There are a variety of risks to consider when investing in AT1 Contingent Convertible bonds (affectionately known as ‘CoCos’). These financial instruments, issued by financial institutions, may appear peculiar on first inspection but, once you get to know these quirky financial instruments better, you will better appreciate their unique risk/return profile.

CoCos stand out as hybrid instruments, blending the characteristics of bonds and equity. They possess a fascinating duality: on one hand, they behave like fixed income products, offering investors regular interest payments; on the other hand, they can convert into equity under specific predefined conditions or can be written down under specific circumstances. This unique combination allows CoCos to dance between the worlds of debt and equity.

CoCos are high yield instruments, and this high yield comes from a variety of risk compensations. We focus here on three of them: conversion risk, extension risk and viability risk.

Conversion risk: the dramatic metamorphosis

One of the key risks associated with CoCos is conversion risk or write-down risk. These instruments typically have a predetermined conversion trigger, such as a decline in the issuer’s capital ratio, like Common Equity Tier 1 (CET1), or a specific regulatory event. When the trigger is hit, the CoCos undergo a dramatic metamorphosis, transforming from debt into equity or can become virtually worthless. In the waterfall structure, they sit between equity and subordinated debt. Conversion risk is, therefore, higher than default risk on the subordinated bonds of the same issuer. That is already something!

Extension risk: when time tests your patience

Imagine waiting for a bus that keeps getting delayed, leaving you unsure of when it will finally arrive. That’s the feeling of extension risk in the world of CoCos, since these instruments come with a feature that allows the issuer to extend the maturity date without a penalty (step-up). As an investor, this can make it challenging to predict the exact timing of cash flows, adding an element of uncertainty to your investment horizon.

Rising interest rates can be a double-edged sword. On the one hand, they are typically good for the financial sector and, therefore, reduce the conversion risk. On the other hand, they can have a significant negative impact on CoCos, especially in terms of their call features. Unlike traditional bonds that often feature step-ups, which progressively increase the spreads over time in case the bonds are not called at the given call dates, CoCos lacks such provisions. This absence of step-ups makes it economically beneficial for the issuer not to call the CoCos bond early, particularly in a rising interest rate environment. By allowing the bond to remain outstanding, the issuer can take advantage of the higher prevailing interest rates and continue paying the existing coupon, potentially saving on borrowing costs.

However, from an investor’s perspective, this prolonged maturity can present challenges. As interest rates rise, the market value of fixed-rate instruments tends to decline. Investors may find themselves holding CoCos with coupons that are comparatively less attractive in the prevailing interest rate environment. Moreover, the extended maturity period can delay the return of principal, affecting investment liquidity and potentially tying up capital for a longer period than anticipated. To call a bond or not is the decision of the issuer. Besides economic arguments, reputational arguments also come into play. Some issuers, although it may be economically reasonable not to call, will not want to snub their investors base and prefer, for reputational matters, to call anyway. Quantifying the exact risk is not an exact science. Recently, all bonds that come at their first call dates have been called.

Regulatory risk: the viability trigger

As we have learned in the Credit Suisse case, this is another crucial aspect to consider. The viability trigger represents the point at which the issuer’s financial health is deemed to be at risk by the regulator, even in cases where capital ratios like CET1 are well above their trigger levels. Hence, CoCos can also be triggered by regulatory intervention. If the viability trigger is activated, the CoCos might undergo conversion or be written off altogether.

It is important to note that the ‘permanent write-down’ is unique to Swiss issuances. This risk factor underscores the importance of staying abreast of regulatory developments and their potential impact on the investment. As illustrated by the Credit Suisse case, the classic waterfall structure was not respected, wherein CoCos were written down to zero while keeping equity alive. The EU/UK regulators have been almost screaming that this is not possible under their framework. And indeed, the EU point of non-viability (PONV) powers are written into statutory law within the Bank Resolution and Recovery Directive (BRRD), that clearly stipulates that instruments can only be written down to zero if shareholders have been fully wiped out and, hence, respecting the bankruptcy waterfall.

Note that in contrast to Switzerland, where it is relatively easy to use the emergency law and pass an ordinance (or add clarifications) over a weekend (as happened during the recent Credit Suisse rescue operation), the complexity of the EU, where all EU countries must agree (and in addition a valuation exercise must be carried out), makes this virtually impossible to do over a weekend or short periods of time.

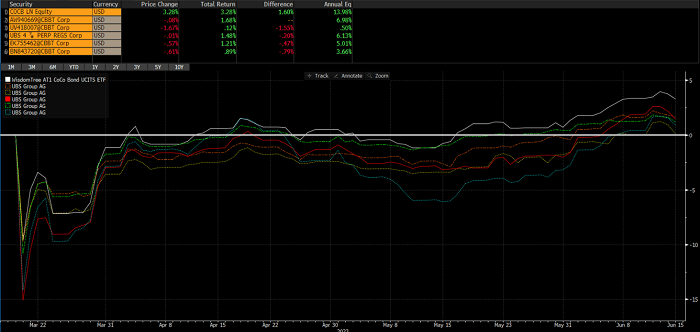

Figure 1: UBS AT1s have underperformed the broad European CoCos market since the Credit Suisse acquisition.

Source: WisdomTree, Markit, Bloomberg, as of 15 June 2023.

You cannot invest directly in an index.

Historical performance is not an indication of future performance, and any investments may go down in value.

The CoCo coupon conundrum

Given the assortment of risks CoCos bring to the table, it’s no surprise that these quirky instruments tend to offer high coupons. Investors demand compensation for taking on the additional uncertainties associated with conversion risk, extension risk and regulatory risk. While these higher coupon rates can be alluring, it’s essential to thoroughly assess the underlying risks and evaluate whether the potential rewards are worth the rollercoaster ride.

CoCos offer a blend of fixed income stability with the tantalising potential for equity-like gains. Conversion risk, extension risk and regulatory risk are the hurdles that come with this unique territory. By diligently understanding these risks, CoCos are, perhaps, the quirky kid one starts to like.

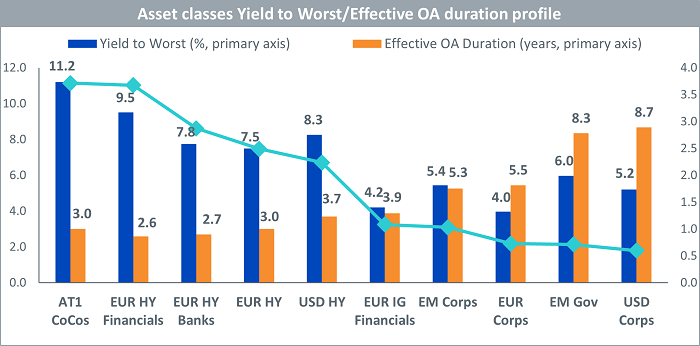

Figure 2: AT1 CoCos offer attractive yield per unit of duration

Source: WisdomTree, Markit, data as of 31 March 2023.

Yield is yield to worst (YTW) and is based on the duration-adjusted market value weighting. Effective OA duration is effective option-adjusted duration. AT1 CoCos is the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index, USD HY is the iBoxx USD Liquid High Yield Index, EUR HY is the iBoxx EUR Liquid High Yield Index, USD Corps is the iBoxx USD Liquid Investment Grade Index, EUR Corps is the iBoxx Euro Liquid Corporates Index, EUR IG Financials is the iBoxx EUR Liquid Financials Index, EUR HY Financials is the iBoxx EUR Liquid High Yield Financials Index, EUR HY Banks is the iBoxx EUR High Yield Banks Index, EM Corps is the iBoxx USD Liquid Asia ex-Japan Corporates Large Cap Investment Grade Index, EM Gov is the iBoxx USD Liquid Emerging Markets Sovereigns Index.

You cannot invest directly in an index.

Historical performance is not an indication of future performance and any investments may go down in value.