Persistent inflation and recession fears have led to jittery markets and exposed cracks across credit markets. Amid ongoing margin pressures, will most high yield companies be able weather an economic slowdown or could deteriorating conditions lead to a spike in default risk? We evaluate high yield company fundamentals and default risk—and why we think the next downturn might be different.

Key takeaways

- Despite the plethora of macro headwinds, many high yield companies in developed markets are well-positioned to navigate an economic slowdown given low leverage, healthy balance sheets and few near-term maturities.

- We believe that high yield corporate defaults in 2022 should remain relatively subdued given stable fundamentals across most issuers.

- While recession risk is rising and default rates are increasing moderately off the recent lows, our view is that default activity should be lower in the next downturn relative to prior recessions given the solid fundamental starting point of many high yield issuers.

Muted default outlook in 2022

Companies are facing a number of macro headwinds and ongoing margin pressures. While this environment can be challenging, we think many high yield companies are well-positioned to navigate an economic slowdown given low leverage, healthy balance sheets and few near-term maturities. Inflation and other pressures are squeezing margins and could erode earnings. However, many companies have various levers they can pull to navigate these situations in an effort to meet their debt obligations and avoid a default situation. In addition, most performing companies reliant on levered credit improved their liquidity runway coming out of the Covid-19 crisis and there is not an imminent maturity wall looming. Stressed companies are still able to access capital markets, albeit at higher cost of capital.

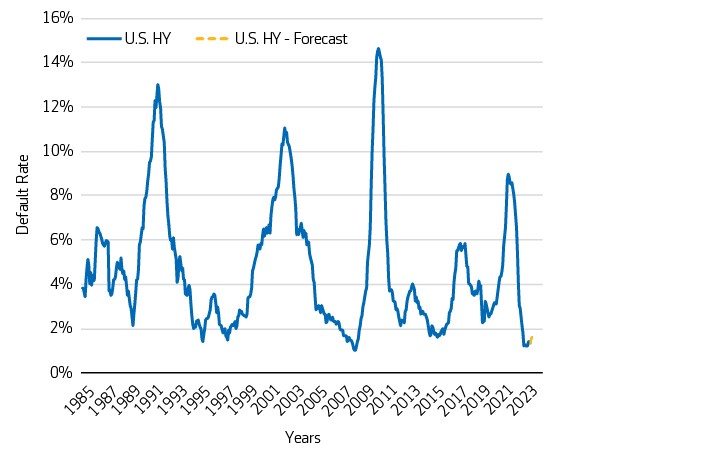

Although high yield company fundamentals are in a relatively healthy position, we expect the default rate to modestly increase in 2022 as a result of idiosyncratic factors. While defaults are trending upward, it is important to remember that defaults are starting from historically low levels that are not sustainable throughout a cycle. As a result, while defaults are starting to increase, we expect the solid fundamental backdrop to help keep defaults below 2% in 2022 and below historical averages throughout 2023.

Exhibit 1: Defaults rates are forecasted to rise modestly, but remain well below the historical average

Rising recession risk and default expectations

A confluence of macro risks has led to rising recession fears. From persistently high inflation, hawkish central bank actions and ongoing cost pressures to weakening consumer demand, earnings compression and tightening credit concerns, there are many factors that could contribute to an economic slowdown or recession.

When the next recession materializes, defaults will inevitably increase. As in all cycles, the extent of defaults will be dependent on the severity of the economic downturn and the triggers that cause the recession. In prior recessions, certain sectors or industries were facing financial challenges and an abrupt shock to revenue or demand created broad-based credit deterioration. In the current environment, we do not see broad-based credit deterioration across any single sector at this point. Certain sectors and industries are more prone to cost pressures and potential weakness than others, however, the stressed or distressed situations that are emerging tend to be driven by idiosyncratic factors.

When default activity does increase, this will likely manifest itself via more liability management or rescue financing type of situations versus outright bankruptcies. We also think smaller, sponsor-owned companies are more prone to liquidity shortfalls as earnings may take longer to rebound vis-à-vis their debt loads stemming from leveraged buyouts. We are watching companies that are experiencing substantive and prolonged margin pressure due to labor or supply chain issues. Additionally, we are cautious on issuers that are facing secular headwinds due to technological advancements. By sector, we are closely monitoring companies within retail, health care, technology, autos, building materials as well as aerospace and defense.

While defaults will inevitably increase during the next downturn, default activity should be lower than prior recessions, given that many high yield companies currently exhibit solid fundamentals as evidenced by five key factors as outlined below.

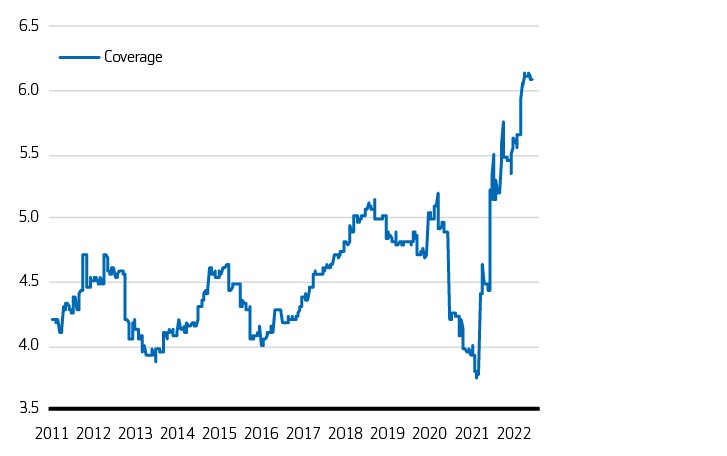

#1 High interest coverage ratios

Interest coverage ratios are near record highs as companies’ earnings have recovered since the depths of the pandemic. Exhibit 2 illustrates that interest coverage (EBITDA/interest expense) has improved tremendously in recent years, is near all-time highs and is well above 2008 levels. However, we are cognizant that this ratio will likely be deteriorating due to an increase in loan resets from higher SOFR/short-term central bank rate increases.

Exhibit 2: US high yield interest coverage ratio

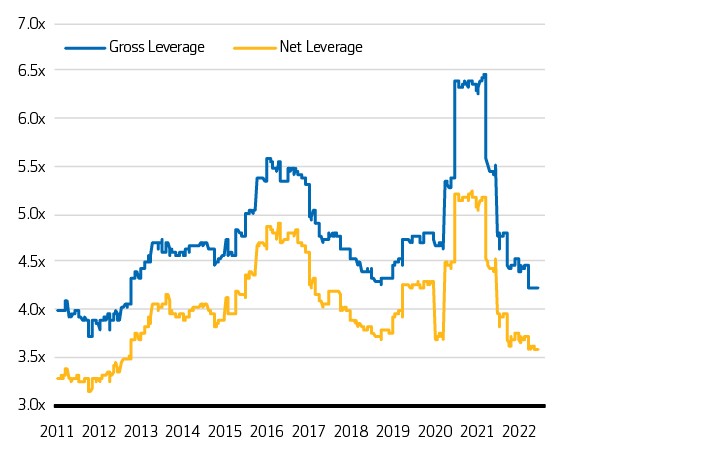

#2 Low leverage

Fundamental improvements and management discipline coming out of the financial crisis have led to healthy balance sheets and low leverage levels. As illustrated below, leverage has declined significantly since the depths of the Covid-19 pandemic in 2020 and is now near average levels. Improved energy fundamentals explain a large part of the decreased leverage, but it has also been fairly broad based.

Exhibit 3: US high yield gross and net leverage

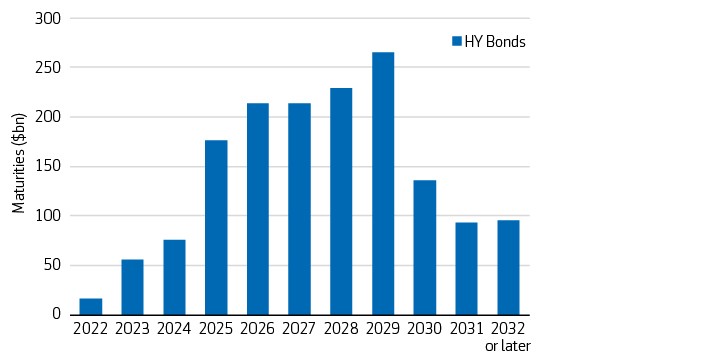

#3 Few near-term maturity concerns

Many companies have termed out their balance sheets, resulting in few near-term maturity wall concerns. As illustrated below, the volume of US high yield maturities in 2022 and 2023 is relatively low, which should allow companies sufficient flexibility to manage their balance sheets and help to minimize default rates in the event of an economic downturn in 2023.

Exhibit 4: US high yield maturity schedule

#4 Rating upgrades continue to outpace downgrades

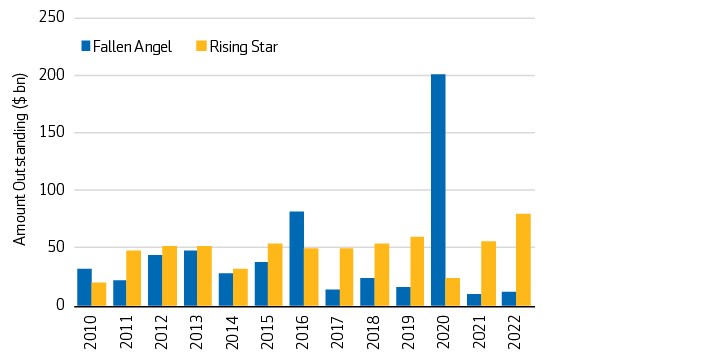

This fundamental improvement continues to be reflected in rating agency actions as upgrades (rising stars), continue to outpace downgrades (fallen angels).

Exhibit 5: Rising stars continue to outpace fallen angels

#5 High-quality high yield market

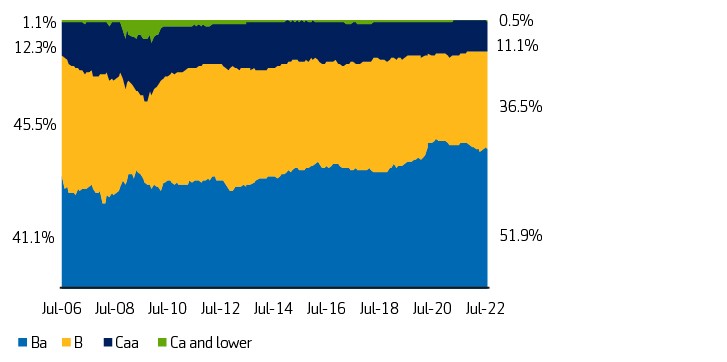

Solid fundamentals coupled with rating upgrades have resulted in one of the highest-quality high yield markets in decades. Within the Bloomberg US Corporate High Yield Index, BBs are at all-time highs while CCCs are below historical averages and lower than 2008. In addition, many of the most distressed companies have been cleansed from the high yield market through the various downturns experienced since 2008, such as the mini energy crisis in 2015–2016, as well as the global pandemic in 2020. This has resulted in a relatively high-quality high yield market with few distressed situations. While the next economic slowdown could result in downgrades, the overall high-quality starting point may help limit distress.

Exhibit 6: Credit quality composition – high BBs and low CCCs

Important disclosures:

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

Investments in high yield bonds may be subject to greater volatility than fixed income alternatives, including loss of principal and interest, as a result of the higher likelihood of default. The value of these securities may also decline when interest rates increase.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM US is also registered as a Commodity Trading Advisor (CTA) with the Commodity Figures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2022 Aegon Asset Management or its affiliates. All rights reserved.