We find commodities in many goods and products that impact our daily lives – in the food we eat, the electronics and appliances that make our lives easier, and the energy we use to power our cars and heat our homes. This means that, when commodity prices rise, so does the cost of living.

Europe and the United States have been facing this situation for the last 12 months, with inflation indicators reaching decades-high levels. The availability of commodities has been affected by insufficient investment in production capacity, supply chain disruptions stemming from the global pandemic, and the war in Ukraine. These factors have seen consumers paying higher prices to obtain instant access to commodities.

An allocation to commodity markets can provide a differentiated source of return for investors, while also potentially improving their portfolio expectations. Let us explore why.

Commodities can help preserve wealth

Over time, inflation has a devastating effect on the real value of money. In a rising inflation environment, cash loses purchasing power. The same can be true for other traditional asset classes, in which returns and cash flows may not keep up with inflation.

The values of stocks and bonds, for example, are tied to expectations of capital appreciation or changes in future cash flows. In contrast, the price of commodity futures is driven by shifts in the global supply of, and demand expectations for, raw materials. As a result, the historical risk and return characteristics of commodities have shown little or no long-term relationship with other financial assets, such as stocks and bonds.

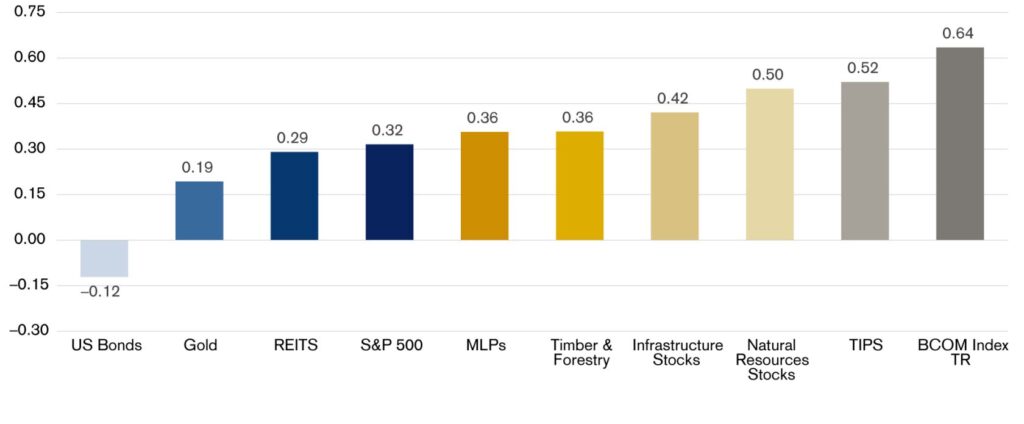

Yet there are other assets that can help investors protect against inflation. What sets commodities apart is that they have historically offered one of the highest levels of correlation to unexpected inflation (see Chart 1).

Sources: Credit Suisse Asset Management, LLC; Bloomberg LP | As of May 31, 2022 Analysis represents asset class returns that are lagged for a one-month period and compared to current period CPI from May 31, 2006, to May 31, 2022. Inflation is represented by Headline Consumer Price Index (CPI). Bloomberg tickers for the indices used are as follows: US Bonds (LBUSTRUU Index); Gold (GLD US Equity); REITs (FNER Index); Timber & Forestry (SPGTTFT Index); S&P 500 (SPTR Index); MLPs (AMZX Index); Infrastructure Stocks (DJBGIYT Index); Natural Resources Stocks (SPGNRUT Index); TIPS (LTP5TRUU Index); BCOM Index TR (BCOMTR Index).

Historically , even a modest allocation to a basket of commodities within a traditional portfolio has helped to reduce overall volatility, especially during periods of extreme market volatility. From a portfolio construction perspective, this is both valuable and the reason why many investors hold commodities as part of their long-term strategic allocation model.

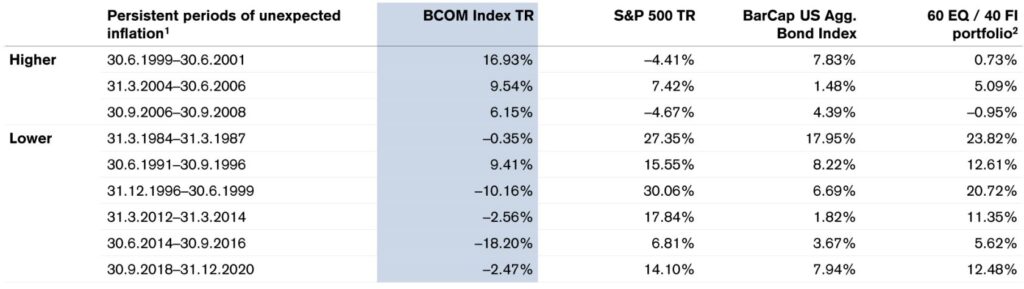

Commodities have also tended to perform well during periods of sustained high unexpected inflation risk (see Chart 2).

Sources: Credit Suisse Asset Management, LLC; Bloomberg (BCOM Index TR); Standard & Poor’s (S&P 500); Barclays (Barclays Capital US Aggregate Bond Index). Last data point: 30.06.2022. 1 Periods of higher or lower-than-expected inflation represents the change between the one-year-ahead forecast from the Quarterly Survey of Professional Forecasters (INFCPI1YR) and the Consumer Price Index (CPI, seasonally adjusted). 2 60 /40 represents a 60% S&P 500 TR / 40% BarCap US Agg. Bond Index portfolio; returns are rebalanced quarterly.

How to invest in commodities

There are different ways to invest in commodities, both directly and indirectly. Investing in physical commodities is impractical for most investors. Storing energy products like oil can be complicated and costly, while other commodities such as wheat are perishable.

Investing in futures

Futures contracts – standardized, legal contracts to buy or sell items at pre-determined prices in the future – can help simplify investing in commodities.

Contracts tied to individual commodities within major commodity indices are highly liquid and offer the ability to gain exposure to commodities. When investors buy futures contracts, they are expected to maintain a certain amount of capital, known as margin, in their brokerage accounts.

Investors involved in futures trading need to monitor these margin requirements and roll these contracts to a forward maturity date.

Using a managed futures account

Managed futures accounts are another option for making indirect investments in commodities. These are a type of alternative investment vehicle that focus on futures and other derivative products. They are permitted to use leverage in the transactions that they make. In addition, they are allowed to go both long and short with the commodities that they follow, meaning that a successful strategy can produce profits in both bull and bear markets.

The benefits to investors are that managed futures accounts remove the hassle of investing directly in futures, and investments are managed by specialist investment professionals called commodity trading advisors (CTAs). These CTAs can help reduce portfolio volatility and offer greater capital efficiency through their investment experience.

Investing in a mutual fund

The other option is to invest in a mutual fund, managed by an experienced portfolio manager. This mutual fund is benchmarked to a publicly observable index, which helps increase transparency, and benefits from exposure to a wide range of commodities. The manager can choose which financial instruments to use in order to represent exposure in the most effective way.

An actively managed portfolio can potentially outperform its benchmark index and offer higher returns to investors. This is often the most practical approach for many investors who want long-term exposure to a basket of commodities for inflation hedging, as mutual funds provide built-in governance and reduce complexity.

Buying an exchange traded fund

Investors can also opt for an exchange traded fund (ETF) to gain exposure to commodities. ETFs typically seek to catch the return on major global commodities by tracking a commodity index. They are traded on a stock exchange and can be bought and sold like all stocks and shares. The return expectations on a commodity index ETF represent the return of the respective index, minus fees and expenses.

Investing in commodity-related equities

The final approach is to invest in commodity-related equities, such as mining companies or oil and gas corporations. The performance of these companies might not be directly tied to the performance of commodity price returns and can be negatively impacted by a company’s management and its hedging decisions, business execution risks, and the overall equity market environment.

Considering a commodity allocation when inflation rises

Making a portfolio allocation toward commodities may offer diversification benefits along with opportunities to improve risk-adjusted returns. However, it is during periods of rising inflation when commodities become particularly useful.

The world is seeing the highest level of inflation in almost 40 years. What commodities offer is a potential way for investors to mitigate the effects of this inflationary environment on their portfolios.

Source: Credit Suisse, unless otherwise specified. Unless noted otherwise, all illustrations in this document were produced by Credit Suisse Group AG and/or its affiliates with the greatest of care and to the best of its knowledge and belief. This material has been prepared by CREDIT SUISSE GROUP AG and/or its affiliates (“Credit Suisse”). It is provided for informational and illustrative purposes only, does not constitute an advertisement, appraisal, investment research, research recommendations, investment recommendations or information recommending or suggesting an investment strategy, and it does not contain financial analysis. Moreover it does not constitute an invitation or an offer to the public or on a private basis to subscribe for or purchase products or services. Benchmarks, to the extent mentioned, are used solely for purposes of comparison. The information contained in this document has been provided as a general commentary only and does not constitute any form of personal recommendation, investment advice, legal, tax, accounting or other advice or recommendation or any other financial service. It does not take into account the investment objectives, financial situation or needs, or knowledge and experience of any persons. The information provided is not intended to constitute any kind of basis on which to make an investment, divestment or retention decision. Credit Suisse recommends that any person potentially interested in the elements described in this document shall seek to obtain relevant information and advice (including but not limited to risks) prior to taking any investment decision. The information contained herein was provided as at the date of writing, and may no longer be up to date on the date on which the reader may receive or access the information. It may change at any time without notice and with no obligation to update. To the extent that this material contains statements about future performance, such statements are forward looking and subject to a number of risks and uncertainties. It should be noted that historical returns, past performance and financial market scenarios are no reliable indicator of future performance. Significant losses are always possible. This material is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of, or is located in, any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation, or which would subject Credit Suisse to any registration or licensing requirement within such jurisdiction. The recipient is informed that a possible business connection may exist between a legal entity referenced in the present document and an entity part of Credit Suisse and that it may not be excluded that potential conflict of interests may result from such connection. This document has been prepared from sources Credit Suisse believes to be reliable but does not guarantee its accuracy or completeness. Credit Suisse may be providing, or have provided within the previous 12 months, significant advice or investment services in relation to any company or issuer mentioned. This document may provide the addresses of, or contain hyperlinks to, websites. Credit Suisse has not reviewed the linked site and takes no responsibility for the content contained therein. Such address or hyperlink (including addresses or hyperlinks to Credit Suisse’s own website material) is provided solely for your convenience and information and the content of the linked site does not in any way form part of this document. Accessing such website or following such link through this document or Credit Suisse’s website shall be at your own risk. This document is intended only for the person to whom it is issued by Credit Suisse. It may not be reproduced either in whole, or in part, without Credit Suisse’s prior written permission. Copyright © 2022. CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.