Global equities continued their solid start to the year as some stronger earnings helped outweigh the negative reaction from US equities, which suffered their first negative week of 2024.

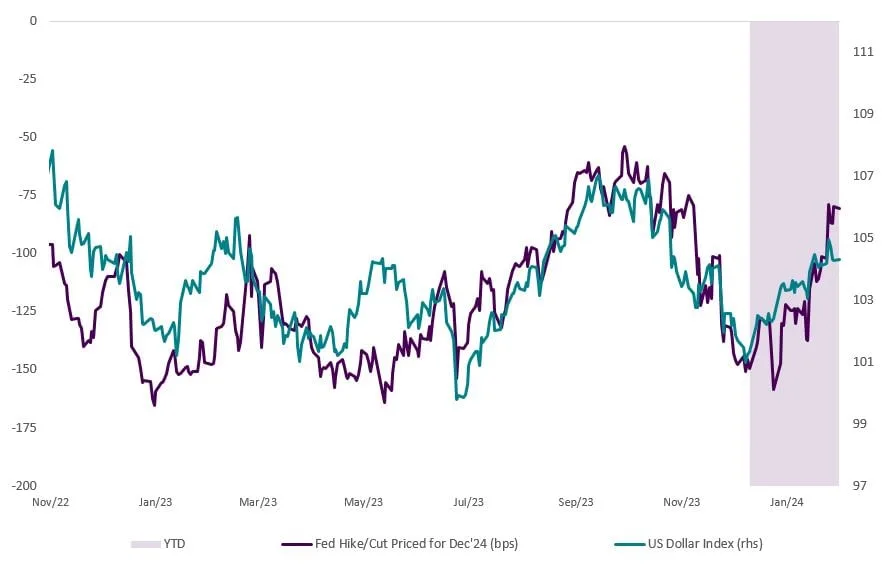

Higher than expected US inflation data last week pushed both bond yields and the US dollar to higher levels. The market is now only pricing in around 80 basis points (bps) of Federal Reserve interest rate cuts this year, down from the 160bps expected in mid-January (Chart 1).

Chart 1: US dollar strengthens as market prices out cuts

Source: Bloomberg as at 19/02/2024.

Despite the prospect of fewer rate cuts, we remain positive on equities. Business optimism has notably improved, especially in the US, and we expect this to translate to an improvement in earnings. However, the longevity of our positive views on equities will depend on business cycle developments.

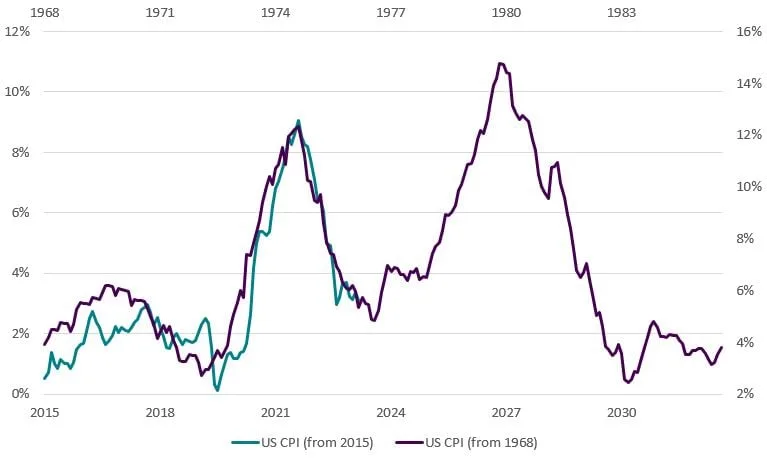

We are expecting inflation to continue to fall over 2024, which should be a positive for equity markets. However, we question whether we go back to the low and stable inflation era that persisted from the early 1980s, or if we will instead see an emergence of a regime termed ‘Spikeflation’, a period of above-average inflation, with periodic spikes higher.

While we have disinflationary forces like AI developments (potentially boosting productivity) and China’s slowdown, there are other inflationary forces like demographics (aging reducing supply of workers in already tight labour markets), climate change (and associated transition costs) and de-globalisation (and ‘friendshoring’ production capacity) which could mean that we may be pre-mature to celebrate recent falls in inflation.

Interestingly, the current development of US inflation looks remarkably similar to the trends in the 1970s when inflation re-accelerated after a period of falling (Chart 2). While history rarely repeats itself, it sometimes rhymes. We therefore remain vigilant and continue to watch the development of business cycles.

Chart 2: Inflation following a familiar path, beware the risk of Spikeflation

Source: Refinitiv Datastream as at February 2024.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.