US equities continue to march higher after a broad-based rally last week saw both the S&P 500 and small-cap Russell 2000 hitting record highs. Meanwhile, further threats of tariffs from President-elect Donald Trump saw European and emerging markets equities continue to suffer patches of volatility and relative underperformance.

We have held a positive view on US equities relative to other regions for some time now. This view pre-dates the US election, but we think that the latest leg up in US equities over the past month partly reflects markets taking a positive view of the outlook – likely on hopes that a lighter tax and regulatory burden will spur animal spirits in the US economy and support earnings growth. However, there is more at play in this recent rally than Trump.

While some may hope that the new President will invigorate the US economy, it is worth noting that the US economy is already a relative bright spot globally. If you strip out weather/hurricane effects, recent US economic activity data has generally been coming in stronger than expected compared to the euro area and UK.

Some of the differences may be politics-related with perceived prospects of more supportive business policies under a Trump administration contrasting with ongoing political uncertainty in France and Germany. In the UK, business optimism has deteriorated following the October Budget.

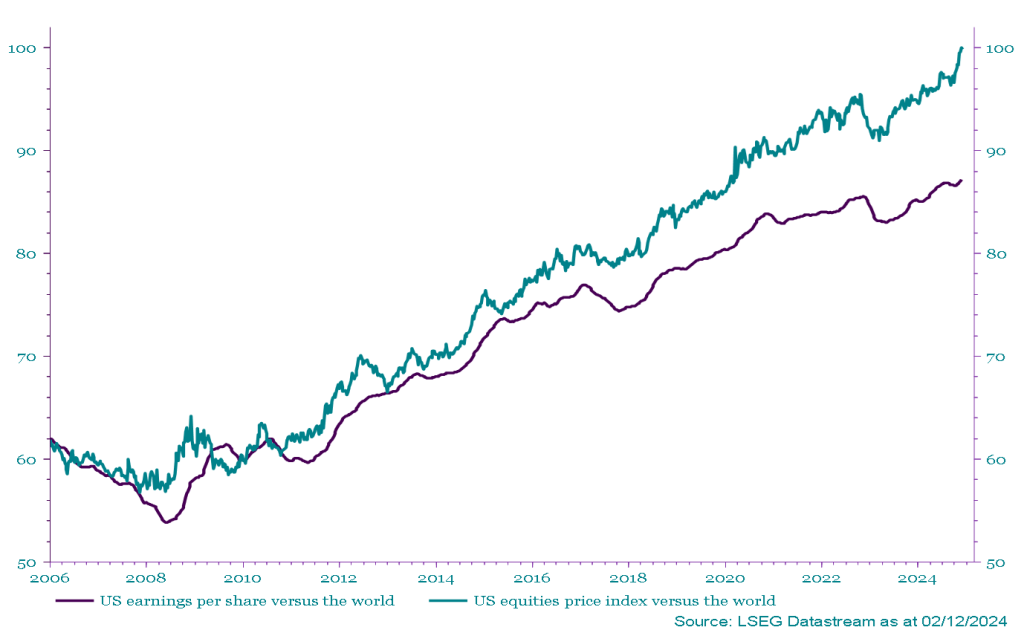

At the company level, we note the strong relative corporate earnings trend that underpinned multi-year US outperformance remains intact (Chart 1). Although US shares are becoming more expensive compared to global peers, the relative earnings per share of US companies is rising compared to rest of the world companies, too.

The widening valuation differential is a longer-term concern, but that differential is not surprising given consistently stronger earnings. Historically, a turn in the relative price trend has been triggered by a turn in relative earnings, not extended valuations.

Arguably, US shares look priced for perfection ahead of the imminent presidency of someone whose policies may be far from perfect for the US economy or for company earnings in all sectors. For now though, we believe that US outperformance remains justified and could continue while earnings trends remain supportive.

Chart 1: US earnings per share vs the world and US price index vs the world

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.