So thinks Stephen Snowden, Artemis’ head of fixed income. He summarises his thoughts in four key charts.

FOR PROFESSIONAL INVESTORS AND/OR QUALIFIED INVESTORS AND/OR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. CAPITAL AT RISK. All financial investments involve taking risk which means investors may not get back the amount initially invested.

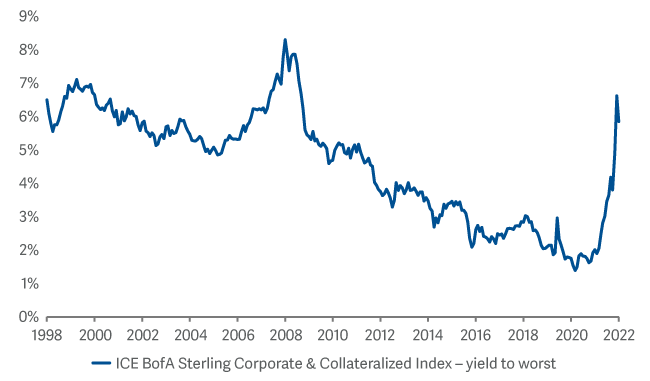

1. Corporate bond yields are at very attractive levels

Corporate bond yields are made up of two components, the underlying gilt yield and the additional spread for the extra credit and liquidity risk.

Over the last few months, 10-year gilt yields have moved to levels not seen for over 10 years.

Meanwhile, credit spreads, while not at levels seen during the global financial crisis, are certainly elevated.

Neither gilt yields nor credit spreads are at their peak, but the two combined mean that the overall yield on corporate bonds is around 6%.

When both gilt yields and credit spreads are evaluated, the all-in yield is high

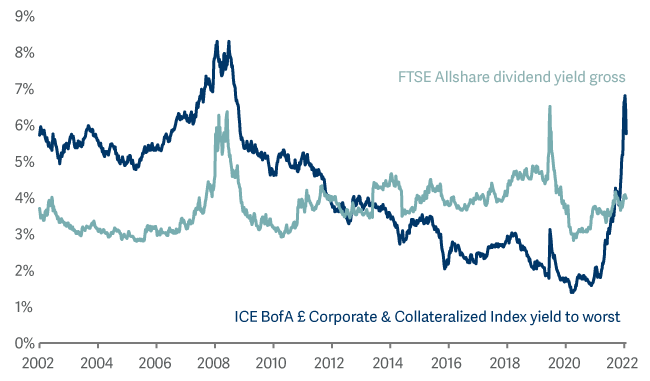

2. Corporate bond yields are now higher than equity dividend yields

The decade or so of quantitative easing suppressed corporate bond yields to the extent that for many years they were much lower than dividend yields.

The recent movements in fixed income markets has reversed this and investment-grade corporate bond yields are now substantially higher than dividend yields.

Investors are now being meaningfully compensated for taking on high-quality credit risk. This is likely to attract more income-seeking buyers into the asset class.

UK corporate bond yield versus UK equity dividend yield

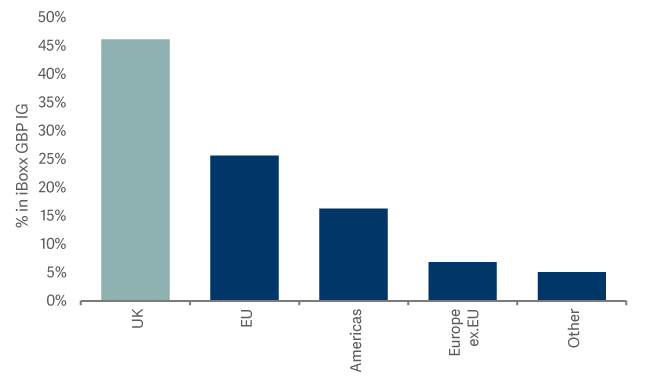

3. GBP credit is not UK credit

The UK suffered a hit to its economic credibility in September because of the actions of the last government.

While the new government has restored confidence, sentiment may remain fragile.

This should not really affect investment in the corporate bond market, as, much like the FTSE 100, the majority of its earnings are generated overseas. 45% of the constituents of the investment grade index (iBoxx GBP) are businesses registered in the UK, but only 20% of their revenues are generated in the UK, so it remains a very international market.

iBoxx GBP IG country of risk

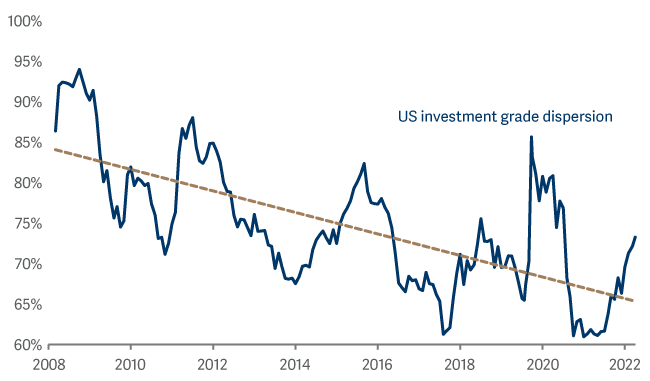

4. Dispersion is increasing in the corporate bond market

During the decade or so of quantitative easing, it was a case of a rising tide lifting all boats: there was always a buyer for corporate bonds in the shape of the central banks.

As QE gives way to quantitative tightening, the situation looks very different. This chart shows dispersion in corporate bond returns since 2008. 100% is the maximum difference between winners and losers, such as during the Global Financial Crisis when bank bonds fell markedly and defensive bonds such as utilities soared.

During the years of QE, the line has been cyclical but has trended downwards. It has recently started to pick up as QE has been withdrawn.

This, and the increase in volatility in the market, creates a very fertile environment for active managers.

Stock selection is of increasing importance in a post QE world

Stephen Snowden manages the Artemis Corporate Bond Fund alongside Grace Le.