2020 and 2021 saw investors putting record amounts of investments into thematic funds. Whilst no two thematic funds are the same, two things in particular were noticeable:

- Strategies focused on software were able to showcase very strong revenue growth metrics, in many cases providing solutions that were more broadly used during the Covid-19 lockdown periods. Investors were attracted to these growth metrics and, in many cases, the assets piled in.

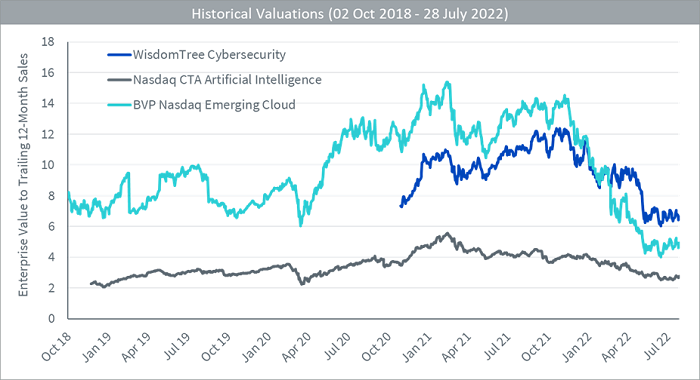

- As performance accelerated, so did valuations, at least measured on an enterprise value to trailing 12-month sales (EV-Sales) basis. This tells us that, even though sales were growing, investors were pushing up valuations because of their excitement in future potential. Obviously, in 2022 the environment has changed.

The result? See Figure 1…

- The WisdomTree Team8 Cybersecurity Index (WisdomTree Cybersecurity), Nasdaq CTA Artificial Intelligence Index and BVP Nasdaq Emerging Cloud Index represent three distinct indices aiming to capture companies in three megatrends. Each touches the software space, but we recognise that the Nasdaq CTA Artificial Intelligence Index is slightly different as it also incorporates significant exposure to semiconductor companies, which can have very different relevant financial metrics than software companies.

- The BVP Nasdaq Emerging Cloud Index has seen three distinct regimes, looking at the EV-Sales metric. October of 2018 to April of 2020 had the valuation moving around but sticking below 10.0x. Then, from April of 2020, the valuation ratio expanded towards a level of 12.0x to 14.0x, until November 2021. In November 2021, the ratio fell off and seems to have stabilised at roughly 4.0x to 5.0x as of July 2022. We can clearly see how these dates correspond to different parts of the Covid-19 pandemic and announcements of shifts in central bank policies.

- WisdomTree Cybersecurity, during its shorter live history, has behaved with high correlation to the BVP Nasdaq Emerging Cloud Index. It is notable that ‘cloud security’ is an important part of cybersecurity today, and there is overlap between these indices. Today, one can consider if the fact that cybersecurity is essential to the strategy of any company translates to a higher valuation multiple than what we’d see for the general cloud computing company.

- The Nasdaq CTA Artificial Intelligence Index is more diversified in terms of industry—there are software companies, but there are also semiconductor companies. The EV-Sales multiple has dropped from November 2021 to July 2022, but from a level of roughly 4.0x to a level of slightly above 2.0x. Semiconductors also tend to have their own cycle of boom-and-bust where there can be a shortage, massive investment, oversupply or a market correction and the cycle continues in a different way than purely focused software companies.

Figure 1: Historical evolution of the enterprise value to trailing 12-month sales ratio for specified indices

Source: Bloomberg, with data shown over the live calculation, available history for each index. WisdomTree Cybersecurity started its time series on 30 October 2020; Nasdaq CTA Artificial Intelligence started its time series on 23 November 2018; BVP Nasdaq Emerging Cloud Index started its time series on 2 October 2018.

Historical performance is not an indication of future performance and any investment may go down in value.

Conclusion—a signal to invest?

We wish the matter was as simple as, ‘valuation is down a certain percentage, therefore it has bottomed and it is a great time to enter’. Unfortunately, all three of the indices shown in Figure 1 could drop further from here. We can note the revenue growth of some select cloud companies, recognising that the BVP Nasdaq Emerging Cloud Index saw the largest overall drop in the EV-Sales ratio.

- Squarespace, Tenable, ServiceNow, AppFolio, 2U, Shopify and Zendesk reported quarterly results during the week of 25 July 2022, on the early end of the quarterly earnings reporting cycle1.

- If we think in terms of ranges: Squarespace and 2U saw revenue growth in the 0-10% range; Shopify was between 10-20%; Zendesk, ServiceNow and Tenable were in the 20-30% range; and AppFolio was the leader at 32% revenue growth, year-over-year2.

We are tending to see cloud computing companies guiding in the range of either stable or slightly lower growth for 20223. As yet, we have not seen revenue growth ‘disasters’, but that doesn’t mean it couldn’t happen as companies continue to report.

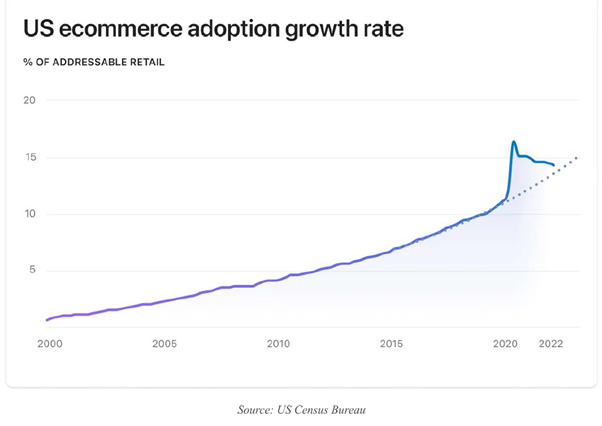

Tobias Lütke, CEO of Shopify, wrote a letter that was posted to Shopify’s public site concerning their strategic decision to let go of around 10% of their workforce4. Included, was the chart in Figure 2 which we think is illustrative of what we are seeing in a lot of the software space.

- Shopify is focused on ecommerce, so the ecommerce adoption rate is critical to their business.

- Ecommerce is still on a significant growth trend, but it’s clear that the slope is moderating back to the longer-term trend after a very large spike. Many software companies might have been priced as though the ‘covid spike’ in growth was going to continue, and what we are seeing in 2022 is the need to moderate back to a still growing but more sustainable growth figure.

Figure 2: U.S. ecommerce adoption growth rate

Source: https://news.shopify.com/changes-to-shopifys-team

We think that ‘growth = opportunity’, but recognise that it will be critical to see central banks transitioning from aggressive tightening to slowing or pausing their tightening. A massive rally in software company share prices would be difficult to see in the face of continued 75 basis point hikes. One way to potentially manage this risk could be a longer investment horizon, where the risks associated with any singular macroeconomic environment can typically be lessened.

Sources

1 Source: Bloomberg for the aggregation of quarterly earnings reporting dates

2 Source: Respective company investor relations website for each specified company where they post a press release and presentation reporting the most recent results

3 Source: Company investor relations websites, recognising that not all companies provide guidance or provide it based on the same exact metrics or time periods