Surging commodity prices are beneficial for the Australian economy, one of the world’s largest commodity exporters. Amidst the escalation of the conflict between Russia and Ukraine, disruptions in the supply of wheat, gas, oil, thermal coal and steel from Russia and Ukraine present a windfall for geopolitically stable suppliers such as Australia. While soaring wheat prices threaten global food security, they benefit Australian farmers who have reaped a record crop. Australia is the world’s second-largest LNG (“Liquefied Natural Gas”) exporter. Against the backdrop of high oil prices and disruption in European supplies, gas prices are being driven higher. In a similar vein, disruptions to Russian coal exports offer a boost for Australia’s exporters. The energy price spike is likely to make users such as Europe and India switch to alternative energy sources such as coal, as the transition to renewable energy sources will take time. Adding another commodity to the list of Australian exports, iron ore is by far the largest commodity that Australia exports to China. In 2020 China imported almost 83% of all Australian iron ore output1. Amidst disruptions to Russian steel exports, Australia’s iron ore exports are receiving a boost from China’s accommodative stance to support its economy. Australia’s trade surplus for January exceeded expectations, rising to AUD$12.9Bn from AUD$8.4Bn, with iron ore and coal listing exports by 7.6%2.

Tailwinds abound for the Australian dollar (AUD)

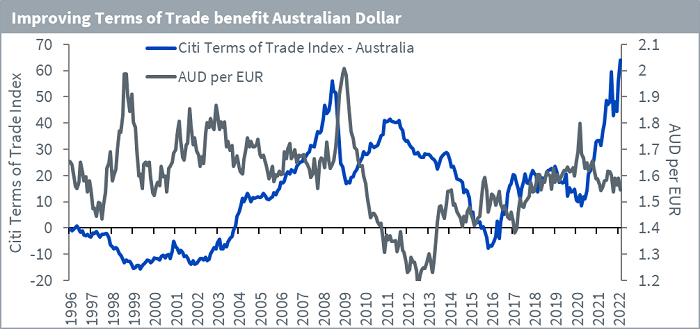

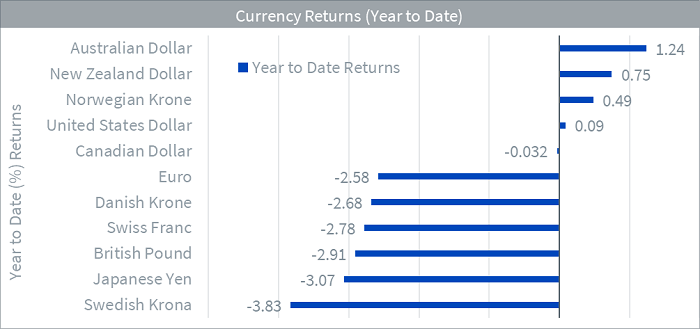

Rising commodity prices are being reflected in the terms of trade (i.e., ratio of export to import prices) which is lending a tailwind to the Australian dollar (AUD). The swings in the terms of trade have generally been driven by movements in export prices rather than import prices. Large movements in the terms of trade have historically had a positive impact on the Australian economy3. The strong employment market in Australia may also provide another tailwind for AUD, bolstering the case that the Reserve Bank of Australia might be closer to lift-off than previously expected. We expect the first hike by the Reserve Bank of Australia to come in June, taking the cash rate to 0.25%, with three hikes in total in 2022, taking it to 0.75% by year-end. The AUD is the strongest currency while the Japanese YEN is among the weakest4 currencies among G10 nations in 2022 evident from the chart below.

The curious case of the Yen as a safe-haven currency

Amidst risk-off episodes in financial markets, the Yen has historically been a safe-haven currency. However even as repercussions of Russia’s invasion of Ukraine roil the global economy, the Yen has declined more than other major G10 currencies, contrary to its haven role. Japan has been shifting away from the export-heavy economic structure that underpinned investors’ attraction to the Yen during wars, natural disasters and other crises, and high resource prices now weigh more heavily on its current-account balance. A weaker Yen raises the cost of imports especially amidst a high commodity price environment which we find ourselves in. Japan ran a current-account deficit of ¥1.19 trillion ($10.1 billion) in January5, marking its second-highest on record amid a widening trade deficit. If this trend continues, its abundant net foreign assets will also decline. Historically very low interest rates in Japan made borrowing in Yen attractive. But now, with other currencies in a similar position of offering zero (or negative) rates on the currency many years out, the Yen lost its competitive edge on the famous carry trade. More importantly, the US Dollar stands to benefit the most, supported by the continuing strength of the US economy and the prospect of the Bank of Japan remaining well behind the Federal Reserve in their path to normalisation of monetary policy. The further widening of policy divergence between the US and Japan should continue to lend a tailwind to the USD versus the Yen. Given the export-driven tilt of Japanese equity markets, a weaker Yen should bolster the case for Japanese equities.

Sources

1 Parliament of Australia

2 Australian Bureau of Statistics

3 Reserve Bank of Australia

4 Bloomberg from 31 December 2021 to 17 March 2022

5 Ministry of Finance Japan