2021 marks a turn for China’s economic recovery as it finds itself in a mid-year rough patch. The V-shaped recovery evident in the first quarter of 2021 is now starting to plateau and we expect China’s growth to normalise over the second half of this year. 2021 welcomes the year of Ox typically characterised by periods of recovery and was last seen in 1997 and 2009 after the Asian Financial Crisis and Global Financial crisis, respectively. Following the recovery from COVID pandemic, we believe this time around, the strength of the rebound has given policymakers confidence to reign in on stimulus and focus on China’s longer-term goals. As outlined in the 14th Five-Year Plan some of China’s key goals are:

Figure 1 – China remains focussed on its long-term goals

Source: WisdomTree

Achieving higher quality and sustainable growth

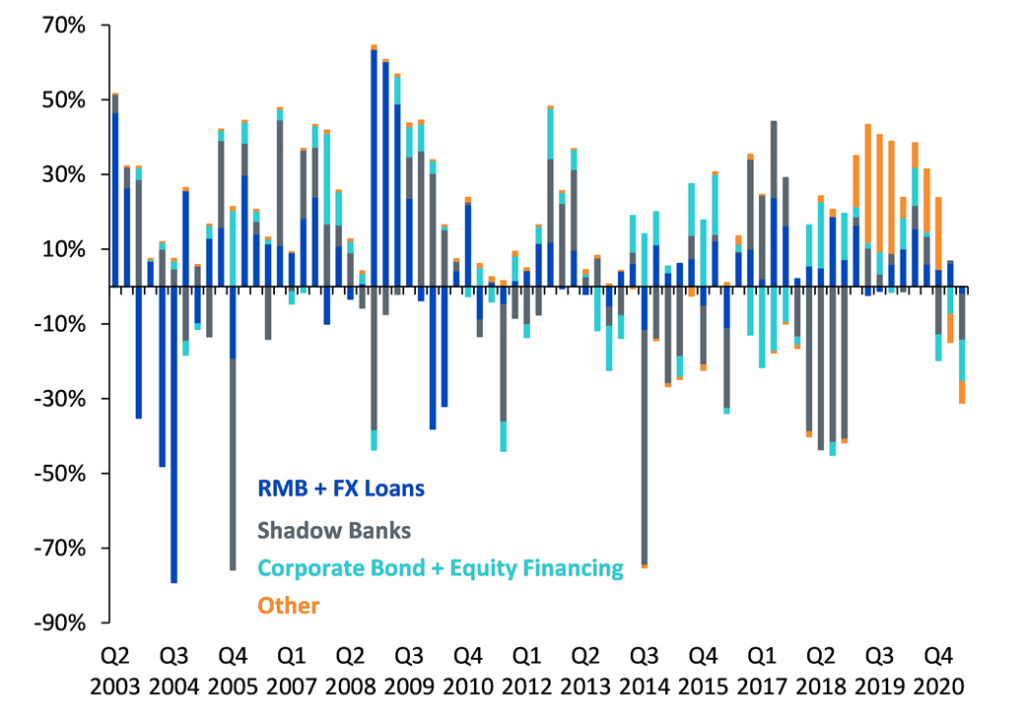

The Chinese economy avoided a contraction in 2020 owing to higher exports and investment in infrastructure and real estate while domestic consumption lagged. Consistent with the Central Economic Work Conference[1] (CEWC), China will look to encourage demand side reforms to enhance the purchasing power of the country’s low to middle class households. Some of the demand side reforms include – optimising the income distribution system, job creation, improving social security, tax regime and transfer payments. China’s domestic consumption accounted for 54.3% of GDP in 2020 and remains the cornerstone of stable economic operations[2]. Retail sales growth edged lower to 12.1% year-on-year (y-o-y) in June from 12.4% in May, owing to the threat of variants. We remain of the view that the build-up of excess wealth in the household sector should unleash a consumer led recovery as vaccines catch up with COVID variants. China’s goals to target quality growth have come at the cost of disciplined approach to injecting capital and withholding stimulus from money-losing, debt laden State-Owned Enterprises (SOEs). The slowdown of credit growth has been gradual and appears on track to achieve the governments goals of keeping credit growth equal to nominal GDP growth this year. On 9th July, the People’s Bank of China reduced the reserve requirement ratio by 0.5% for most banks, in line with the State Council’s guidance thereby unleashing nearly US$1trn Yuan of long-term liquidity into the economy. This recent move by the PBOC is not to be confused with a broad-based easing stance as they continue their path of prudent monetary policy.

Source: Bloomberg, WisdomTree, data available as of close 30 June 2021

Historical performance is not an indication of future performance and any investments may go down in value.

Opening its economy and attracting foreign trade and investment

In June last year, the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOF) jointly issued two negative lists that include special administrative measures and the Free Trade Zone (FTZ) special administrative measures on access to foreign Investment. The two negative lists refer to the industries where foreign investment will either be prohibited or restricted. Compared to the 2019 negative list, the new 2020 national negative list has cut the number of restrictive measures by 17.5% and the new 2020 FTZ negative list has cut the measures by 18.9%.

China’s onshore local currency bond market has also grown five times more than a decade ago. The ease and scalability of the Bond Connect program, launched in 2017 helped allay investor concerns over repatriation and capital account risk since assets are held and settled offshore. In November 2020, China integrated and relaxed the qualification requirements for the Qualified Foreign Institutional investors (QFII) and Renminbi Qualified Foreign Institutional Investors (RQFII), contributing to its popularity. China appears keen to promote greater cross-border use of renminbi.

Since its opening in 1991, Chinese equity markets have grown at a fast pace both in terms of market capitalization and breadth of listed companies. It is currently the second largest and most liquid equity market in the world based on a swathe of reforms that started in 2002. The MSCI inclusion in 2019 was testament of how far China had progressed in its capital market reforms. We still believe there is a long way to go with only 20% market capitalisation recognised so far, with an inclusion factor capped at 20% on MSCI.

Figure 3: Chinese reforms implemented since 2002

Attaining Climate goals

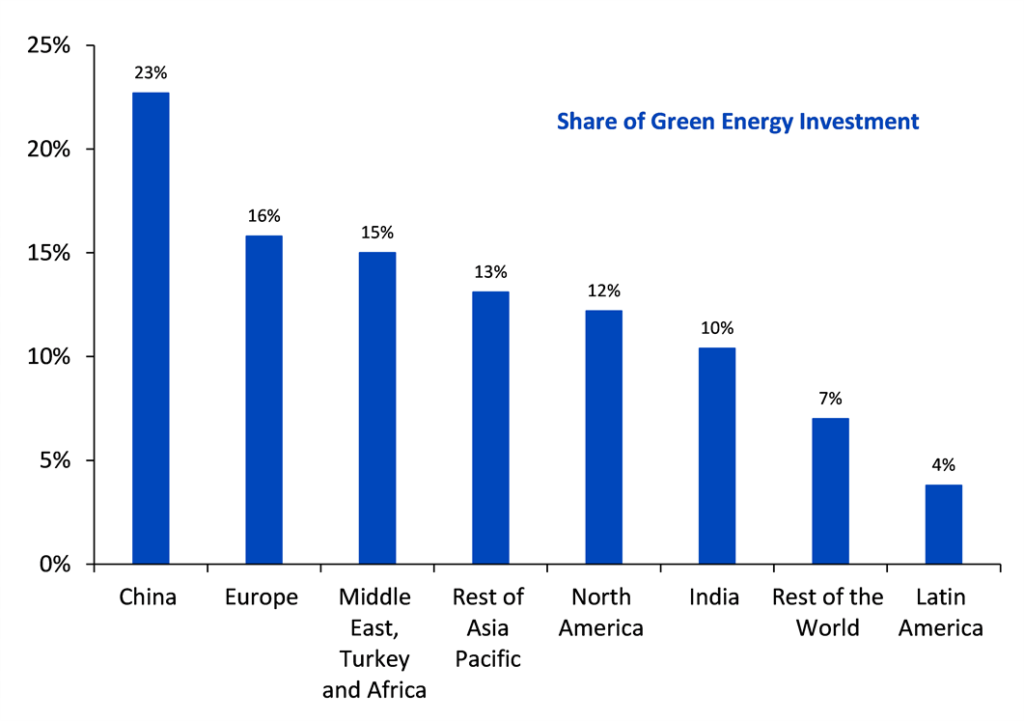

China has expressed a strong commitment to climate action. Being a large importer of traditional sources of energy, we believe China will continue to pursue climate action as it serves its long-term goal to become more self-sufficient. To maintain accordance with the Paris climate accord, China has pledged to achieve carbon neutrality by 2060 and reach peak emissions by 2025. China is gradually shifting its energy mix from coal towards cleaner sources of energy like solar and wind power. It is aiming for renewable power to account for more than 50 percent of its total electricity capacity by 2025, up from 42% currently. China is well ahead of the pack in the global race towards electrification evident from its development and deployment of electric vehicles and charge point infrastructure.

Figure 4: Share of green energy investment in new capacity 2020-2050E

Source: Bloomberg Finance LP, WisdomTree as of 30 December 2020

Historical performance is not an indication of future performance and any investments may go down in value.

Opportunity in China A-shares

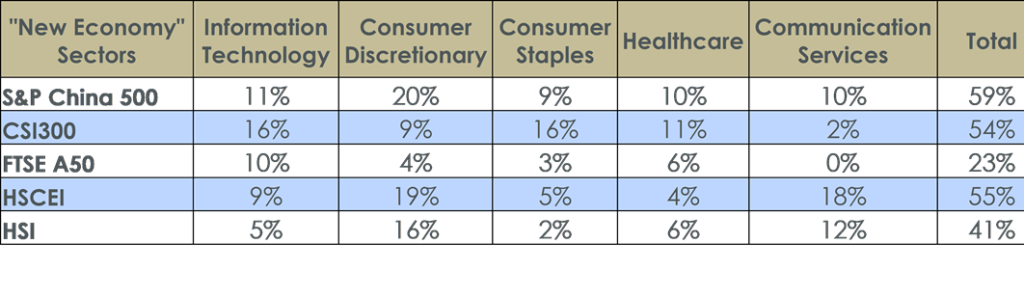

Chinese A-share earnings estimates revision breadth has begun to show early signs of stabilization. Earnings remain an important driver of equity market performance and we expect the upcoming Q2 earnings season to be an important catalyst for Chinese A-shares. Considering both favourable valuations and improving earnings revisions the Chinese A-share market presents a compelling investment opportunity for foreign investors looking to diversify their portfolio. Chinese A-shares also offer a more balanced exposure to the new economy sectors such as information technology, consumer discretionary, consumer staples and healthcare. We have observed that the S&P China 500 Index offers investors a higher exposure to new economy sectors in comparison to competitor indices owing to its higher exposure to Chinese A-shares:

Figure 5: Comparison of new economy sectors across indices:

Please note HSCEI represents Hang Seng China Enterprises Index; HSI represents Hang Seng Index

Historical performance is not an indication of future performance and any investments may go down in value.

The S&P China 500 Index appears to provide a comprehensive exposure to Chinese equities without the concentration risk present among other indices. It offers much lower concentration in financials (15.1%) compared to FTSE A50 (37.37%), Shanghai Shenzhen CSI 300 Index (23.6%) and Hang Seng China Enterprises Index (28.34%)[3].Historical performance of the S&P China 500 Index has been impressive in comparison to peer indices as illustrated in the chart below:

Figure 6: Historical Comparison of performance of Chinese indices

Source: Bloomberg, WisdomTree monthly data from 31 December 2008 to 30 June 2021 The S&P China 500 Index was launched on August 28, 2015. All information for the S&P China 500 Index prior to its launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The back-tested calculations are based on the same methodology that was in effect on the launch date.

Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion

Negative sentiment towards Chinese equities appears misplaced owing to the recent concerns on capital market regulation related to offshore listings. Beijing is increasing regulations of Chinese listings overseas. Regulators globally are attempting to crackdown on the power that technology companies have held so far. In lockstep we expect investors to temper their growth expectations for technology companies considering the increased scrutiny even though these companies remain very profitable. As China continues to lay an emphasis on its long-term goals and transitions away from a carbon intensive economy, it remains a fertile ground for potential investment opportunity.

[1] The main economic agenda setting event for 2021

[2] The State Council, The People’s Republic of China

[3] As of 30 June 2021