Key Takeaways

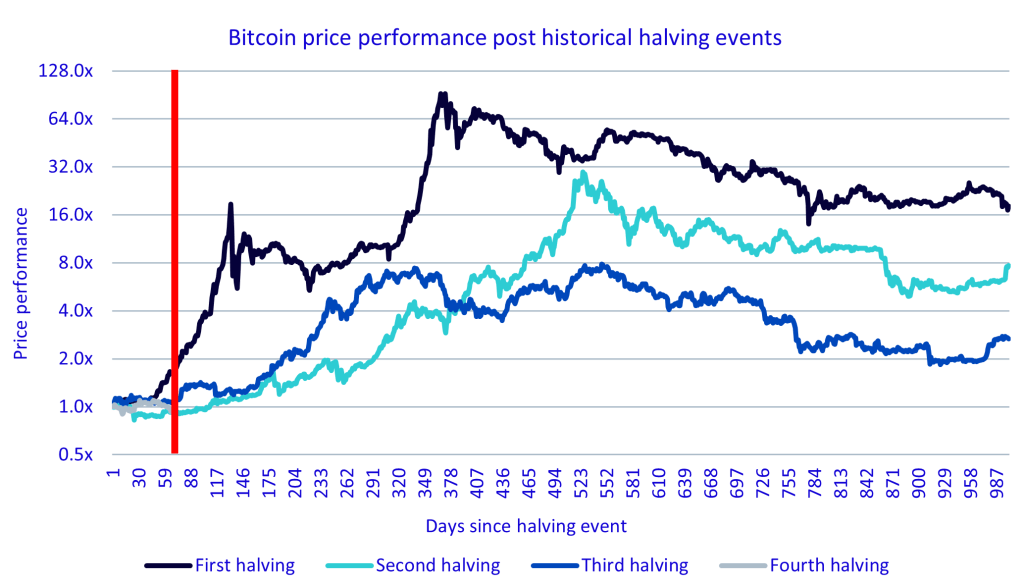

- Bitcoin halving has yet to realise its expected positive price momentum post the halving event

- Investors should remain patient, as potential positive price action hasn’t taken place immediately in 2/3 of the prior halvings

- Miners are actively seeking to increase efficiency, given the reduction in rewards due to the halving

- Bitcoin offers a unique exposure for investors, given its unique, transparent monetary policy

- Related ProductsWisdomTree Physical Bitcoin, WisdomTree Blockchain UCITS ETF – USD AccFind out more

As we approach the midpoint of 2024, approximately 89 days have passed since the pivotal bitcoin halving event in April1. While bitcoin flirted with all-time highs earlier in the year, surpassing $73,0002, it has yet to breach this threshold. Historically, any significant price change following halving events has not always been immediate; two of the last three halvings saw delayed price increases. This pattern underscores the importance of patience for investors awaiting the ‘halving trade’ to play out. To keep things in context, bitcoin closed just under $64,000 on 20 April (halving date), not too far from the current price of $63,000 as of the time of writing.

Source: Glassnode, WisdomTree as of 2 July 2024 . Rebased to 1 in from halving date. The vertical red bar indicates where we are as of June 30, 2024. Historical performance is not an indication of future performance and any investment may go down in value.

Implications of the 2024 halving:

Tightening supply dynamics

The recent halving has had a profound impact on bitcoin’s supply dynamics:

- Newly minted bitcoin per block reduced from 6.25 to 3.125, effectively decreasing the market’s supply influx

- Approximately 19.7 million bitcoin (nearly 97% of the total supply) are currently in circulation, with as much as a million or more lost forever3

- The maximum supply remains capped at 21 million, with future halvings continuing to reduce new issuance

A reminder of bitcoin's unique monetary policy

Bitcoin continues to offer a distinctive approach to monetary policy:

- It provides a transparent and codified system, contrasting with traditional fiat currencies managed by central banks

- The fixed and predictable issuance schedule operates without central authority intervention

- This structure positions Bitcoin as a potential long-term store of value, akin to gold, offering an alternative to inflationary fiat currencies

- Halving events introduce a cyclical element to bitcoin’s economic system, given that they occur roughly every four years

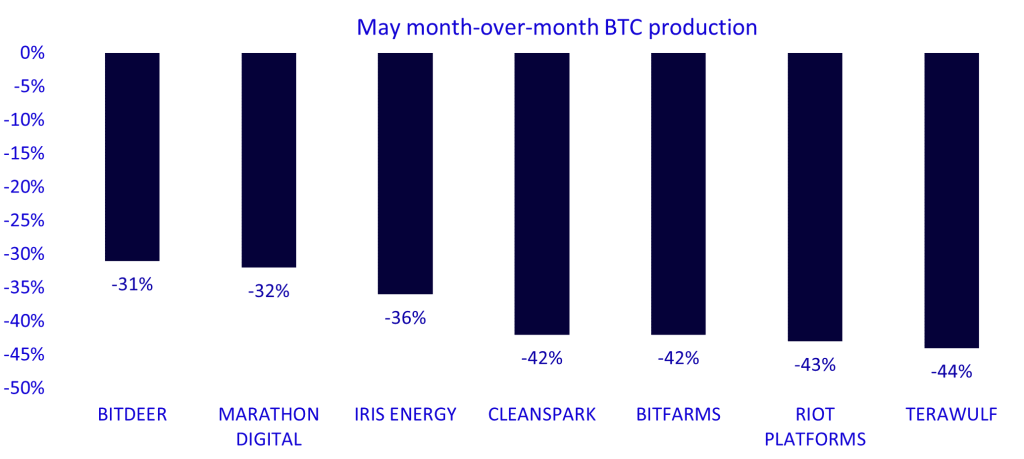

Challenges for miners

The halving has significantly affected the bitcoin mining landscape:

- Miner rewards have been halved, resulting in a lower block subsidy in bitcoin terms

- This change increases financial pressure on miners, particularly if bitcoin’s USD price doesn’t sufficiently cover their energy input costs

- The industry is currently witnessing consolidation, restructuring, and even closures/repurposing of mining operations

Post-halving mining industry developments

Source: WisdomTree, Blockworks, https://blockworks.co/news/who-mined-most-btc-since-bitcoin-halving. Historical performance is not an indication of future performance and any investment may go down in value.

This shift has catalysed several industry trends alluded to in the bullets above:

- Mergers and acquisitions (M&A) activity: The sector is seeing increased M&A activity, best exemplified by Riot Platforms attempted hostile takeover of Bitfarms4

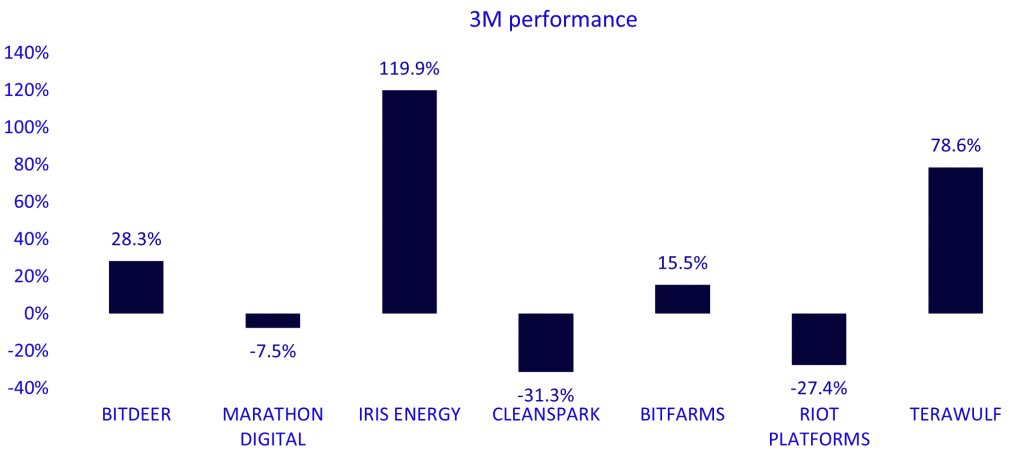

- Operational efficiency focus: Mining firms are investing in improved computing infrastructure to improve their hash rate5, increasing their chances of success to receive block rewards

- Diversification of revenue streams: Companies like Terawulf and Iris Energy are exploring new avenues, such as offering their computing infrastructure for AI model training, capitalising on high demand in this sector6,7

There is a notable divergence in performance within the mining space. Well-capitalised and efficient firms are better positioned to thrive in an increasingly competitive ecosystem. Those that have been nimble and quick to adjust to the changing market dynamics have so far outperformed their peers.

Source: Bloomberg as of 26 June 2024. Historical performance is not an indication of future performance and any investment may go down in value.

Conclusion

As we navigate the post-halving landscape, it’s crucial for investors to maintain a long-term perspective. Historical patterns suggest that any significant price change may not be immediate but tends to evolve over several months following the halving event. Bitcoin’s deflationary nature and transparent monetary policy make it a compelling long-term store of value, with each halving event presenting an opportunistic entry point into the asset class due to the supply constraints it introduces, which has historically led to upward pricing pressure.

As a result of this event, the bitcoin mining industry is adapting, with efficient and innovative firms poised for growth ahead, amidst increased pressure from reduced bitcoin block rewards. While patience is required in the short term, the long-term prospects for bitcoin and the mining sector remain promising. Investors should stay informed, consider opportunities within the space, and recognise this is a trend that will play out over the back half of 2024.

1 The halving took place on 20 April 2024.

2 Source: Coinmarketcap. Bitcoin daily close price reached an all time high of $73,079 on 14 March 2024.

3 https://fortune.com/crypto/2024/04/24/bitcoin-wallets-waking-up-lost-coins-satoshi/

4 https://www.bloomberg.com/news/articles/2024-05-28/riot-platforms-pursues-takeover-of-rival-bitcoin-miner-bitfarms

5 A measure of computational power that is being used to mine and process transactions on a Proof-of-Work blockchain, such as Bitcoin

6 https://investors.terawulf.com/news-events/press-releases/detail/79/terawulf-announces-may-2024-production-and-operations-update

7 https://www.afr.com/technology/how-this-aussie-bitcoin-miner-is-cashing-in-on-the-nvidia-ai-boom-20240616-p5jm6w