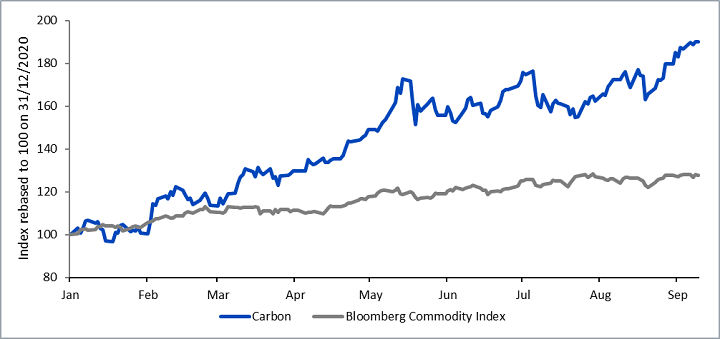

The price of carbon emission allowances has risen significantly since the start of this year. As of 09 September, the price of carbon is up over 90% year to date (in EUR terms). Carbon’s rally has dwarfed that of broad commodities, an asset class otherwise on a strong run this year (see figure below).

Figure 1: Carbon’s rally received an additional boost from natural gas shortages in August

Historical performance is not an indication of future performance and any investments may go down in value.

So, what might be behind the rally?

An asset class built on a structural need

The European Union Emissions Trading Scheme (EU ETS) is the world’s biggest carbon market and the foundation of the European Union’s (EU) policy to mitigate climate change and reduce greenhouse gas emissions. The scheme is intended to support the EU in achieving carbon neutrality in the region by 2050.

The EU ETS limits the amount of greenhouse gases that can be emitted by companies each year. Companies must hold enough allowances to cover their emissions and secure these allowances from a limited supply issued each year. Price increases in carbon emission allowances make it more expensive for companies to cover their carbon footprint and incentivise them to invest in pollution abatement technology.

As an asset class, Carbon is an investment in European Union’s Carbon Emission Allowances, a liquid futures market. With the European Union looking to increasingly reduce emissions, supply is structurally expected to remain tight.

More momentum from Hurricane Ida

According to the US Energy Information Administration (EIA), more than 90% of natural gas production in the Federal Offshore Gulf of Mexico (GOM) was offline in late August following Hurricane Ida. GOM production of natural gas averaged 1.9bn cubic feet per day (Bcf/d) in August, down 0.4 Bcf/d from July. The EIA expect production to gradually come back online over the month of September.

But how does the shortage of US gas supply relate to carbon prices? The first-order effect is on the European gas market. According to the European Commission, Europe’s gas market has been tight this year due to low domestic production. There has, therefore, been greater reliance on liquified natural gas (LNG) imports. With the US being one of the key suppliers of natural gas to Europe, tightness in US gas supply thus has a bearing on Europe.

This tightness in the gas market, in turn, incentivises more coal-fired electricity production in Europe, triggering more demand for carbon emission allowances. Given this has happened in August, a time when auction supply is already limited, the boost to prices has been augmented further.

As winter approaches, tightness in Europe’s gas supply may continue to have a bearing on carbon prices as electricity producers may be forced to keep turning to coal. Coal is a relatively cheap fuel for power generation but has a relatively high carbon footprint and therefore requires more emission allowances.

Related blogs

+ What’s Hot: Aluminium’s fundamentals keep getting better

+ What’s Hot: Is it time to look at China again?

Related products