small- and mid-size biotech stocks went on to deliver sizable gains, hitting a record high in February 2021.

Our take on biotech now

We cannot predict when the current biotech rout will end. But in our view, the fundamentals driving the industry’s attractive growth opportunities have remained intact. Small- and mid-cap biotech companies are pioneering some of the most exciting advances in medical research, such as gene therapies, liquid biopsies, precision oncology and engineered antibodies. Many of these medicines have the potential to revolutionize the standard of care for patients, dramatically improving survival rates and quality of life.

In June, for example, Intellia Therapeutics delivered the first positive clinical trial data for in-vivo gene editing, a process by which a specific point in the human genome is edited from within the body. Intellia was able to knock down a harmful protein for patients with a fatal hereditary disease by an average of 87% — with just a single infusion. While the data are still early, the outcome is remarkable and suggests gene editing therapies could have enormous potential.

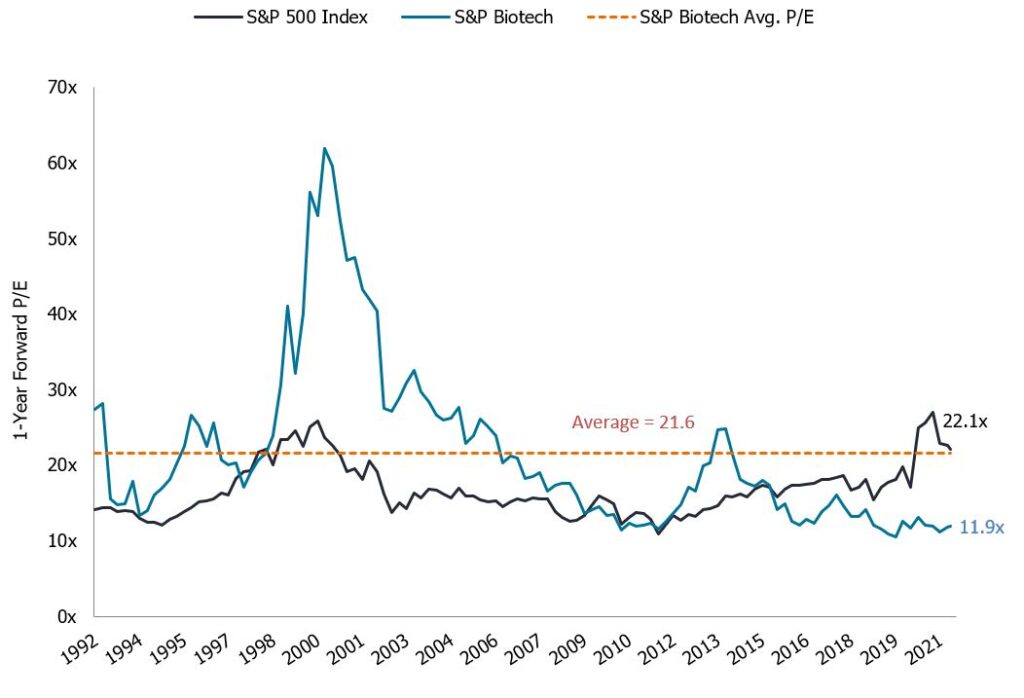

Meanwhile, biotech stocks now trade well below the long-term average (see Exhibit 3) due to the challenges described earlier. But in our view, these headwinds should pass. For one, the eventual appointment of an FDA commissioner should lead to greater regulatory consistency. At the same time, progress on infrastructure bills and other spending measures in the U.S. should help reduce uncertainty about drug pricing. On that point, we’d note the Biden administration has demonstrated consistent support for biomedical research, and we believe this will factor into any efforts at reform. This is particularly true in the wake of the industry’s enormous contributions to fighting the COVID-19 pandemic and as China ramps up investment in its own biotech industry.

Exhibit 3: Biotech valuations drop

The forward price-to-earnings (P/E) ratio for the typical biotech stock sits well below the long-term average for the sector, as well as the S&P 500.

“Volatility is the price of admission” when investing in biotech, but we remain optimistic about the long-term view. In fact, after large drawdowns, the returns can be significant. In August, Pfizer announced it would acquire Trillium Therapeutics, a Canadian biotech developing blood cancer drugs, for nearly U.S. $2.3 billion, a more than 200% premium to Trillium’s prior-day closing price.6 Should we see more M&A deals such as this, biotech’s blues could well come to an end.

Footnotes

1Bloomberg, as of 26 August 2021. Health care returns are for the S&P 500 Health Care Sector.

2The SPDR S&P Biotech ETF (XBI) corresponds generally to the total return performance of an index derived from the biotechnology segment of a U.S. total market composite index.

3Bloomberg, data are from 8 February 2021 to 26 August 2021.

4Goldman Sachs Global Investment Research, FactSet, Bloomberg. Data as of 20 August 2021 and 26 August 2021.

5Goldman Sachs Global Investment Research, FactSet. Data as of 20 August 2021.

6Bloomberg, as of 20 August 2021.

The S&P 500 Health Care comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector.

The health care industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.